Many Public Sector Units (PSUs) have near-monopoly in large and growing sectors. And even as they easily grab big, lucrative orders, they execute at a gnawingly slow pace. And investors, who are often lured by strong revenue visibility to pay a premium, get impatient over time with concerns on the ground work. The stock loses its sheen and analysts don’t cover it, as it becomes a more-of-the-same story. But things change for the better and the giant flywheel picks up momentum. The National Building Construction Corporation (NBCC), a construction project and property development company, is one such PSU.

NBCC’s stock has been languishing at price levels under ₹40 per share for a year and has been on a downtrend since the peak of ₹141 touched over five years ago. While its performance may take time to perk up, investors can consider accumulating the stock on the strengths of improving execution and sales, growing overseas orders and valuation multiple that is lower than historic average.

Strong fundamentals

NBCC is the trusted choice for construction work in India. For example, when the Amrapali group was found to have committed fraud, the Supreme Court directed NBCC to take over the pending construction projects in Noida. Be it setting up new Government University campuses or redevelopment of Government properties, NBCC is often the first choice for the Centre and many State Governments.

And thanks to this, it has built an enviable order book — at ₹55,000 crore as of September 2022, which gives six years’ visibility (at FY23 management revenue projection of ₹9,000 crore). In the first half of FY23, new orders worth ₹1,720 crore were added. This included forays into new segments such as the Puducherry and Aligarh Smart City projects and construction of a hospital in Mauritius. There is ₹6,500 crore additionally in the pipeline for FY23, including redevelopment of government of India press, residential colony near Inderpuri and Loha Mandi and a new social housing project in the Maldives.

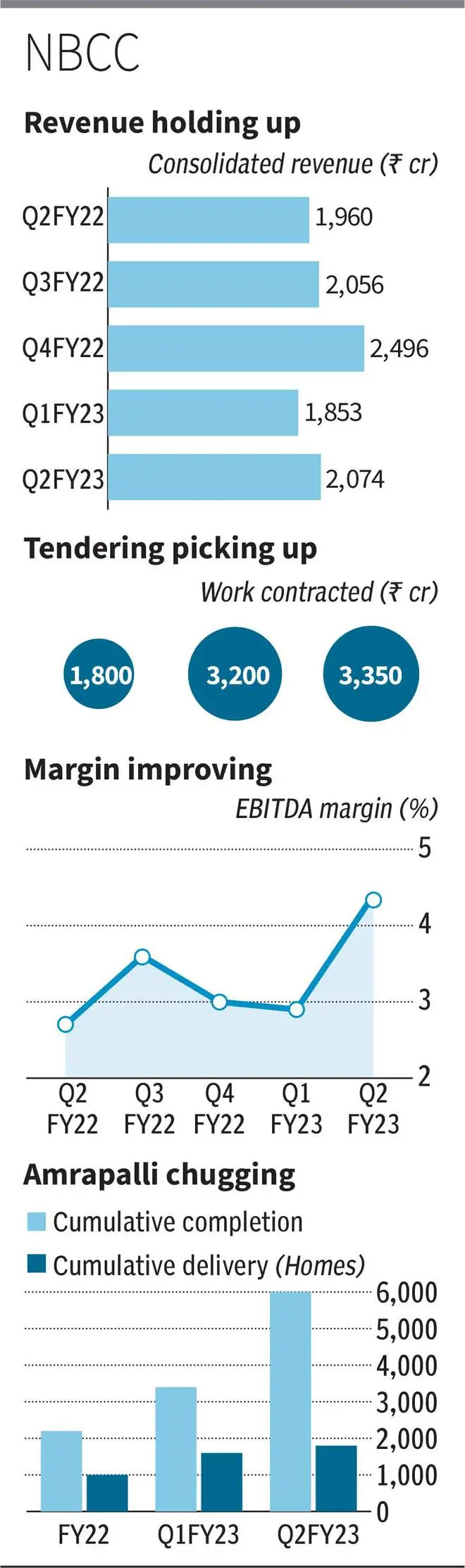

But, tender for execution of work awarded has been slow, with backlog built due to Covid. There is ₹20,600 croreof ongoing work, which is only about 37 per cent of order book. This is, however, being remedied — value of work contracted out through tender increased from INR ₹1,800 crore in H1 FY22 to ₹3,000 crore in H2 FY22 and ₹3,350 crore in H1 FY23. There is ₹1,900 crore actively in the process of contract approval, with plans to award ₹3,000 crore total in H2 FY23. For FY24, management expects ₹9,000 crore to ₹10,000 crore worth of tender approved. And expectations of the pace catching up with revenue (projected at ₹9,000 crore in FY23), augurs well.

Improving margin

Bulk of the outstanding orders — about ₹32,000 crore — is for Project Management Consultant (PMC), wherein the company works as a consultant on projects, from concept stage to completion and maintenance, and earns consultation fees. This is a cost-plus pricing model with low but stable margin. Around ₹23,000 crore is for real estate and redevelopment where it is a project developer, and hence has potential for more profits and higher margin. This segment had slowed or stalled during Covid, but is gaining momentum.

NBCC’s management reported substantial sales improvement in its World Trade Centre, Nauroji Nagar project, with ₹1,326 crore of sales in H1 FY23. Another commercial property in Sarojini Nagar started sales with ₹46 crore in the September quarter. With a total inventory of ₹1,400 crore in the project, sales volume can aid margin.

In Amrapali, 6,000 homes have been completed, with 2,600 added in just the September quarter. However, handover has been seriously lagging — with only 200 in the quarter for a total of 1,800 homes vs the plan of 12,000 by March 2023. Data from CREDAI Colliers Liases Foras housing price tracker showed a strong residential property market for Delhi-NCR, with 14 per cent y-o-y price increase. The positive outlook for the market can bode well for sales revenue and margin.

Management has guided higher EBITDA margin — 5.4 per cent for FY23 vs 2.8 per cent in FY22 (standalone basis). Consolidated margin has been increasing — 4.4 per cent in Q2 FY23, up from 2.9 per cent in Q1. The expectations on continuation of higher margin are from pick-up in the real estate segment. NBCC expects commercial property sale in Bhubaneswar and Kolkata, higher contribution from Amrapali, redevelopment projects sales in Nauroji Nagar plus launch of projects in Patna and Coimbatore in the coming quarters.

Also, the company is focusing on projects overseas, on the back of completion of work in Mauritius. This includes High Commission of India work in Kuala Lumpur, Burundi Parliament and Ministerial Work and a residential complex for Consulate General of India in Jeddah.

Reasonable valuation

At the current price of 38.8, NBCC is trading at 17.4 times the estimated FY23 EPS of ₹2.23 (Bloomberg estimates). This reflects reasonable valuation given its prospects, as well as when compared with its five year average of 21 times.Also, given the good delivery track record and virtual lack of competition in the segment NBCC operates in, the stock may see an upward reset in its multiple. The key risk to consider is slow sales in the real estate sector, which may push margins lower.

Promoters — Government of India — hold 61.75 per cent stake. The company has no debt and paid a dividend of ₹0.5 per share for FY22 (yield of about 1.5 per cent).

NBCC had consolidated revenue and profit of ₹7,885 crore and ₹238 crore respectively in FY22. In the September quarter, revenue was ₹2,074 crore (8 per cent higher yoy) and profit was ₹98 crore (32 per cent higher yoy) on the back of higher share of real estate sale.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.