‘Don’t try to catch a falling knife’ is an oft-used phrase in markets when stocks have quick deep corrections, especially in the current context of brutal draw-downs in many US technology and media stocks. However, the rule does not apply to all stocks. When companies amongst the bluest of blue chips have severe draw-downs, attractive long-term opportunities open up.

One such opportunity appears to be emerging in the stock of leading global media and entertainment conglomerate – The Walt Disney Company (Disney). Currently in its 100th year, Disney has a long history of successful business execution and performance across multiple market cycles, including many recessions, to back it up. Over the last 100 years, despite its size, it has also been nimble and innovative to adapt to changing dynamics and remain a leader/significant player across its business segments.

Currently trading at $96, the stock of Disney is down around 40 per cent on a year-to-date basis versus the S&P 500 down 19 per cent. The stock is down 52 per cent from its all-time high level reached in 2021. In previous bear markets like the one in 2007-09, Disney’s fall was in line with the S&P 500. This time around, the correction is more severe versus the benchmark index.

Disney currently trades at discount on multiple parameters when compared to its five-year average – one-year forward PE of 18.6 times versus five-year average of 28.7, EV/EBITDA of 12.8 times versus 17, and price/book of 1.8 times versus 3.2. Part of the valuation discount and share price correction can be attributed to markets de-rating streaming business valuations post the carnage in Netflix stock. At current valuations, the risk-reward appears favourable. . Streaming peer Netflix trades at one-year forward price/sales of 2.6 times. Assigning the same multiple for Disney’s streaming business (estimated revenue of $26 billion for the streaming business) and adjusting for its share price, implies rest of Disney’s business is available at a PE of around 11 times, which is an attractive multiple for a 100-year-old successful conglomerate. Further, the streaming business industry is growing through a transition phase, there may be scope for re-rating in that business as it moves past current phase.

However given that broader US markets appear to have more unwinding to do and Disney too may correct further along with broader markets, we recommend investors to accumulate the stock on dips over the next few months rather than a lump-sum purchase.

Business

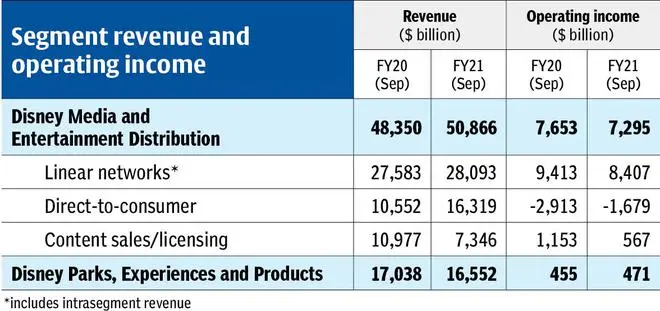

Disney is a diversified, worldwide entertainment conglomerate with operations in two segments – Disney Media and Entertainment (DMED), which accounts for around 75 per cent of revenue, and Disney Parks, Experiences and Products (DPEP), which accounts for the rest.

The DMED segment encompasses the company’s global film and episodic television content production and distribution activities. Content is distributed across three lines of business – Linear Networks, Direct-to-Consumer (streaming business similar to that of Netflix), and Content Sales/Licensing. Content is generally created by three production/content-licensing groups – Studios, General Entertainment, and Sports. The main revenue streams for DMED are advertising revenues, affiliate revenues (fee paid by distributors like cable companies), subscription revenues, theatrical distribution revenues (box office).

Some of its popular channels under Linear Networks are ABC Television Network, ESPN, National Geographic, Star branded networks etc. Its Direct-to-Consumer offerings include Disney+, Disney+Hotstar (popular in India), ESPN+ and Hulu. Content Sales/Licensing includes theatrical distribution, licensing content to third-party television and streaming services. Disney owns a few of the leading theatrical studios in the world like Walt Disney Pictures, Marvel Studios, Lucas films, 20th Century Studios that have produced many of the enduring classics and current-day blockbusters.

One notable thing within DMED in recent times is the remarkable success of Disney’s core streaming service – launched in November 2019 , it has scaled up to around 140 million subscribers now in a very short span of time. To get a perspective, Netflix which launched its streaming services more than a decade ago, has around 220 million subscribers (Netflix ARPU is higher though).

The DPEP business has two sub-segments – Parks & Experiences and Consumer Products. The Parks & Experiences business owns and operate famous theme-parks that include Walt Disney World in Florida, Disneyland in California, Disneyland Paris, Hong Kong Disneyland. It also owns and runs cruise lines. Consumer products involves monetising the many famous Disney brands via sale of branded merchandise and licensing trade names/characters.

Overall, Dinsey has a well-diversified business and dominant presence in its areas of operations. It has built a strong, resilient and innovative business model that can withstand market cycles and continue to grow.

Financials

In FY21 (September), Disney reported revenue of $67.42 billion, EBIT of $7.76 billion and net profit (adjusted for one-offs) of $4.22 billion. This implies EBIT and net profit margin of 11.5 per cent and 6.25 per cent respectively. Results were generally flattish year-on-year, with different business segments impacted by the pandemic in each of those years (FY20 and FY21). In the first six months of FY22, the company reported robust growth as re-opening theme played out and DPEP rebounded. Revenue was up 30 per cent year-on-year and operating income was up 83 per cent. Operating margin for the six-month period was at 17 per cent.

The interesting thing to note hear is that prior to the launch of its streaming business in 2019 and also the pandemic impact on theatrical distribution, Disney was operating with much better margins. For example, for the years FY16, FY17 and FY18 it delivered operating margins of 28 per cent, 27 per cent and 26 per cent respectively.

Thus as theatrical business returns to normalcy post-pandemic and streaming business becomes profitable (analysts expect Disney’s streaming business to generate operating profit by FY25) and it scales up, there is scope for earnings accelerating over the next few years (subject to impact of recession in the US/slowdown in global economy). For example, a recent report on Disney from Deutsche Bank estimates FY21-24 revenue CAGR at 14 per cent, while EBIT is estimated to grow substantially higher at 24 per cent. Consensus view, too, reflects this with FY23 revenue expected to grow at 11 per cent, while EPS is expected to grow at 42 per cent.

Risks

Being a consumer discretionary stock and many of its business segments prone to cyclical headwinds, some of the estimates for Disney may get impacted if a US recession takes hold. Factors that lend comfort on prospects for the stock despite this are as follows: one, with earnings and margins currently compressed due to the impact of pandemic and investments in streaming business, the current valuation of 18.6 times is not expensive (given streaming business, which accounts for around 30 per cent revenue, is unprofitable and valued more on price/sales basis) on an absolute basis also. To the extent current forward estimates get missed due to any economic slowdown, the stock/valuation can get more impacted. However, it is more likely that after a over 50 per cent draw-down, a major part of correction is done, thus presenting an opportunity for long-term investors.

Two, irrespective of cyclical headwinds, Disney is well-positioned for margin expansion and this bodes well for the long term. Three, with an innovative and resilient business model, Disney is relatively better positioned than many other stocks to weather economic storms and come out of it successfully as it has done in the past.

However to the extent the risks exists, accumulation is better than lump-sum buying.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.