Amidst the massive selling by foreign institutional investors in banks stock for a good part of the current fiscal, two names that have somewhat bucked the trend are HDFC Bank and ICICI Bank. The latter stands out for its ability to aggressively grab some market share off HDFC Bank when regulatory curbs were imposed on its business, and significantly clean up its books - ahead and during the pandemic.

At 3x FY23 price-to-book, valuations have zoomed compared to the historic average of 1.7x. However, past number needs to be seen in the context of the troubled period between FY16 – FY20 when a huge portion of its legacy corporate book had to written off following the asset quality review and the bank’s internal leadership issues. Now, these behind and underwriting standards significantly bumped up, valuations appear justified given the growth potential.

Qualitative improvement

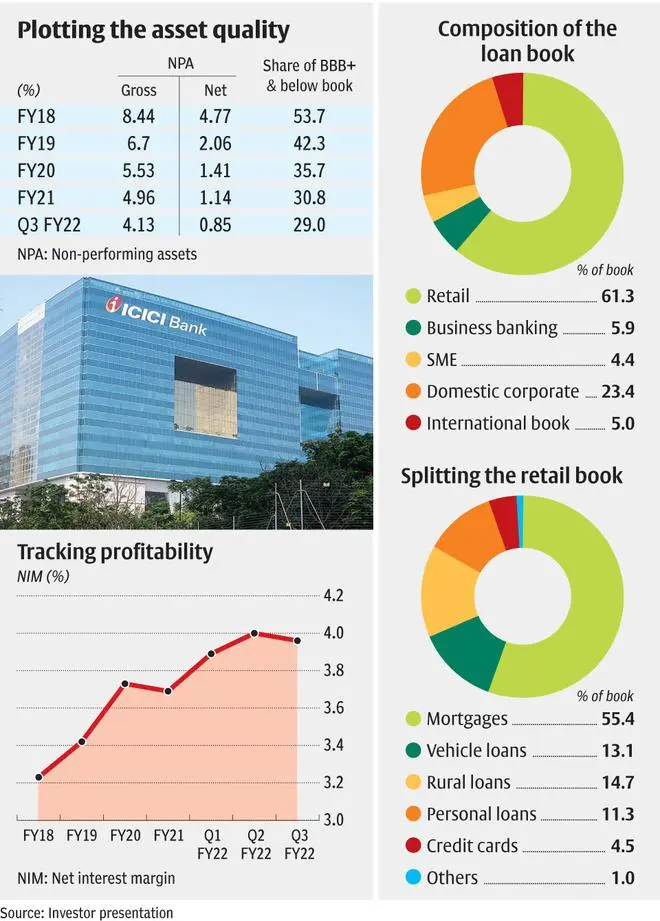

One of the striking aspects about ICICI Bank which makes it a ‘consensus buy’ among banking stocks is the way it has approached the mountainous bad loans. From Rs 54,063 crore of non-performing assets (NPA) in FY18, the number has fallen to Rs 37,053 crore in December quarter of FY22 (Q3 FY22; see table). At 0.85 per cent net NPA ratio (gross NPA less provisions, write offs and recoveries) in Q3 FY22, this is the lowest level of dud loans the bank has maintained for almost a decade.

In fact, having bettered the Street’s expectation quarter after quarter on NPA front, should FY23’s provisioning cost fall below Rs 10,450 crore as per analyst estimates for FY23 (Rs 7,472 crore for nine months of FY22 as against Bloomberg estimates of Rs 10277 crore), there is ample room for rerating in terms of earnings and profitability.

The other favourable aspect is the steadily falling share of weak loans (BBB and below rated accounts) in the last three years (see table). What this suggests is that should there be another round of asset quality issues in this portfolio, ICICI Bank may be less vulnerable with 71 per cent of its corporate loans to well rated entities (A- and above). Overall, the market perception of ICICI Bank has undergone reasonable improvement in the last four years, thanks to its portfolio composition and approach to business seeing a sea change.

Dissecting the business

From being known as an aggressive player in the market, ICICI Bank has embarked on is a cautiously aggressive growth approach. By that it means, the bank will not chase a certain rate of growth or certain portfolios of business but will look at opportunities which fit its risk framework.

For instance, the last three years offered a good potential to expand on the retail side of business and the bank monetised the same. Today, at 61 per cent retail loans, the retail concentration is among the highest within top five private banks, beating that of even HDFC Bank, which until FY20 was seen as the largest retail bank in the country.

The granularity of ICICI Bank’s retail portfolio also offers comfort (see table). On a sustained basis, the bank has drawn nearly half its retail book from the home loan and this trend continued till the Q3 FY22. That said, while the bank’s share of secured loans remains higher in comparison to peers to less than 50 per cent, investors need to be mindful that composition of risky unsecured products – personal loans and credit cards which is steadily inching up – at 17 per cent of retail loans in Q3 FY22 as against 15 per cent a year-ago. The bank’s retail NPA at 3.04 per cent in FY21 was quite unnerving. Much of it accrued from the unsecured book. Come FY22, the started providing NPAs of the retail and business banking segments (combined) which came at 2.43 per cent in Q3 FY22 as against 3.26 per cent a quarter ago. With 1.2% of the loan book restructured and retail loans accounting for 68 per cent of restructured accounts, the bank time till FY24 to regularise its retail book. While higher growth is padding up the pain, if the economy, especially for the salaried class, doesn’t bounce back quickly, ICICI Bank’s asset quality could be in a tight spot once again.

Nonetheless, the good part is that barring unsecured retail, the likely pain from small and medium enterprise loans (SME loans) and corporate portfolio could be muted in the near-term. The bank has contained the share of SME loans at 4.4 per cent, though the growth in the portfolio has been over 30 per cent till Q3 FY22. Share of its corporate book too has been steadily maintained 24 – 25 per cent which positions the bank advantageously to capture a pick-up in private capex or corporate loan cycle.

Overall, loan book composition remains a favourable one and faster adoption of technology, in sourcing high-yielding retail loans such as personal loans and credit cards, and SME and business loans has led to an improvement in profitability or net interest margin to 3.95 per cent in Q3 FY22 from 3.63 per cent in FY21.

Going ahead, as retail loan growth may normalise and remain a cash cow for the Bank, thus ensuring that upward trend for NIMs is maintained. But the improvised corporate portfolio has the potential to add the alpha to its growth and earnings potential.

Risks to factor

Operationally, unsecured retail loans pose a challenge, which is also the case with most private banks. The other risk is with respect to its leadership.

Much of the transitioned at ICICI Bank has happened under Sandeep Bakshi, an old-timer who helmed ICICI Prudential Life Insurance and was brought back to head the bank in October 2018. Bakshi’s term will end in October 2023. While he is eligible for another term, RBI’s decisions are difficult to second-guess, thus leaving room for leadership related uncertainties.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.