The IPO of Syrma SGS Technology (Syrma) opened for subscription on August 12. The issue is open till August 18 and at the time of publishing this, it was subscribed 0.37 times. The issue mainly consists of a primary issue of ₹766 crore and smaller offer for sale by the promoter of ₹74 crore, for a total issue size of ₹840 crore. The company intends to use the issue proceeds for mainly funding expansion of manufacturing and R&D facilities (₹480 crore), meeting working capital requirements (₹132 crore) and general corporate purposes (₹154 crore). The market cap of the company at issue price (price band of ₹209-220) will be around ₹3,800 crore. The promoters will own around 47 per cent of the company post IPO. It also worth noting that the company had done a pre-IPO placement to a financial investor at ₹290 per share a few months back, and the IPO has been priced lower than that due to volatile market conditions since then.

Business and prospects

Syrma is an Electronic System Design and Manufacturing (ESDM) company with a focus on technology-based solutions and original design manufacturing (ODM). This business which is globally classified under the sector - electronic manufacturing services (EMS), encompasses large scale efficient manufacturing for original brands, and is globally a well established and mature business for multiple decades. A popular example in this case is that of Apple and Foxconn. While Apple develops and owns all the intellectual property pertaining to the iPhone, it outsources the manufacturing to companies like Foxconn. Syrma is a company similar to Foxconn, but at much smaller scale with focus on different segments.

In India, EMS is a fast-growing sector following thrust for domestic manufacturing and re-strategizing of global supply chains with a China plus one strategy. The range of services offered by EMS companies extends from partnering with end customer from product design/prototyping to manufacturing and providing after sales service. The exact involvement of the EMS company in the product cycle will however vary from a case to case basis depending on the customers’ requirement. As per a report by Frost and Sullivan (F&S) included in the prospectus, globally the EMS sector is expected to growth at CAGR of 4.5 per cent between CY20-25 and reach a size of $1 trillion by CY25. However it is expected to witness much faster growth in India. According to the F&S report, the EMS sector in India is expected to grow at a CAGR of 30.3 per cent between FY21-26 and reach a size of $135 billion by FY26. Import substitution, incentives for domestic manufacturing (production linked incentives/PLI schemes), policies aimed at promoting make in India and China plus one strategy are tailwinds for the sector in India. Further, secular factors like solid growth prospects for consumption of electronic goods in India in the long term, India being viewed by rest of the world as not just a low cost manufacturing alternative but as a destination for high quality design work and manufacturing, also work in favor of the industry. The sector in India is currently dominated by manufacturing of mobile phones (65.5 per cent of industry size). This is followed by consumer electronics and appliances with 12.7 per cent, Telecom with 4.6 per cent and lighting with 4 per cent market share. Automotive, Industrial, IT, Medical and others account for the balance 13 per cent.

