Investors with a moderate risk appetite and investment horizon of two-three years can use any correction in the stock of Gujarat State Chemicals and Fertilisers (GSFC) to accumulate the stock. GSFC is a leading producer of fertilisers – urea and complex fertilisers (phosphatic fertilisers) – and several industrial chemicals such as caprolactam, melamine and cyclohexanone. It is the largest maker of caprolactam and melamine in the country.

We believe GSFC to be a good medium term diversification idea for three reasons.

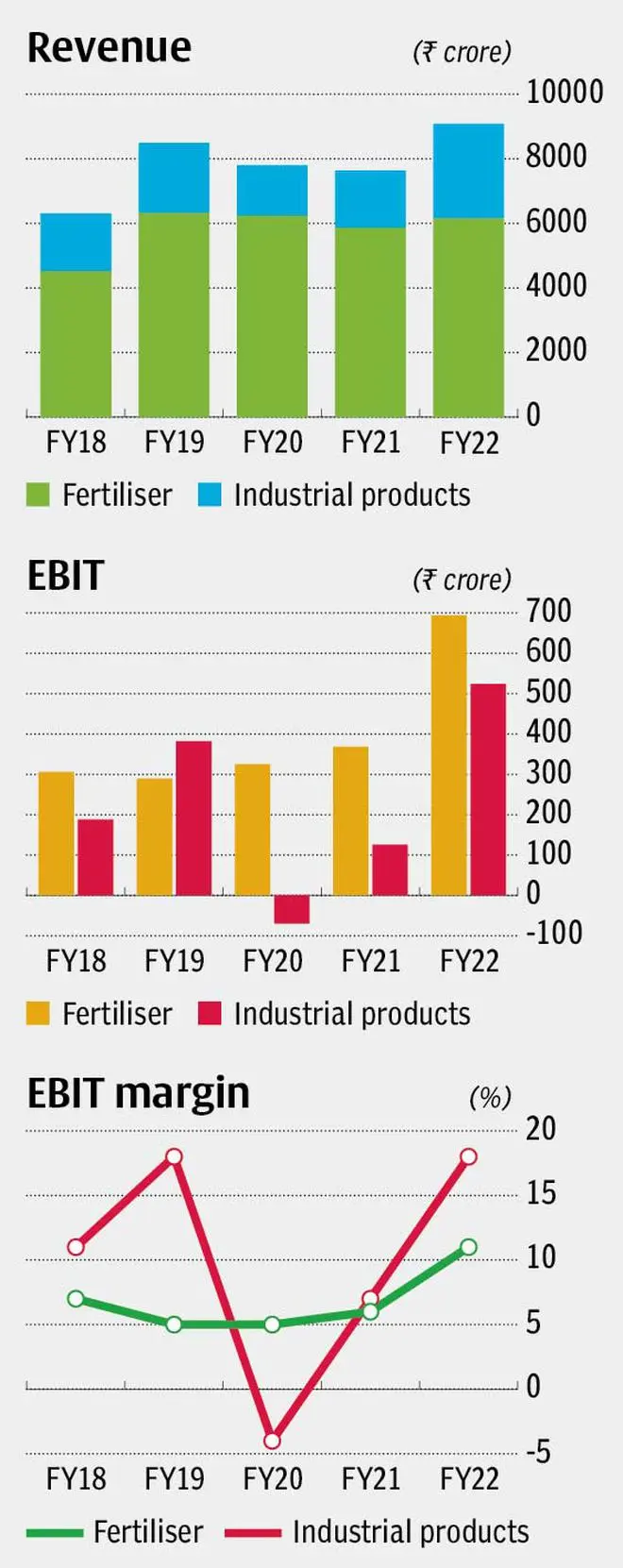

First, the company’s fertiliser and chemical business complement each other. The company’s fertiliser portfolio consisting of better margin phosphatic fertilisers (NPK grades) such as Ammonium Sulphate and 20:20:0:13 (NPK grade with sulphur) render stability during downcycles in its chemical business. While industrial chemicals traditionally enjoyed profit margins higher than fertilisers, it is cyclical in nature. Given that the pricing for these products is linked to international prices, global supply demand trends and input prices have a significant bearing on this segment and company’s overall profitability. For instance, in the years FY15, FY16 and FY20 when the industrial chemicals segments witnessed margin pressure, the fertiliser business cushioned the company’s operations. In FY15, FY16 and FY20, the industrial products segment EBIT margin was at 9 per cent, 4 per cent and -4 per cent respectively, while the fertiliser segment margins for the period came in at 12 per cent in FY15 and FY16 and 5 per cent in FY20.

