After a weak close in the first week of the calendar year, markets ended in the green this time. Bellwether indices Nifty and Sensex ended the week up by 0.5 per cent and 0.6 per cent, after some volatile movements. While relentless selling by FIIs pressured the index, lower consumer price Inflation (CPI) data, which came it at a one-year low of 5.72 per cent for December 2022, and decent results from IT majors TCS and Infosys alleviated some market concerns.. Interestingly, global markets,, including the US, also fared well. Looking ahead, Budget expectations and earnings will likely drive the market.

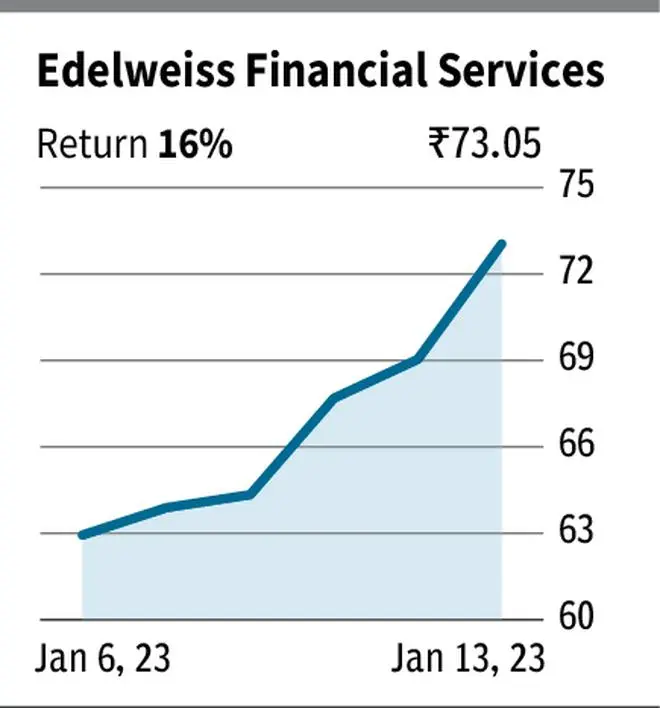

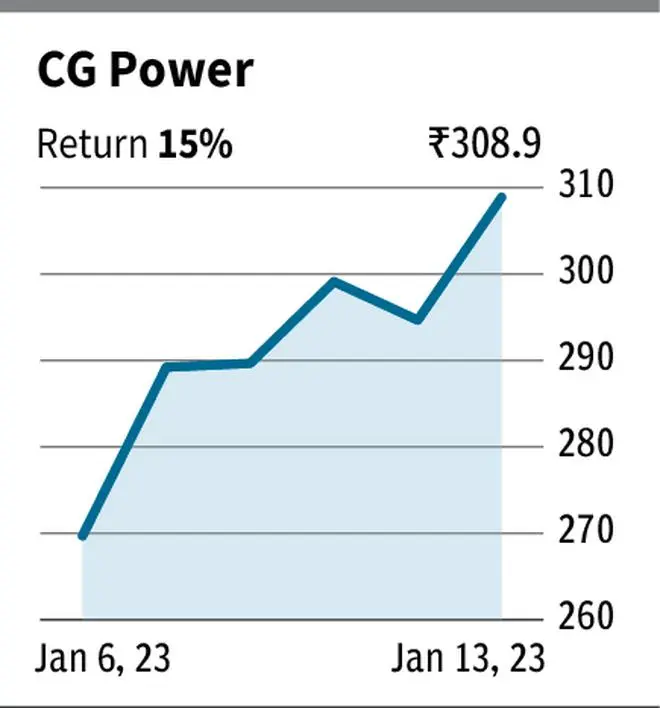

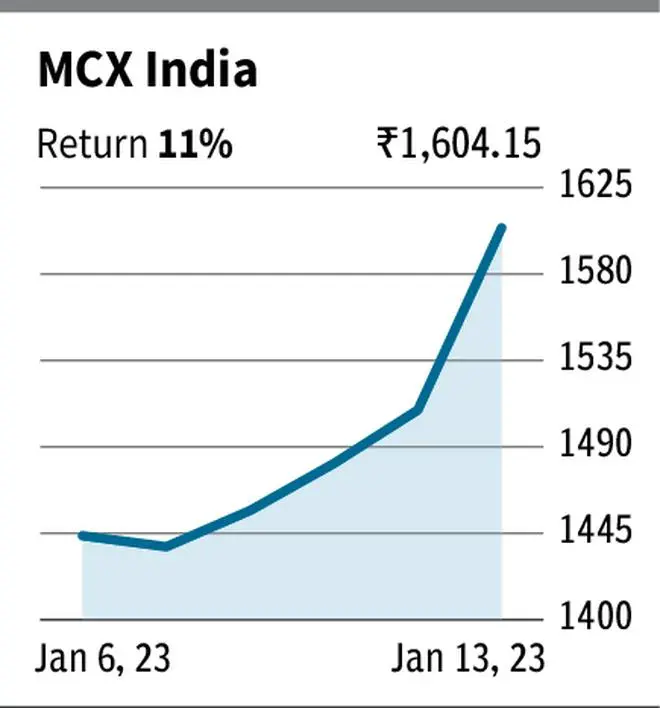

This week, the stocks of Edelweiss Financial Services, CG Power and Industrial Solutions and MCX India turned out to be market darlings, raking in healthy gains.

Stock of Edelweiss Financial Services posted returns of 16 per cent in the last five trading sessions, ranking first among the stocks that are part BSE 500 Index. However, there appears to be no fundamental news during the week to drive the upside in the stock. The company houses the group’s financial services business which includes subsidiaries that are into broking, asset management, insurance, and wealth management, to name a few. Even as the company’s revenue and operating profit moderated in 1HFY23 by 5 per cent and 17 per cent to ₹3,281 crore and ₹1,261 crore compared to the same period previous year, higher other income helped the company report 24 per cent increase in net profit to ₹112 crore in 1HFY23. The stock currently trades about 1.1 times its book value.

Ranking second in the winners’ list is the stock of power and industrial equipment and solutions company CG Power and Industrial Solutions, with a gain of 15 per cent over the last five trading sessions. The Murugappa group-owned engineering major plans a ₹230-crore capex for expanding its motor manufacturing in Goa, to also capitalise on the EV opportunity. The company reported stellar performance in the 1HFY23 with revenue and operating profit growth of 35 per cent and 64 per cent to ₹3,361 crore and 452 crore. Net profit rose 20 per cent in the April-September 2022 period to ₹309 crore compared to ₹257 crore in the same period last year. The stock trades about 81 times its trailing twelve-month earnings, compared to about 40 times for the industry.

The other stellar performer last week was the stock of commodity exchange MCX India, which gained 11 per cent. The upmove was on the back of SEBI approval for multiple contracts for all commodities in the derivatives segment. Until recently multiple derivatives contracts were allowed only in precious metals – gold, silver, and others. This move to allow the same for all commodities is expected to increase investor and trader participation across commodities. The company posted revenue and operating profit growth of 38 per cent and 61 per cent in the 1HFY23 period to ₹236 crore and ₹113 crore, respectively. The stock currently trades 42 times its trailing twelve-month earnings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.