Whether it is in the group of entertainment bigwigs or the group of FAANG, Netflix is unique. In the group of the world’s largest entertainment companies, Netflix is the youngest in the club. Founded in 1997 as a video rental company, it was subsequently catapulted into the big league within the shortest time, with massive global success of its streaming business that was launched in 2007. In the process it had started setting the trend for century-old media and entertainment companies like Walt Disney (founded: 1923), Comcast subsidiary - NBC Universal (founded 1926), Warner Bros Discovery (Warner Bros - founded 1923), to follow.

Similarly, amongst the FAANG stocks, Netlfix was the least profitable company for much of last decade as compared to the highly profitable and cash printing business of the rest in the group. Yet it got categorised in this group for its pioneering business model that showed huge potential, which made it attractive for investors to bet on.

After a record run in business performance and in stock returns till 6 months back, its business model and returns potential is being questioned. Is the story over?

In our opinion it hardly appears to be the case. The company seems to be more at an inflexion point where some business model adjustments will be required as streaming companies compete hard against each other, and now look to penetrate into value-conscious customers, after lapping up the low hanging fruits till now. In mean time, both stock price and Wall Street analyst expectations have reset to realism after extraordinary expectations.

The massive 73 per cent correction in the stock price of Netflix since its all-time high of $700 reached in November 2021 has flushed out investor frenzy and euphoria. The last two quarters of disappointing earnings report have tempered Wall Street’s aggressive growth estimates, and expectations are more reasonable now, with scope for positive surprises in the long run.

In this context, it may be an ok time to start getting one’s foot in the door of Netflix stock. Trading at 15 times CY23 PE (Bloomberg consensus) and 12 times EV/EBITDA (CY23), the risk-reward is favourable from a long-term investing perspective. Investors, however, need to take cognizance of three important things – one, it will take time for Netflix to readjust its business model (revenue stream from monthly subscription and advertisement, versus only monthly subscription now). Two, broader US markets have been under a lot of pressure in the last 3 months due to a combination of very high inflation and Russia-Ukraine crisis. In the process, many quality stocks have dipped well below what some would determine as fair value. Netflix will not be immune to this trend. The third factor to note is that if economic slowdown in developed world is worse than currently anticipated, there may be more interim pain in upcoming quarterly results.

Hence, investors can look to accumulate in small quantities now and over the next 6 months as volatility plays out, rather than making a single large lump sum purchase.

