Benchmark indices Nifty 50 and S&P BSE Sensex extended their gaining streak for nine straight sessions and rose by 1.3 and 1.01 per cent, respectively, last week.

While the BSE Capital Goods index ended the week on a flat note and BSE IT fell by about 1.13 per cent, all other sectoral indices gained during the week. BSE Realty (5.25 per cent), BSE Auto (3.47 per cent) and BSE Bankex (2.89 per cent) were the top gainers.

Among BSE 500 stocks, the top 5 gainers were AU Small Finance Bank (19.34 per cent), Balaji Amines (16.27 per cent), Godrej Properties (13.93 per cent), IDBI Bank Ltd (11.02 per cent) and Welspun India (10.55 per cent).

Out of these, there was fundamental news flow during the week that were catalysts for the upside for three of them mentioned here. There appears to be no significant news flow during the last week for the other two stocks

AU Small Finance Bank

The single-day gain of about 17 per cent on the Thursday session led to the stock of AU Small Finance Bank becoming the top performer of the week.

The key trigger appears to be the RBI’s nod on the re-appointment of the MD and CEO Sanjay Agarwal, for about three years. Prior to the April 13 rally, the stock was down about 10 per cent on a YTD basis.

The stock was under pressure because of a lack of clarity about management continuity and the uncertain macro environment. With Sanjay Agarwal continuing his position at the bank, the key overhang appears to be gone.

The stock currently trades at a trailing P/B of about 5.64 times.

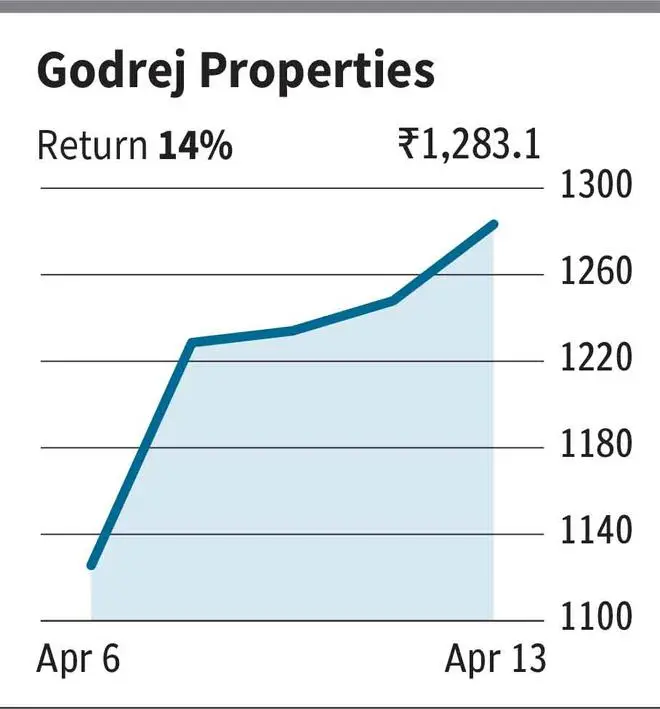

Godrej Properties

The real estate developer Godrej Properties gained 14 per cent in the last week. The main trigger which has caused the interest of the street in this stock is the numbers put out by the company. The company stated that the sales volume of the company for the March 2023 quarter rose 19 per cent QoQ in area terms from 4.42 million sq. ft. to 5.25 million sq. ft.

The sales volumes for FY23 grew by 40 per cent to 15.21 million square feet from 10.84 square feet in FY22. March 2023 quarter bookings were ₹4,051 crore and FY 23 booking value grew by 56 per cent to ₹12,232 crore. The company’s realisations for FY23 grew 41 per cent to ₹8,991 crore, and March 2023 collections stood at ₹3,822 crore, which is 127 per cent higher QoQ and 52 per cent high YoY.

The real estate developer Godrej properties gained 14 per cent in the last week. The main trigger which has caused the interest of the street in this stock is the numbers put out by the company.

The company stated that the sales volume of the company for March 2023 quarter rose 19 per cent QoQ in area terms from 4.42 million sq. ft. to 5.25 million sq. ft. The Sales volumes for FY23 grew by 40% to 15.21 million square feet from 10.84 square feet in FY22.

March 2023 quarter bookings was ₹4,051 Crore and FY 23 booking value grew by 56 per cent to ₹12,232 crore. The company’s realisations for FY23 grew 41 per cent to ₹8,991 crore, and March 2023 collections stood at ₹3,822 crore which is 127 per cent higher QoQ and 52 per cent high YoY.

The stock of Godrej properties currently trades at a trailing PE of 85.3 times and Price to Book ratio of 4.11 times.

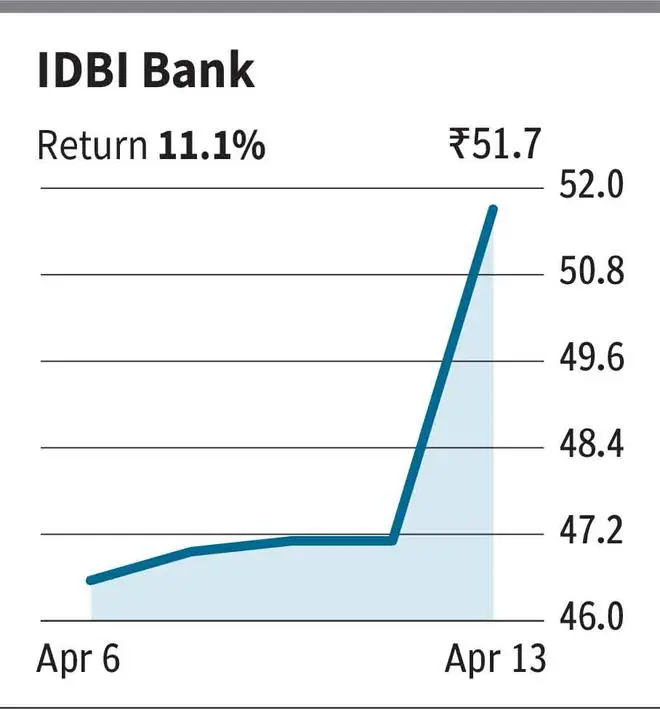

IDBI Bank

The stock of IDBI bank closed 10 per cent higher on April 13 from the close of previous trading session. The sudden interest of the market in this stock is due to incremental news over the privatisation process of the state-owned bank.

As per a Reuters report, RBI has started evaluating five potential bidders who might be interested in picking up a majority stake in the bank.

Currently, the government of India owns 45.48 per cent in the bank. Life Insurance Corporation of India is the other majority shareholder in IDBI, with around 49 per cent stake.

The stock is currently trading at a trailing PE of 17.29 times and a Price to book ratio of 1.23 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.