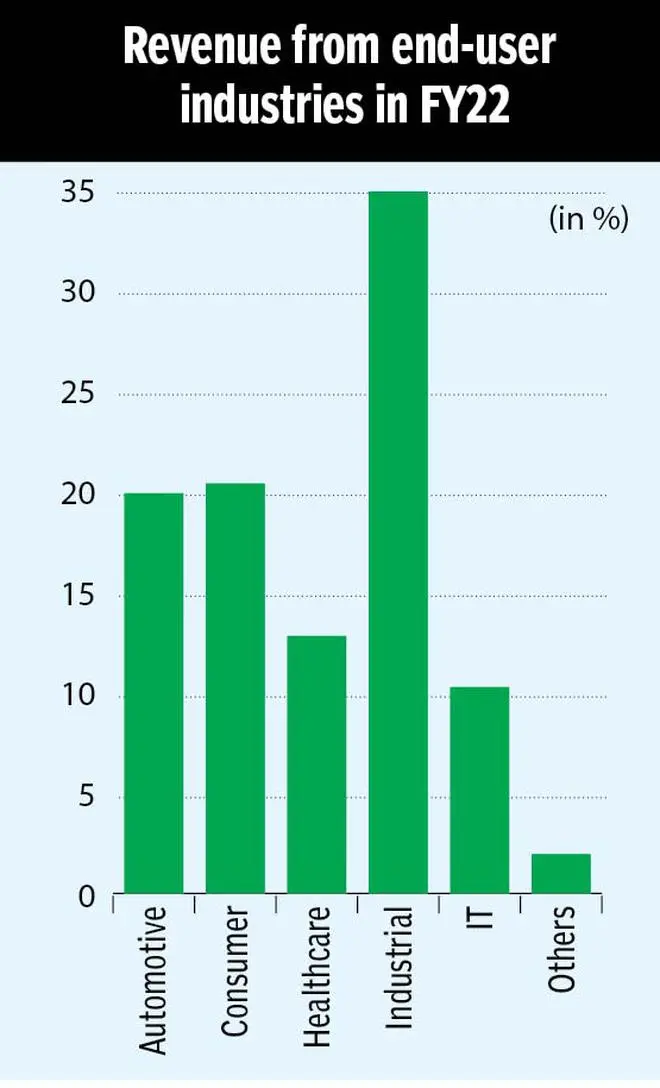

Within the EMS sector, Syrma is a leader in high mix, low volume segment with presence in most industrial verticals. Currently it is focused on, automotive, consumer, healthcare, industrial and IT verticals. Products currently manufactured by Syrma include Printed Circuit Board Assembly/(PCBA) for electronic products used in different industry verticals; box products like set top boxes, POS printers, home automation controllers; RFID (tags), magnetic & electro mechanical products (coils, inductors, magnetic filters). Besides its current focus, some of the end user industries where the company sees more opportunities and plans to focus on are in lighting, medical electronics, and Aerospace & Defence.

Syrma operates through 11 manufacturing facilities located in North and South India. Some of its marquee customers are TVS Motors, Eureka Forbes, Hindustan Unilever, Robert Bosch Engineering and Business Solutions. Exports accounted for 43.6 per cent of FY22 revenue.

Financials and valuation

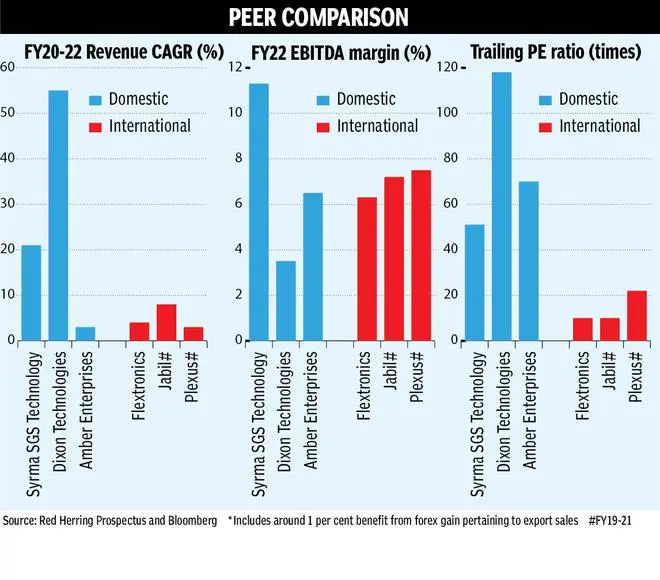

For the year FY22, Syrma reported revenue of ₹1,284.4 crore, EBITDA of ₹143.7 crore and PAT of ₹76.5 crore. This represented Y-o-Y growth of 42, 23 and 16 per cent respectively. EBITDA margins declined by nearly 200 basis points to 11.3 per cent. According to management this was due to productivity being impacted in FY22 due to supply chain issues and expenses relating to ramp up of new products. The growth in revenue the company witnessed in FY22 was after a flattish revenue trend in FY21. For the period FY20-22, the revenue, EBITDA and PAT CAGR was 21 per cent, -1 per cent and -9 per cent respectively. According to the management, the year FY20 had a boost from few one of projects that resulted in much higher margins in the year, which to some extent explains the decline in EBITDA/PAT since. It needs to be noted that company had made acquisitions in FY22 and the comparison of revenue, EBITDA and Profits is based on profroma financals (ie assumes the acquisition had happened prior to the years considered here).

At IPO price of ₹220 and based on its post issue market cap, Syrma is priced at a trailing PE of around 51 times. On a pre-issue basis it is priced at 40 times. While this cheaper than listed peers in India like Dixon Technologies which trades at 118 times and 70 times., the peers appear to be highly overvalued on a fundamental basis and hence it is hard to use that as justification.

The lofty valuations that the peers command in India, is usually unheard of in global markets for the EMS sector. Scarcity premium may be a factor playing out in India. Hence value conscious investors need not subscribe to the IPO and can wait and watch for now. EMS sector is a low margin/ high turnover business and hence can face out-sized benefits (during boom times) and out-sized contraction in profits during down cycles in business as operating leverage plays out in both ways. The current valuation does not appear to offer sufficient margin of safety for risks that may play out.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.