Business case

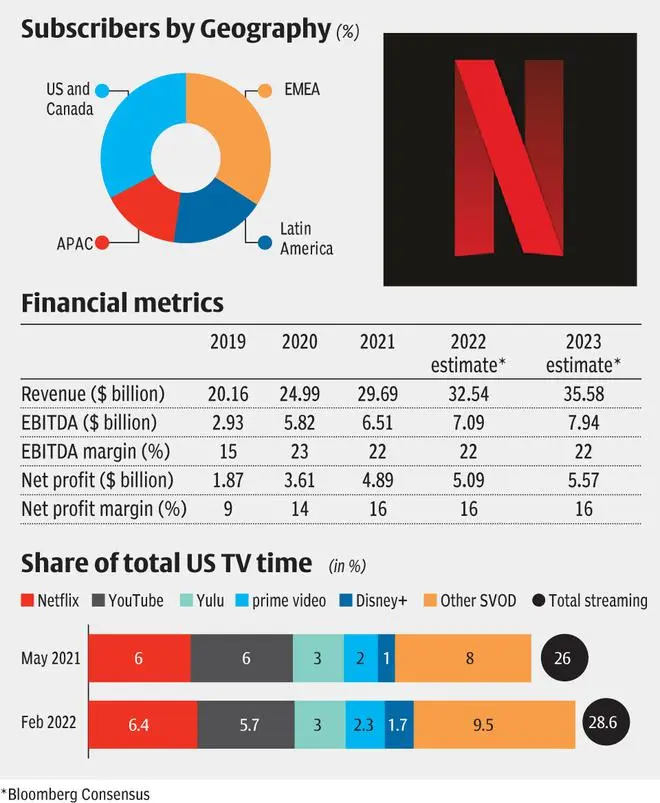

OTT/cord-cutting, was the top trending theme in the global media and entertainment industry even before the pandemic struck in March 2020. The theme only got a more accelerated structural uplift during the pandemic and appears a largely irreversible trend globally. Consumers have got used to the convenience of watching content of their choice, at the time of their choice, in the device of their choice. This is unlikely to change. In this backdrop, the business case for streaming business remains very strong. As per the presentation by Netflix in its most recent earnings report, even in the most advanced streaming market – the US, streaming only makes up for 29 per cent of total TV time, still leaving a long runway of growth to convert more of legacy TV viewers to streaming.

Further, within the streaming segment in the US, Netflix remains the largest with 6.4 per cent share, and substantially ahead of comparable peer offerings like that of Disney and Prime Video. With penetration estimated to be much lower in the rest of the world, the opportunity remains good. With over 220 million subscribers globally, Netflix remains the leader in this business and well-positioned to tap the opportunity. Its closest media competitor Disney+ was way behind at 130 million subscribers as of end 2021.

Besides this, Netflix has amongst the largest content budget globally, which is a key driver of subscriber growth and retention. As per a Bloomberg report, Netflix content budget in 2021 was at $12.2 billion (amortised cost; cash spend higher at $17,5 billion), versus $10.5 billion for Amazon Prime Video, $5 billion for Disney+, and $4.3 billion for HBO Max (Warner Bros Discovery). For the year 2022, its content budget (amortised) is estimated at $13.4 billion, marginally below $14 billion for Amazon Prime Video. Peers Apple TV+, Disney+ and HBO Max are expected to incur $6 billion, $9.5 billion and $5.6 billion respectively. By virtue of being one of the largest spenders on content over the last decade, the company has built deep expertise and studio relationships for quality content production and delivery. This competency will remain an advantage, going ahead.

What recent stumbles mean

Netflix’s corrections since the start of the year have been triggered by significant resets in its net subscriber add numbers. The first slump in its stock price in January was due to the company guiding for lower than expected net subscriber adds for March quarter. This got further amplified with the company missing the revised estimate and actually reporting decline in subscribers for Q1. Netflix reported Q1 net subscriber losses of 0.2 million versus guidance of adding 2.5 million. It has lowered expectations for 2Q as well, but expects to end the full year with increase in subscribers.

Its performance has thus triggered doubts on whether the total addressable market for streaming companies may be lower than what was earlier anticipated. However, if one were to take a long-term view, it appears more like at an inflexion point. Netflix is not the only company facing this problem. The shares of Disney are down 45 per cent from its peak level reached in 2021. The correction has been mainly triggered due to expectations reset in its streaming business. Disney’s fall may have been cushioned by its more diversified business. Shares of Warner Bros Discovery, Paramount Global (ViacomCBS) have also been under pressure recently. It appears the entire industry will have to readjust business models and arrive at an ideal equilibrium between monthly subscriber charges, reducing account sharing (password crackdowns) and introducing/increasing ad revenues to maximise streaming member count. Broadly the theme of legacy TV losing ground to streaming remains intact.

What works in favour of Netflix post recent correction and reasonable valuation is that it remains the best pure-play option for investors to bet on structural shift to streaming. Other companies come with some overload of legacy and other diversified businesses. Netflix also has amongst the strongest balance sheets compared to large media peers, with net debt at just $6 billion, which is less than 1x 2022 EBITDA. This, combined with estimated positive free cash flows of around $1 billion in 2022 and $1.7 billion in 2023, implies the company is well-positioned to compete during this phase of inflexion in the industry.

In terms of financial performance, for the year 2022, consensus expects the company to report around 10 per cent revenue growth to $32,537 and EPS of $11 (3 per cent growth). EPS growth is expected to improve to 15 per cent in CY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.