Following prior week’s losing streak, markets took a breather and closed on a positive note this time, with a 2.7 per cent increase in NSE Nifty 50 Index for the week ended June 24. However, with most of the global concerns – geopolitical, inflation – unlikely to abate sooner, the market direction remains unclear, and a structural recovery may still be some time away.

Notwithstanding the cautious outlook for the broad market, there are stocks and sectors that have bucked the broader trend and have outperformed the market. We will discuss three such stocks, which have delivered impressive returns this week, in this column.

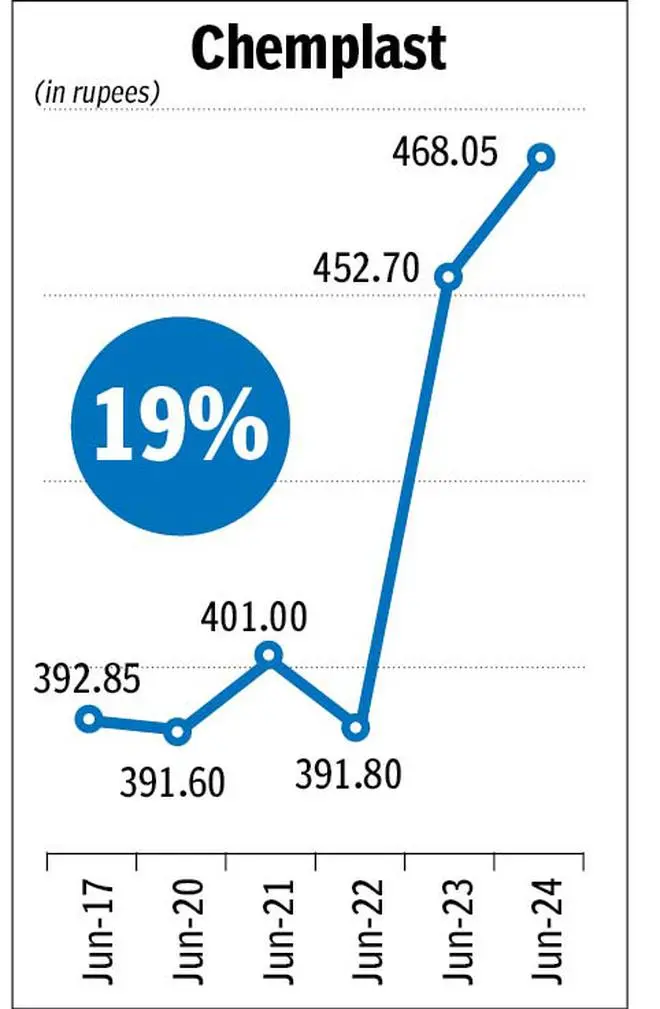

The stock of specialty chemical manufacturer Chemplast Sanmar clocked about 19 per cent gains this week. The company is into manufacturing of specialty chemicals such as specialty paste PVC resin (largest in India), starting materials and intermediates for agrochemicals, pharmaceuticals, and fine chemicals. Its portfolio includes caustic soda, chlorochemicals, hydrogen peroxide and industrial salt, amongst others. Robust performance by the company in the March 2022 quarter and FY22 has helped it garner investor interest. In FY22, the company clocked its higher ever revenue of Rs 5885 crore, which is about 55 per cent growth over FY21 revenue of Rs 3798 crore. However, its operating margin moderated from about 25 per cent to 20.2 per cent, due to weakness in Q3 performance on account of shutdown and extended monsoon. This had a spill over effect in Q4, as the inventory built up had to be liquidated at lower realisation, due to a moderation in the prices, which resulted in inventory losses in Q4 FY22. Also, a fall in Chinese consumption due to covid lockdown impacted volumes in FY22, which is expected to normalise in FY23. The stock trades about 10.3 times and 9.8 times its estimated FY23 and FY24 earnings, respectively.