However, in the last one year, the industrial products segment benefitted from higher realisation on account of subdued supplies from China. This had helped chemicals margin in FY22.

Now, with resumption of Chinese supplies, the profitability of the chemical segment has been impacted due to higher fixed costs, because of vintage of the plant, high raw material costs and falling realisations for key products. For instance, GSFC which is still the only player in Caprolactam has seen significant pricing pressure due to cheaper imports from China. The product which accounted for lion’s share of the company’s profits a decade back or so, has now dwindled. The squeeze in margins currently is on account of higher input costs (benzene which is a crude derivative) on one hand and lower realisation due to cheaper Chinese imports on the other hand. The impact of this is already visible in 1QFY23 performance.

However, products such as technical grade urea and nitric acid have shielded the impact to an extent. Nitric Acid price for Indian players has more than trebled in the past year, according to data from Chemanalyst. It has gone from ₹17,690 per tonne in June last year to ₹59,550 this year and is ruling at a one-year high.

Fertiliser stands out

Even as the chemical segment currently grapples with high input costs and falling realisations, the fertiliser segment has managed to pull through, thanks to the decontrolled subsidy regime for phosphatic fertilisers, wherein the government gives fixed subsidy to producers and the balance is recovered from farmers. Products such as Ammonium sulphate and NPK 20:20:0:13 should aid margins even as commoditised low margin fertiliser products such as Di-ammonium Phosphate and urea may still drag the overall profitability.

The company has planned capex of ₹720 crore over the next two years. It is expanding its ammonium sulphate facility by adding another train with a capacity of 400 tonnes per day. GSFC is also increasing its sulphuric acid capacity by 1800 tonnes per day which goes into making phosphoric acid, which is in turn used in complex fertilisers. It is also augmenting phosphoric acid capacity by 600 tonnes per day. These investments should support GSFC’s growth over the next 3-5 years.

In addition to this, if the recent moderation witnessed in global gas and crude prices sustain, it should provide a relief to chemicals division as well boost fertiliser segment performance.

Second, GSFC’s strong balance sheet with a net cash surplus (debt of ₹231 crore, cash equivalents of ₹307 crore and equity of ₹1,167 crore as of March 2022) offers more room to pursue aggressive expansion plans to drive long-term growth, besides providing a competitive advantage in a rising interest rate scenario. The return on equity and capital employed at mid-single digit is depressed due to low profitability currently. The company’s expansion initiatives along with focus on cost control and effective utilisation of cash, if done, can potentially improve the quality of earnings.

Finally, the current valuation of the stock lends comfort. At the current price, it trades at half its trailing book value (FY22) and about 6.3 times its FY22 earnings. Given that the fertiliser segment revenues peak in Q1 and Q2 coinciding with the Southwest monsoon season, using trailing 12-month earnings to measure earnings multiple may not be appropriate.

Financials

In the recent June quarter, GSFC reported robust performance, thanks to higher realisation in the fertiliser segment. Operational revenue grew 63 per cent to ₹3018 crore, compared with ₹1850 crore, a year ago. Operating profit margin for the quarter stood at 17.4 per cent, higher by about 650 basis points, compared to June 2021 quarter margin of 10.8 per cent. While fertiliser segment registered record margin of 22 per cent, chemicals recorded a meagre 4 per cent EBIT margin. Net profit grew 2.5 times to ₹345 crore in the June quarter, vis-à-vis ₹136 crore for the same period last year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.