Investors with a one-to-two-year investment horizon can consider investment in the stock of Karnataka-based paper producer West Coast Paper Mills, considering the cyclical nature of the industry. With a total paper manufacturing capacity of 3.3 lakh tonnes per annum, West Coast is the country’s second largest paper manufacturer, with presence across categories such as printing and writing paper, packaging boards, cups, and boards.

The paper Industry has been one of the key beneficiaries of the unlocking of the economy, with reopening of schools and colleges having helped companies in this space witness healthy volume growth. This, coupled with improvement in realisations, has enabled companies to achieve robust operating performance over the last few quarters. We believe West Coast to be a good stock to accumulate on dips for investors with moderate risk appetite, for three reasons.

Improving demand

First, the demand for paper has seen significant uptick over the last few quarters, thanks to the reopening of offices and schools and resultant requirement for writing/printing paper. Also, the need for packaging boards and paper in e-commerce on surge in demand from the food, pharma, health, and hygiene segments, has helped paper mills.

The paper Industry is expected to grow upwards of 8 per cent over the next five years, according to media reports. Besides, higher demand from the education sector for products such as maplitho and cream wove, the new education policy, which envisages bringing over 2 crore children to mainstream education, can support demand growth for West Coast and the sector. These two products account for two-thirds of the company’s printing and writing paper revenue. Incorporated in 1955, West Coast is one of the largest paper mills, and is well-placed to ride the strong demand for paper and packaging boards.

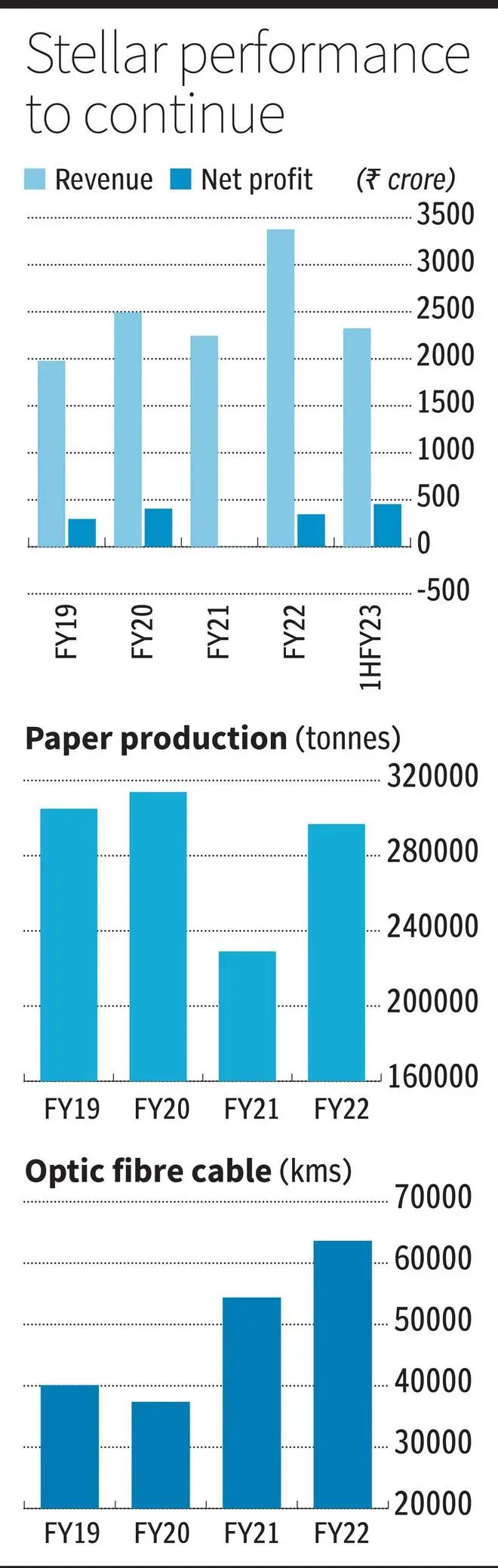

Second, the company is making process improvements at its Paper Division at Dandeli to reduce costs as well improve product quality. The investment should help reduce cost of power and chemicals and thereby improve operating margin. Further, the price realisation for paper has increased from about ₹55,000 a tonne in early 2021 to ₹75,000-80,000 a tonne currently and is expected to hold on to those levels. Steady realisation, along with cost reduction, should aid margin improvement in the near term. Also, the recent cool-off in global coal and oil prices should help paper mills, by way of marginally lower operating cost. In 1HFY23, the company’s revenue and operating profit grew 62 per cent and 184 per cent to ₹2,324 crore and ₹688 crore, respectively.

Also, the company’s Cable Division, which contributes about 4 per cent of the consolidated revenue, is seeing traction. The company has forayed into newer products such as ribbon cables and plans to forge long-term agreements with telcos, going forward, which will lend stability to the segment’s revenue. It is also pursuing export opportunities in this segment.

Third, Andhra Paper, wherein West coast holds 72.24 per cent stake, has delivered solid performance over the last few quarters. In 1HFY23, the company reported revenue of ₹937 crore, implying a 54 per cent year-on-year growth. Operating profit margin expanded from 12.7 per cent in 1HFY22 to 28.8 per cent in 1HFY23, thanks to strong volume growth and sharp increase in realisation. Net profit saw a 4.4 times jump to ₹198 crore, versus ₹45 crore last year. With a capacity of 2.4 lakh tonnes per annum, the company is set to sustain its growth momentum in the medium term too, which will have a positive rub-off on West Coast’s profitability.

Third, West Coast’s strong balance sheet with negligible debt and impressive return ratios adds to the company’s attractiveness. Its current return on equity is at an impressive 20 per cent, while return on capital employed is at 23 per cent.

As of 1HFY22, the company’s total debt stood at ₹322 crore, down from ₹478 crore in March 2022. The debt-to-equity ratio for the company also has reduced further from 0.28 times in March 2022 to 0.16 times, as of September 2022.

Valuation

The company currently trades at an attractive 6.4 times its trailing twelve-month earnings. Here, it is important to understand that the earnings growth momentum is likely to sustain in 2HFY23 as well and hence the valuation from a forward earnings perspective should look even more attractive. Interestingly grade B mills such as Satia Industries and Seshasayee Paper are trading at a higher multiple of 10 times and 8.2 times trailing twelve-month earnings.

Concerns

Restrictions on import of scrap/used paper and availability of wood chips are a concern for the industry. However, West Coast has implemented clonal plantation programme apart from seedlings distribution at subsidised rates to augment availability of wood. It is also procuring wood from private cultivators in Karnataka, Tamil Nadu, Andhra Pradesh and to manufacture some specialty papers, the company imports pine wood pulp. All these should help mitigate any constraint on raw material availability. Though increase in chemical prices – caustic soda — may have a bearing on profitability, the company is working to optimise raw material usage to sustain operational efficiency.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.