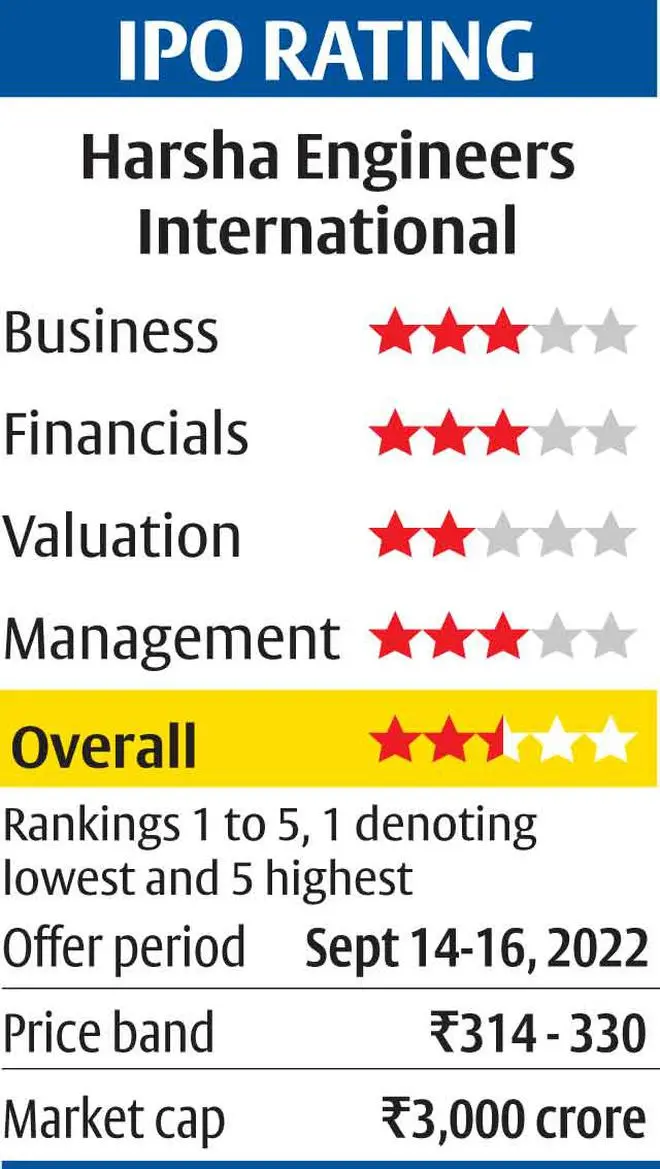

The IPO valuation at 32.5 times trailing PE is cheaper than peers (though not exactly comparable) like Rolex Rings (42.5 times), Sundaram Fasteners (40 times), and SKF India (60 times). Read on to know if the business is attactive enough.

The IPO of Harsha Engineers International Limited (HEIL), a manufacturer of bearing cages and a smaller solar EPC business, is open from September 14-16. The issue size is ₹755 crore, consisting fresh issue of ₹455 crore and an offer for sale of ₹300 crore. The company intends to use the proceeds for debt repayment/prepayment (₹270 crore) and funding capex (₹78 crore). The offer for sale is by the promoters/promoter group and their stake will reduce to 74.61 per cent post the issue.

Incorporated in 2010, it has amalgamated into its fold a well established engineering business that has been in operation since 1986. Its long-term prospects appear interesting with its leading presence in bearing cages manufacturing. However, with the company’s flagship engineering business deriving 40 per cent of its revenue from Europe, it may have to weather through near-term macroeconomic headwinds prevailing there.

In this context, the IPO stock valuation at 32.5 times trailing PE (pre-issue valuation of 28 times), does not offer adequate margin of safety given the risks of demand slowdown in Europe.

The long-term investors can give the IPO a pass, and await for clarity on how the earnings fare as the headwinds mentioned play out. The stock can be considered for investing later depeding on the prevailing valuation and trends.

Business prospects

HEIL is the largest manufacturer of precision bearing cages in organised sector in terms of revenue. As per the information in its RHP, it has market share of 50-60 per cent, and is also the leading manufacturer of precision bearing cages, globally. This business and a few other allied operations account for 94 per cent of its revenue. It derives around 6 per cent revenue from solar EPC business under which it provides turnkey solutions for photovoltaic requirements. As of now, investors need to assess the company based primarily on its engineering business as the solar EPC business is not material for now. There is also no synergy between the two businesses, and according to the management, the different businesses are housed together to consolidate business operations under one entity.

