In the past, stocks of sugar producers have reacted swiftly to any news flow on sugar production – domestic or global. This is because, India being the world’s second-largest producer and a net exporter of this commodity, the global demand-supply dynamics and pricing play a vital role in the profitability of Indian sugar companies.

In the past, a downward revision in the sugar production estimates was seen as a positive move, and stocks used to cheer on such occasions. This is because lower production should translate into better pricing in the home and overseas markets. Likewise, the expectation of higher output is seen as a dampener for domestic and global sugar prices, and stock prices tend to react negatively to these developments.

However, the recent announcement from the trade body, the Indian Sugar Traders Association (ISTA), about lower production in the sugar season 2022-23 has not evoked significant price action. On Monday, ISTA said it expected production during the 2022-23 sugar season to be lower at 33.5 million tonnes, compared to the earlier estimate of 34.5 million tonnes. The downward revision in the production estimate comes after lower production expectations in the key cane-growing state of Maharashtra due to unexpected excessive rainfall. Sugar production in the state is expected to decline in the sugar season 2022-23 to 124 lakh tonnes, from 137.28 lakh tonnes in 2021-22.

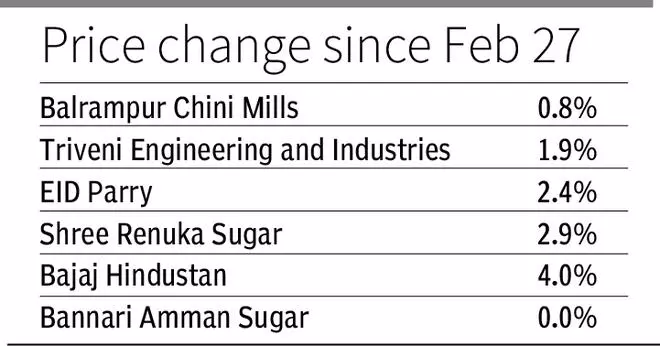

Except for Bajaj Hindustan, which gained 4 per cent over the last three days, most sugar stocks have risen by a modest 1 to 3 per cent since Monday. The reason for this neutral reaction from sugar stocks is possibly on two counts.

First, the overall weakness in the Indian stock market has had a rub-off on sugar stocks, which have been under pressure over the last two months.

Secondly, with the ethanol-blended petrol programme (EBP), the dynamics of the Indian sugar industry are changing. The sensitivity of stock prices (of domestic sugar producers) to domestic and international demand-supply dynamics and price movement has been waning lately. This is because higher sugar production, which was earlier perceived negative for prices, is no longer unfavourable. With a higher EBP target of 20 per cent by 2025, the industry is well positioned to absorb excess production, by diversifying towards ethanol. Similarly, lower cane and sugar production can affect ethanol production. Thus, the dependency on sugar companies has now reduced, and the trend is expected to continue going forward.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.