When a promoter accumulates stocks of his or her company it’s read as a good sign – a reiteration of its strong business potential. However, in One97 Communications’ case, despite its celebrated promoter Vijay Shekar Sharma buying 1.72 lakh shares in the open market for ₹ 11 crore in May (disclosed to exchanges last week), it is barely a mood lifter for the stock.

In fact, the stock has hardly moved much in a month. Deep in the well trading at ₹ 648 level a share, it has more than halved since its listing and way off the mark from its issue price of ₹ 2,150 apiece. We at BL Portfolio recommended to our readers to avoid One97’s initial public offering. When we review our stand in the wake of the massive stock price correction and a slew of brokerages having a positive outlook on the stock lately, we affirm there aren’t strong fundamental reasons for us to change our view.

If any, the business case for the company has deteriorated since its IPO and hence we recommend investors to sell the stock.

Lack of moat

There are two things one cannot take away from Paytm. It was the pioneer in digitalising payments and for long enjoyed the first mover advantage. Secondly, among all the fintechs at play, Paytm was better placed to look at a next level transition. While the first factor played out enough and is now at the tipping point of saturation, it’s the second aspect which tempted investors to consider Paytm as decent play in the financial services sector. At the time of IPO, in November last year, Paytm had two attractive options ahead of it – transition to a small finance bank, given that its is one of the few payment banks which completed five years of operations and is eligible for the next level move or contend for the new umbrella entity (NUE) license which the Reserve Bank of India had paved way in August 2020. Going by news reports, NUE licenses is something that the RBI may not take up in a hurry any time soon. So, the wait continues for Paytm and all the license applicants.

As for the SFB aspirations, embroiled with regulatory tangles and the RBI not permitting the payments bank to onboard new customers and have its systems audited by third-party, the chances of finding success on this front is also limited in the near- to medium-term. Now with both the possibilities of business elevation out of question for the company, the forward pretty much revolves around ringfencing and growing its existing businesses which largely revolves around payments and distribution of financial products, mainly loans.

Fault lines

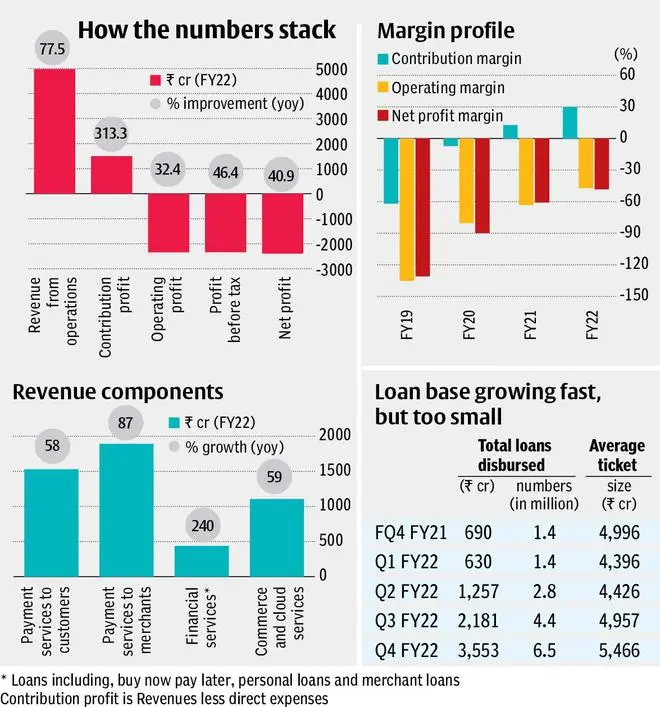

Payments and financial services business accounts for over 78 per cent of Paytm’s revenues. This can be broken down into three segments – payment services to consumers (B2C business), payment services to merchants (B2B) and financial services business, where Paytm is a distributor of loans and other financial products. The entire business is therefore commission driven and volume dependent. While Paytm had the first mover advantage, the industry is densely populated and with the underlying regulatory terrain changing, especially in the B2C or the retail segment, the lucrativeness of the business is also gradually melting. Unless the user base almost doubles every year, thereby increasing the opportunities to earn from merchant discount rates (MDR) – that is, through wallets, net banking, co-branded credit cards and post-paid instruments, the financial viability of this business could be very strained.

As for the financial services business, where Paytm is a distributor of loans, being a heavily volume dependent game, unless there is a meaningful increase in ticket sizes of loans, or a wider customer base is added apart from small kirana shops and traders, the upside in this business can be very limited in the long run. It is for this reason, that an elevation in its business model is an important aspect but that’s going to be missing now for the foreseeable future. Therefore, achieving profitability will largely hinge on improving operational efficiencies from here on, given the natural constraints that the top-line could face. While the company is showcasing its contribution margins (30 per cent in FY22), in a services sector, that’s barely a benchmark to track. In the financial services sector which is still in the evolution stages, manpower, marketing and technology remain the chunky cost centres and whether the company can shrink (or nomalise) these costs and yet generate revenues is the question. Hence the focus, as the case with all industries, must be on operating margins, which is still in the red for Paytm. While the guidance is to turn Ebidta positive by September 2023, given the current levels (see chart), investors would be better off if they wait and watch, rather than plunging into the promise.

Valuations

At price to book value of 5.6 times FY23 estimates, valuations have more than halved from its IPO levels. Yet the stock remains in the no-go zone. As highlighted in this week’s Big Story, some bluechip financial sector stocks appear attractive post the recent correction and makes for a better investment bet in comparison to One97. Even If payments should be the area of focus, even Fino Payments Bank (profitable company), trading at 4 times FY23 estimated book is preferred over One97.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.