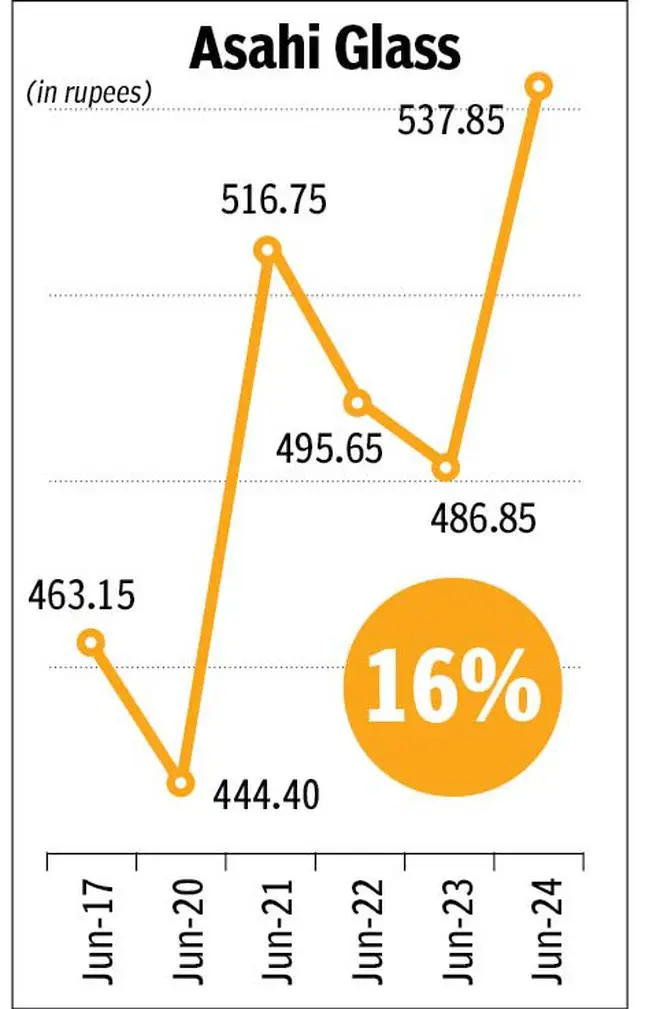

Another stock that fared better than the market was that of value added and integrated glass solutions provider Asahi India Glass, gaining about 16 per cent. The company has two business segments – Automotive glass and Architectural glass. Automotive glass accounts for 52 per cent of the company’s revenue and Maruti is a key customer; the company also has new customers such as Kia Motors on board. A leader in the passenger vehicle glass market with about 73 per cent share, the recovery in passenger vehicle segment should result in higher revenue from this segment. The margins may remain muted though, due to the high freight cost and weak rupee since the clear glasses for auto industry are imported by the company. However, the architectural glass which contributes 48 per cent to revenue is expected to benefit from the anti-dumping duty, reduced production from China due to decarbonization drive in China. Also, the demand from real estate segment is looking up and should boost this segment’s performance. In FY22, Asahi recorded revenue growth of 20 per cent to Rs 1614 crore, compared to FY21. The company’s operating margin was at about 24 per cent in FY22, higher than the sub 20 per cent levels in FY21, thanks to the stellar performance by the architectural glass segment. The stock currently trades at about 31 times and 26 times its estimated FY23 and FY24 earnings, respectively.

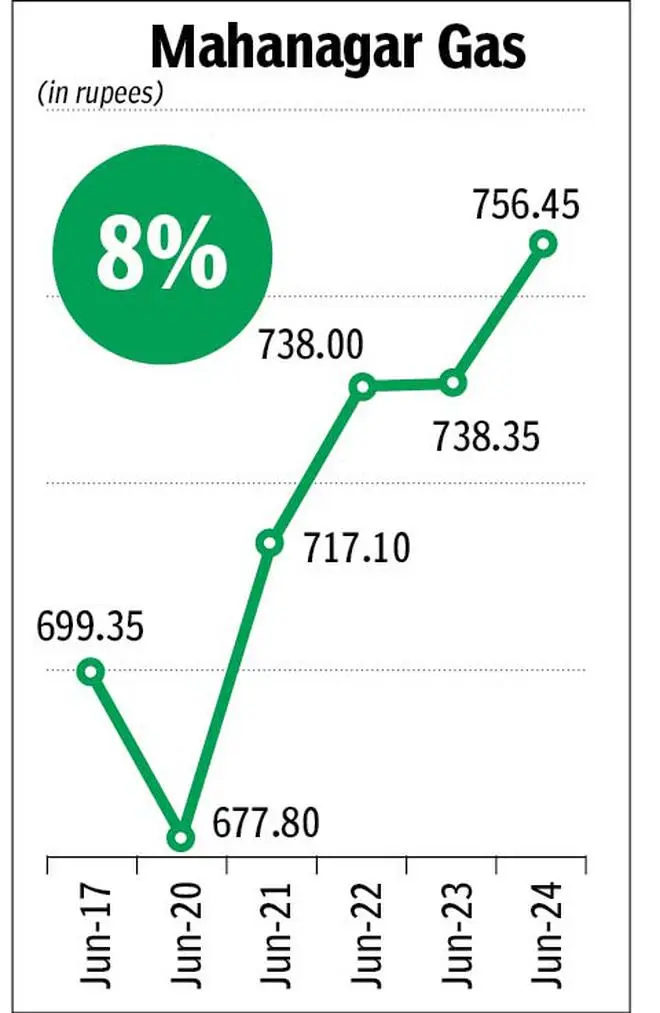

The stock of Mahanagar Gas also had a good run, clocking 8 per cent gain for the week. The company which is into gas distribution gets its lion share of revenue from CNG (Compressed natural gas) which accounts for 70 per cent of the company’s revenue while PNG (piped natural gas) accounts for the balance. The sharp correction (over 30 per cent) in the international gas prices, if it sustains, will be a big positive for gas distribution companies in general and Mahanagar gas. While EV penetration may risk the CNG business in the medium term, the cost advantage of gas over petrol and diesel should benefit Mahanagar Gas. CNG penetration still being lower in the passenger vehicle segment at about 20 per cent, provides ample room for growth. In FY22, the company reported revenue growth of 56 per cent (Rs 3468 crore) even as net profit was flat last year. The stock currently trades about 10.4 times and 9.4 times its FY23 and FY24 estimated earnings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.