The capital goods theme has been in the spotlight in recent times on account of strong order inflows, high capex outlay by the government and expectations of private capex revival. ABB India has been a beneficiary of the theme. While BSE Capital Goods index has increased about 39 per cent during the last year, the stock of ABB India Ltd surged by about 67 per cent.

The stock currently trades quite expensive at a trailing P/E of around 94 times. It is also trading at around 30 per cent premium to its historical five-year average P/E of times 72 times and its FCF yield is less than one per cent, which indicates steep valuation.

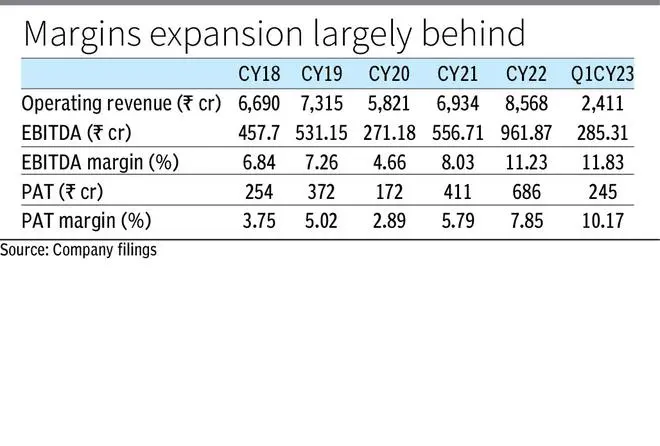

ABB’s revenue and profit CAGR during CY2018-22 are 6.2 per cent and 26 per cent respectively (adjusted for its discontinued operations). While revenue growth has been low, margin expansion/operating leverage have given a boost to earnings. However, as ABB India is currently hitting capacity utilisation of 90 per cent, margins may have peaked, leaving less room for further upside. Further, ABB India is more into short-cycle product-based business and in past cycles has seen margins dip more versus project-based peers like Siemens. When Covid downcycle hit the business, its EBITDA margin fell from 8 per cent during CY19 to 4.8 per cent in CY20 while Siemens’ margins weren’t impacted during the same time.

Ultimately, despite the company’s fundamentals being robust, its pricey valuation calls for caution, leaving risk reward unfavourable. Hence investors should consider booking profits in the stock.

Business

ABB India is an Indian listed subsidiary of MNC Asea Brown Boveri Ltd, which holds 75 per cent stake in the company. The company reports its financials on a calendar year basis in line with its Swiss parent. Its business comprises mainly four segments — one, electrification (41 per cent of revenues); two, motion (39 per cent); three, process automation (18 per cent) and four, robotics and discrete automation (2 per cent). The types of customers served here are mainly original equipment manufacturers (OEMs), Engineering Procurement and Construction (EPCs) players, channel partners, distributors and retailers.

Under electrification segment, the company provides products across the full electrical value chain — from substation to the point of consumption, including medium and low-voltage electrical components, power conversion products and charging solutions for electric vehicles. ABB’s motion business offers generators, electric motors, drives for automation solutions in transport, infrastructure and discrete and process industries.

The process automation segment provides industry-specific integrated automation, turnkey engineering, digital solutions. Here, it serves process and hybrid industries such as oil and gas, power, pharmaceutical, chemicals, metals and marine. Its robotics and discrete automation division provides solutions in robotics, machine and factory automation. The division mainly serves automotive, electronics and logistics sectors.

Currently, the company is taking more of short cycle product-based orders compared to large project-based orders as conversion from orders to cash is quick in short cycle orders as per management. The company hived off its project-based power grid business to Hitachi Energy, which achieved closure in 2020 done mainly to focus more on automation and digitalisation. It used to contribute nearly 40 per cent of the company’s revenue. Currently, projects contribute about 12 per cent of the revenue while the same for products and services is 80 per cent and 8 per cent respectively. Further, the company earns about 12 per cent of its revenue through exports.

Orderbook and outlook

During CY22, the company secured orders worth 10,028 crore, up 31 per cent on a y-o-y basis and hence clocked a book-to-bill of around 1.17 times. The growth in order inflows was seen across four segments, the highest being electrification (36 per cent) and process automation (30 per cent) followed by motion (27 per cent) and robotics (23 per cent) segments. Along with having highest growth, electrification contributes the highest to the order inflows (37 per cent), driven by large-value industrial solutions orders and growth in export orders. Further, during Q1CY23, the company saw order inflows worth ₹3,125 crore i.e. a growth of about 36 per cent y-o-y, taking the order backlog to nearly 7,170 crore as on March 31, 2023.

The management has identified electronics, railways, data centres, logistics and renewables as high growth areas in the coming times while sectors such as food and beverage, healthcare, water, automotive, mining, petrochemicals, cement and marine shall continue to deliver sustainable business for the company.

Financials

During FY2022, the company reported about 24 per cent increase in revenue to 8,568 crore which has been driven by growth in sectors such as data centres, food and beverages, transportation, energy efficiency, and building automation. It was contributed mainly by electrification and motion segments at growth of around 28 per cent and 30 per cent. The company saw about 22.5 per cent growth in revenue from operations in Q1CY23 y-o-y. The management has given guidance of ₹10,000 crore of revenue in CY23, which may translate into about 17 per cent growth during the year..

The company’s EBITDA margin has expanded to 11.22 per cent in CY22 against 8.03 per cent y-o-y while its EBIT margin expanded from about 6.5 per cent to 10 per cent during the period. Except motion business, margin expansion was seen across all segments on account of strong execution and better price realisations.

Further, over the last few quarters, the management guidance has changed from PBT of 10 per cent to PAT of 10 per cent which is what the company has achieved during Q1CY23. However, as capacity utilisation is currently moving around 90 per cent, further margin expansion can be limited.

ABB India is a net cash company with a healthy net cash balance of around ₹3,909 crore, as on March 31, 2023 (5 per cent of market cap). About, ₹2,000 crore has been set aside for inorganic opportunities, mainly built on the ones where technology can be added to the existing base.

While fundamentals look good, the prospects appear fully priced, making the risk-reward unfavourable at current levels. Being in a cyclical business and with margins likely peaked out, the time to consider the stock is when it is trading below historical average. The current 30 per cent premium to historical average PE is too steep for comfort.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.