The shifting focus of government towards the infrastructure has led to allocation to NHAI to move up two-fold at ₹1.34 lakh crore in current budget versus previous year’s. The target set by the government to construct 25,000 kilometres of highways by FY23 has led to a positive atmosphere for road and infrastructure developers. In the recent years pandemic has disrupted the sector by disrupting the availability of labour and/or supply chain disruptions also. However, with the pandemic problem being tackled there is a lesser chance of any disruption which this space can see.

Within this space, IRB infrastructure is a prominent player and is mainly focused on BOT (Build operate and Transfer) and TOT (Toll Operate and Transfer) projects. The stock is trading at a forward P/E of 18.4x against its 5-year average of 11.6x, its peers such as KNR constructions is trading at a forward P/E of 15.5x and PNC Infratech is trading at a forward P/E of 11.1x. The company has received financial closure for two projects from April 2022 till date and two projects got appointed in the same period. The revision of toll rates due to inflation is expected to benefit the operational projects and add to the toll collections.

While its prospects look good, new investors can follow a wait and watch approach for now due to its premium valuation. Existing investors can continue to hold the stock as of now.

Business and prospects

The company is a major toll developer in the country and its focus is BOT (Build Operate and Transfer) projects. Along with this, it is also involved in TOT (Toll Operate and Transfer) projects where government gives an already operational project to private entity on long term contracts. The company is also involved in HAM (Hybrid Annuity model). This is a model where government puts 40 per cent of equity whereas 60 per cent equity is put up by the private developer. IRB Group’s portfolio (including Private and Public InvIT) comprises 24 projects which includes 23 highway projects that further include 18 BOT projects, 1 TOT project, 4 HAM projects and 1 Airport project in Sindhudurg District of Maharashtra.

In October 2021, the company raised funds from Cintra (a global infrastructure operator) and GIC (a global investment firm). Cintra was given 24.9 per cent equity in lieu of ₹3,148 crore and GIC was given 16.9 per cent in lieu of ₹2,167 crore. The shares were issued at ₹211.79 per share. The shares are now trading around the same levels now, after initially rallying post the deal. Out of these issue proceeds, ₹3,250 crore worth of company debt has been paid off and now ₹3,000 crore debt remains which is self-liquidating as specific cashflows are attached to it.

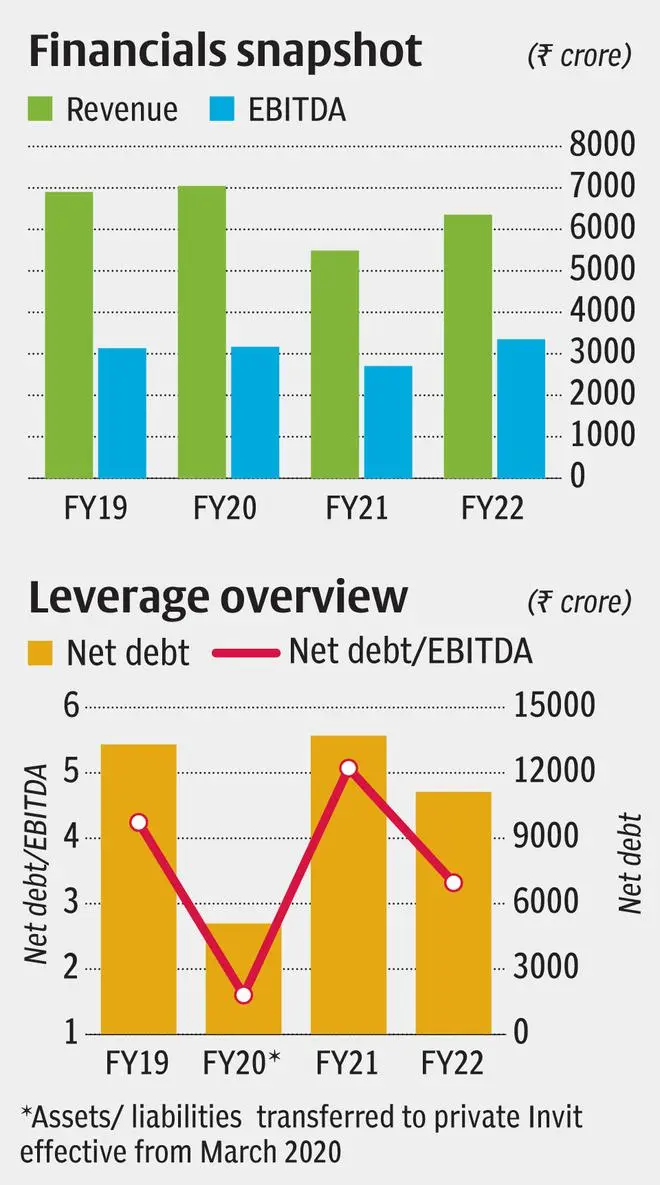

The deal gave a good boost to the company on the leverage front. In FY22 the Net debt to EBITDA came down to 3.32 from 5.07 in FY21 and the Debt/Equity improved to 1.09 from 2.43.

The company has a healthy orderbook, as on March 31, 2022. It had an orderbook worth ₹16,051 crore which is 10 per cent higher than March 31, 2021. IRB infrastructure has ₹5,591 crore worth operations and maintenance projects in BOT/TOT projects and remaining ₹10,459.5 crore in EPC/Construction projects in BOT/HAM. The company has bagged nearly ₹7,.600 crore worth projects in FY22. The order book gives around 3 years of revenue visibility and with the infra push more projects are expected to come up and growth prospects look decent.

The order to bill ratio of the company for FY22 is 2.76 while it was 2.75 in FY21 which suggests decent execution capability of the company.

Subsequent to last FY results (Q1FY23 results yet to be reported), the company has received appointed date for Palsit-Dankuni expressway on April 2,2022 and the concession is 17 years It has also received appointed date for Pathankot-Mandi on May 20,2022 highway with construction period of 730 days and operation period of 15 years.

IRB group has received financial closure for Chitoor Thachur Highway private limited on May 18,2022 which will have construction period of 730 days and operation period of 15 years. In addition to it on June 16,2022 the company also received financial closure for Meerut-Budaun expressway which has a traffic linked concession period of 30 years extendable for 6 years.

Recent financials

The total income of the company rose 15.8 per cent at ₹6,355.44 crore. The EBITDA also grew 24 per cent to ₹3,349.42 crore in FY22. The EBITDA margin grew to 57.71 per cent in FY22 from 51 per cent in FY21. The net profit of the company rose around 208.5 per cent to ₹361.3 crore in FY 22 from ₹117.49 crore in FY21. The huge rise in the net profit can be attributed to a combination of improvement in operational performance and the rise in other income.

The revenue is close to its pre-Covid levels (FY 2019: ₹6,902 crore) while EBITDA has already crossed the pre-Covid levels (FY2019: ₹3132.9 crore). The total toll collections and HAM proceeds in FY22 was ₹1827.7 crore and in FY21 it was ₹1611.2 crore. The toll collections in April 2022 were ₹327.4 crore which grew 5 per cent in May 2022 to ₹343.51 crore and in June 2022 it declined 4.2 per cent and settled at ₹329.12 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.