Investors with a moderate risk appetite and two-to-three-year investment horizon can consider accumulating the stock of leading sugar and ethanol maker Triveni Engineering and Industries.

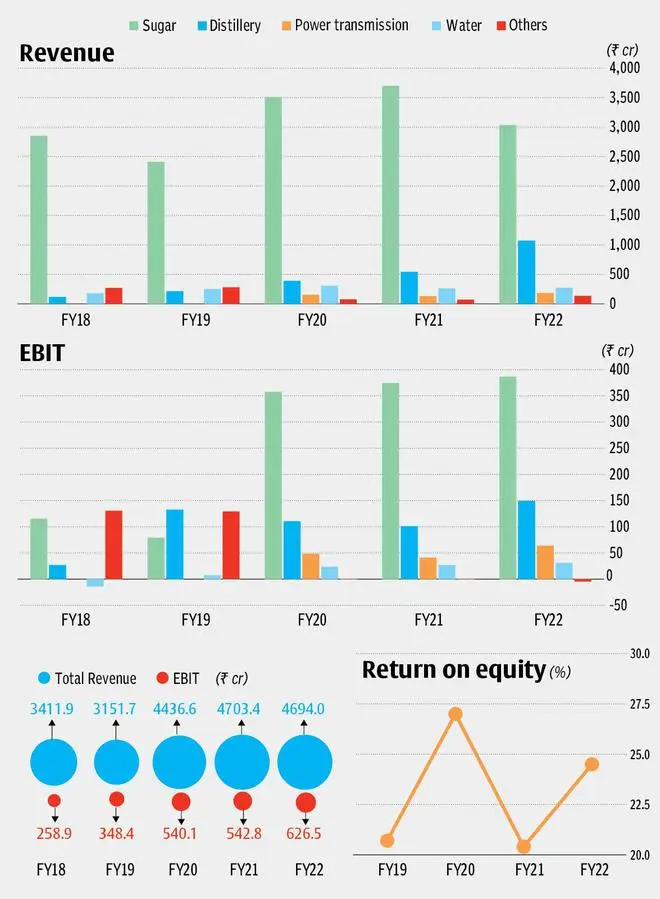

The Noida-headquartered company operates seven sugar mills in Uttar Pradesh (predominantly Western and Central UP), with a crushing capacity of over 61,.000 tonnes per day. Besides sugar, Triveni has a 660 KLPD (kilo litre per day) distillery which produces Extra Neutral Alcohol (ENA is the basic raw material for alcoholic beverages) and Ethanol. Besides sugar and distillery, which of course are the two large business segments accounting for over 88 per cent of revenue in FY22, the company also has a power transmission division which is into manufacturing of turbo gears and a water division which offers water treatment solutions.

Prospects

We believe the stock to be a good diversification bet for three reasons.

First, the sugar business is expected to witness healthy growth in FY23, on the back of a few initiatives by Triveni. The company’s efforts to improve cane crop productivity through crop replacement programme is expected to yield better results in the upcoming sugar season and this should aid higher sugar production.

Triveni is currently undertaking a ₹130 crore capex for de-bottlenecking and process improvements at three of its mills, which is expected to be completed by October 2022. It is converting its mill located at Deoband into a refinery. Post this, the company will be able to increase its refined sugar production from about 43-45 per cent of the total production to 60 per cent. The realisation on refined sugar is higher by up to ₹0.8-0.9 per kilogramme, compared to unrefined sugar.

Also, the pharmaceutical grade sugar production capacity will likely double to 7 per cent from 3.5 per cent currently at its Sabitgarh plant. This sugar grade commands premium of about ₹3-4 per kg. The capex which will funded through internal accruals and debt should help the overall sugar business revenue and profitability beginning FY23.

Second, the capacity expansion at its distillery units should help the company more than double its distillery revenues over the next two years. In the last quarter the company augmented capacity at Sabitgarh plant from 160 KLPD to 200 KLPD. Likewise, the company had added a new 160 KLPD dual feed distillery at Milak Narayanpur.

A new grain-based 60 KLPD distillery has also been commissioned at Muzaffarnagar along with increase in the capacity of the existing distilleries at Muzaffarnagar and Milak Narayanpur by 40 KLPD. With this the total distillery capacity stands at 660 KLPD currently. The full benefit of the new capacity will be evident from the current quarter onwards. Besides these, the company’s board has approved two brownfield projects at Rani Nangal and Sabitgarh, which will increase its distillery capacity by another 450 KLPD. The expansion estimated to cost the company around ₹460 crore will be operational by Q3 of FY24 and will be funded through a combination of debt and internal accruals.

The new facility with a fungible capacity, offers freedom to operate either on grain or molasses (as feedstock), which will allow greater flexibility to choose between the two depending on availability and pricing. In terms of raw material, molasses enjoys higher contribution (₹15 / litre), compared to grain (₹11 a litre). Post the expansion, Triveni’s annualised ethanol capacity should increase from 22 crore litres to 32 crore litres. This should result in the company more than doubling its revenue from the distillery business, in the next two years.

Given the impressive margins (has been upwards of 20 per cent barring FY22) in this segment, the expansion should also improve the company’s profitability significantly. The Government’s resolve to implement 20 per cent Ethanol Blended Petrol programme beginning April 2023, should help steady growth in the company’s distillery business and also lend stability to the overall operations of Triveni.

Finally, the company’s engineering division is also witnessing traction. The company secured its second international order for its water treatment business from Bangladesh recently. The order book for this segment stood at ₹1,645 crore as of Q1 of FY23, higher by 4 per cent compared to same quarter last year.

The power transmission business operates a facility in Mysuru, wherein it can produce gear boxes up to 70 MW capacity with speeds of 70,000 rpm. The order book for this segment has seen healthy growth in the last quarter with the total closing order pegged at ₹243 crore as of June 30, 2022, which includes ₹110 crore worth long duration order. Revenue from this segment grew by 7.6 per cent in June quarter to ₹30.4 crore.

Financials and valuation

In the latest June quarter, the company reported revenue growth of 18.2 per cent to ₹1225 crore, compared to the same period last year, largely driven by distillery segment. The operating profit margin declined from 15 per cent in Q1 of FY22 to 10 per cent in Q1 of FY23, largely on account of export subsidy of ₹45 crore (pertaining to FY21), adjusting for which the operating margin would have been largely flat in the current quarter.

At the current price, the stock trades about 10.2 times and 9.4 times its estimated consensus earnings for FY23 and FY24. The earnings estimate does not factor in the upside from the new brownfield expansion, to be completed in Q3 of FY23.

Risks

Couple of risks that investors need to monitor are with regard to leverage and volatility in global sugar prices.

While Triveni’s revenue and profit are expected to grow at a healthy pace over the next two-to-three years, the company’s expansion initiatives will likely result in an increase in the borrowings. As of June 2022, the total debt on the books stood at ₹1,617 crore, which includes ₹386 crore worth term loans, the balance being interest subvention loans for meeting working capital need. The total debt-equity ratio for the company stood at 0.82 times as of March 2022 (total debt of ₹1,568 crore), higher than 0.64 times in FY21, though it is lower than the ratio of 1.5 and 1.1 in FY19 and FY20, respectively.

Another factor to monitor is, although softening in global crude prices over the past month may not have any impact on India’s EBP program, it can be a sentiment dampener for global sugar prices, given than there may be high diversion of cane towards sugar, should the oil prices continue their downward trend. This can possibly have an impact on realisation for Indian sugar producers given that it is a global commodity. This can cause short term volatility in stock prices of listed sugar players such as Triveni.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.