Mid-sized private banks had a very rough patch during FY19-FY21. With the results gaining momentum, it is becoming evident that the recovery from the bad period is an uneven journey for most of them. Seen against this backdrop, the stock of IndusInd Bank stands out among the pack.

What’s more, the banking sector has been outdoing the Street’s expectations in terms of earnings performance for almost a year. IndusInd Bank is one of the stocks that has consistently found a place among the outperformers during this period. Not just that, with every passing quarter, it is demonstrating that the troubles of the past are reasonably behind it. That’s not to say that there are no downside risks in that stock, but yet, the predictability and quality of earnings is on the mend, which is a reassuring factor for investors.

This is why, despite nearly 3x gains from its March 2020 lows (₹313 apiece) and gaining 37 per cent in a year, we believe there is room for further re-rating. In the coming months, the bank will reveal its plan for the next five-year growth phase. Going by precedent, while there have been several speed bumps in the journey, the bank has more or less kept track with its larger slated objectives, and this has added strength to its valuations in each phase of growth.

Presently trading at 1.8x FY23 estimated price to book (1.6x FY24 estimated P/B), valuations at these levels are still at a significant discount to the bank’s peak (or best days) valuations of FY16–18 at 3.5–4.2 12-month trailing P/B, suggesting that with sustained improvement in financials, there is scope for rerating.

IndusInd Bank stock may be a value buy for investors with 3–5 years’ horizon.

Improving fundamentals

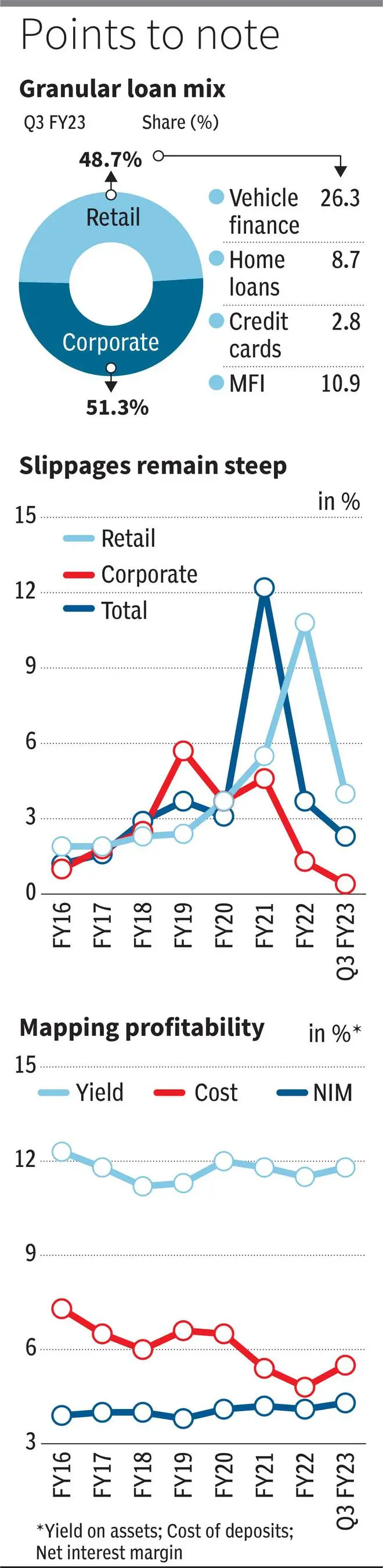

IndusInd Bank has an established position in the lending space as a vehicle financier (VF), more so in the commercial vehicles segment. The share of vehicle finance to its overall book stood at 26 per cent as on December 31, 2022 (Q3, FY 23). However, as part of its strategy to reduce dependence on a single product, the bank forayed into the microfinance space. It has also spread into other retail pockets such as credit cards, home loans, small business loans and personal loans. Diversification process remains work in progress for the bank, and how successfully it manages to broadbase the book without taking a hit on asset quality will be a critical stock re-rating factor.

Overall, from a corporate heavy-loan book (nearly 60 per cent of total book in FY17), the bank’s efforts to make it retail-centric (share at 53 per cent in Q3) are beginning to yield results. This momentum is expected to continue.

While the acquired MFI book did cause trouble in 2021, thanks to the whistle-blower incident, the advantage from the book outweighs the pain, especially when seen against the bank’s net interest margin. Despite its cost of deposits increasing by 81 bps year-on-year to 5.47 per cent, NIM in Q3 rose 17 bps year-on-year to 4.27 per cent, 25–28 per cent share of high-yielding loans, including MFI portfolio, played a dominant role.

IndusInd Bank is increasingly focusing on the mid- and small-sized corporate loans segment. This is a high-risk play, but if underwritten well, its also a high-reward segment. Therefore, while cost of deposits will increase, IndusInd Bank’s ability to push better yielding products could help counter the pressures. However, there may not be more room left for further increase in NIM. Expect it to settle at 4–4.2 per cent in the coming quarter.

Key risk

MFI and VF segments have seen a reset in their NPA levels for the system and for IndusInd Bank. MFI no longer is less than a per cent NPA business and likewise, VF has also seen its steady-state NPAs recalibrate from 1.5 per cent to 2–2.25 per cent. With the share of these loans being a significant component of IndusInd Bank’s total assets, slippages and credit cost may remain elevated. In Q3, gross NPA reduced by only 5 bps year-on-year to 2.06 per cent while net NPA came at 0.62 per cent.

Total slippages at ₹1,467 crore largely comprised retail loans (₹1,348 crore) , with MFI loans taking a reasonable share. MFI segment’s gross NPA came at 3.75 per cent, up from 1.51 per cent seen in FY20, indicating that normalisation may still be some quarters away. Therefore, slippages rate at 2.3 per cent in Q3 is quite steep and may stay at 1.5-2 per cent for the foreseeable future, given the changing loan mix of IndusInd Bank. The management has guided for gross NPA at 1.8–2 per cent and net NPA of less than a per cent, going forward. The current valuations capture this risk. However, with times getting difficult due to increasing cost of funds and a likely slowdown in loan growth for the banking system, one needs to watch out whether slippages can get further aggravated.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.