Bearings are the key components in many engineering applications involving motion, thereby reducing friction. Bearing cages, manufactured by HEIL is an component that hold the bearings together, separating balls/roller and maintain symmetrical radial spacing within. HEIL manufactures a wide range of brass, steel and polyamide bearing cages. It also has a smaller stamping business – process of manufacturing converting flat metal sheets into specific shapes and sizes. Overall, its engineering business operations are run out of manufacturing facilities - two in India, and one each in China and Romania. The manufacturing and service operations based at India accounts for 72 per cent of its FY22 revenue.

HEIL’s customers are mainly bearing companies operating in automotive, railways, renewable energy and other industrial sectors. It supplies to leading global players like Timken, NSK and SKF. Its top five customers account for 70 per cent of its engineering business revenue. While this might pose some customer concentration risk, it is balanced by the long-standing relationships with each of the top five customers having been company’s customers for more than decade.

Risk vs reward

According to a CARE report in the RHP, the global bearing companies have steadily increased outsourcing bearing cages manufacturing, and the business has been steadily concentrated to a few manufacturers like HEIL.

As per the report, the Indian bearing cages market ($295 million in FY22) is estimated to grow at a CAGR of 8.3 per cent between 2021-29 and globally ($4,261 million) at 6.4 per cent for the same period.

Given the HEIL being well positioned to tap domestic and global opportunities, the scope for more outsourcing to India under China plus one strategy of international companies, long track record etc., its prospects look interesting.

However, with the company’s international exposure tilted majorly towards Europe in engineering business space, the possibility of facing speed bumps over the next few quarters cannot be ignored. Europe is facing multiple macroeconomic issues simultaneously. High inflation, hawkish central bank, and a looming energy crisis with Russia restricting natural gas supplies together can have cascading effect on the European economy over the next few quarters. How exactly it will play out is not clear. In a such a situation, it would be prudent to stay cautious.

With IPO priced at 32.5 times trailing PE, while cheaper than engineering peers (though not exactly comparable) like Rolex Rings trading at 42.5 times, Sundaram Fasteners at 40 times, and SKF India at 60 times, it is not cheap at an absolute level. The peers are over valued and hence being relatively cheap does not offer sufficient downside protection as global environment gets more uncertain.

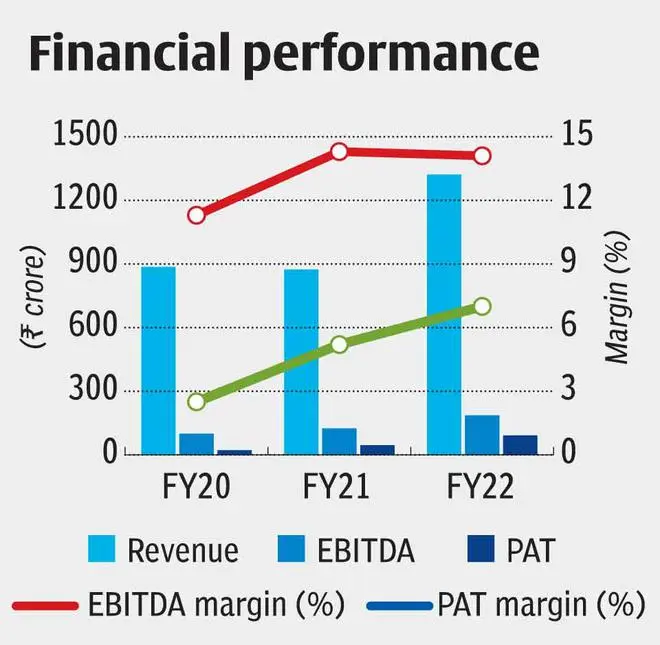

Financials

In FY22, HEIL reported a consolidated revenue of ₹1,321.48 crore, EBITDA of ₹186.57 crore and PAT of ₹91.9 crore. This represented a growth of 51, 49 and 102 per cent over FY21. This followed flattish revenue performance in FY21 over FY20. The company’s balance sheet position appears comfortable for now with net debt/equity at 0.68, and inflow of IPO funds will further shore up finances.

While the FY22 growth looks high, it cannot be extrapolated as it comes with some benefits of base effect. The net income also got some benefits from jump in other income to ₹17.5 crore in FY22 versus ₹2.9 crore in FY21. Investors need to track quarterly earnings post listing to better assess long-term prospects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.