With markets closed on Monday on account of Maharashtra Day, Indian markets will be open on Tuesday after a gap of three-days.

Here is recap of major trends of the Indian stock markets last week.

Both benchmark indices Sensex and Nifty 50 were up nearly 2.5 per cent each last week. Except for BSE Consumer Durables index (flat for the week), all other major sectoral indices gained during the week. BSE Realty (5 per cent), BSE Capital Goods (4.5 per cent) and BSE Power (3.4 per cent) were the major gainers.

Among BSE 500 stocks, the top 5 gainers were Rail Vikas Nigam Ltd (38.84 per cent), Gujarat State Fertiliser and Chemicals (28.8 per cent), India Bulls Real Estate (27.97 per cent), Mangalore Refinery and Petrochemicals Limited (20.58 per cent) and IRCON International (17.66 per cent).

Here are the three stocks that outperformed the overall market last week.

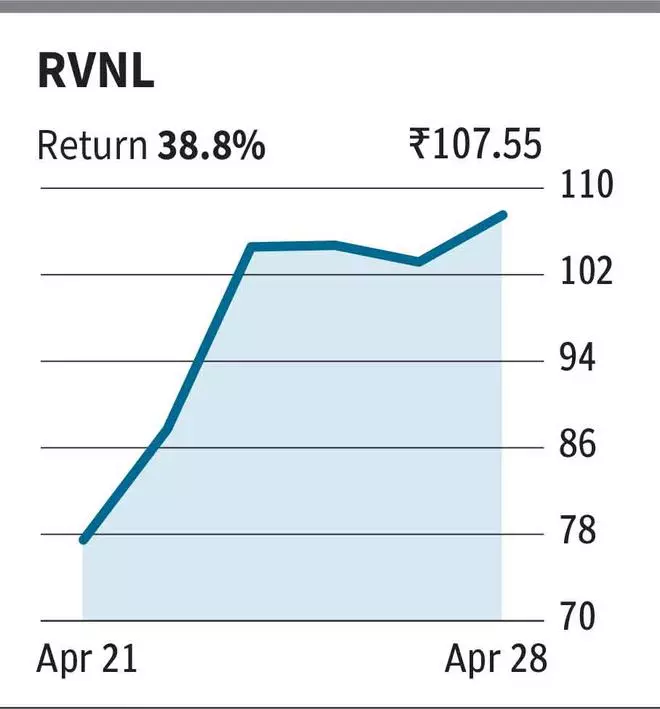

Rail Vikas Nigam Ltd (RVNL)

RVNL provides rail construction related services by designing and constructing bridges, roads and related infrastructure.

Two major events led to the the stock gaining nearly 40 per cent in one week.

One, RVNL has announced that it won a ₹121-crore worth project from North-Central Railways for the provision of E1-based automatic signaling with continuous track circuiting and other associated works. Two, the Finance Ministry approved conferring the PSU with Navratna status, an upgrade from its earlier Miniratna status. This would mean that the company will have more autonomy in terms of certain financial decisions.

The stock of RVNL currently trades at a trailing P/E of around 15.53 times.

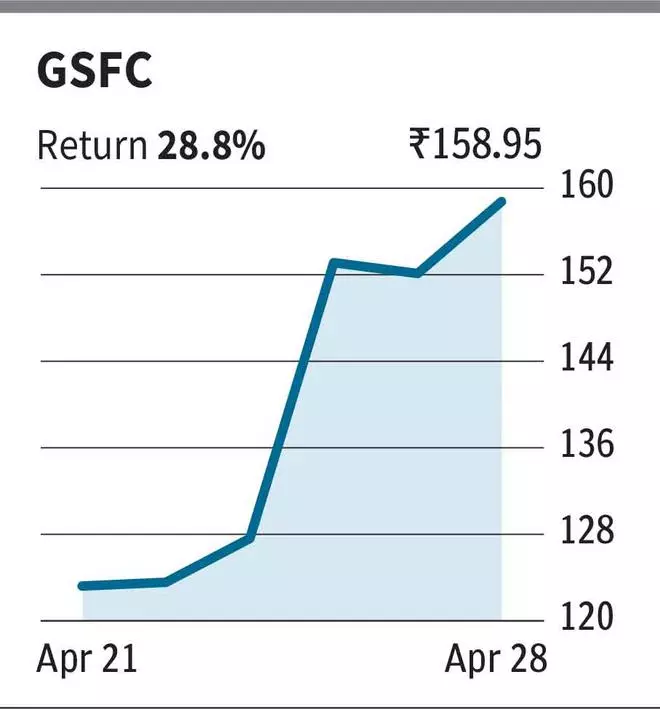

Gujarat State Fertiliser and Chemicals (GSFC)

GSFC’s share price shot up by 29 per cent last week.

The new policy announcement by the Gujarat government regarding dividend distribution, bonus, share splits, and buyback appears to have triggered the rally in Gujarat PSUs, including GSFC. According to the new policy, the state PSUs are supposed to pay shareholders, a minimum dividend of at least 30 per cent of their profits after tax or five per cent of their net worth, whichever is higher.

On account of the stated policy, the street believes that better capital allocation and financial discipline can be expected and investors will be provided with more clarity on what they can expect in terms of dividends and bonus shares.

The stock of GSFC trades at a trailing P/E of about 4.76 times.

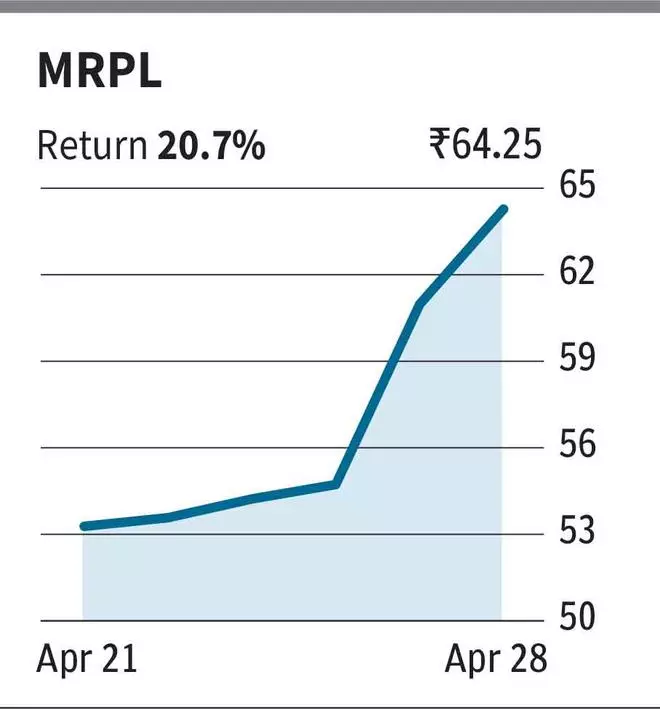

Mangalore Refinery and Petrochemicals Limited (MRPL)

The stock of MRPL gained nearly 20 per cent on account of strong quarterly results. A subsidiary of ONGC, MRPL manufactures and sells refined petroleum products in India.

The company saw a sequential jump in its EBITDA from around ₹287.4 crore in Q3 to ₹3490.2 crore in Q4 FY23. Compared to a loss of around ₹195 crore during Q3, the company reported a net profit of around ₹1913.4 crore in Q4.

However, it is worth noting that the company’s revenue and PAT declined by nearly 36 per cent y-o-y and stock too is down by nearly 20 per cent in the last one year.

The stock of MRPL is trading at a trailing P/E of around 3 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.