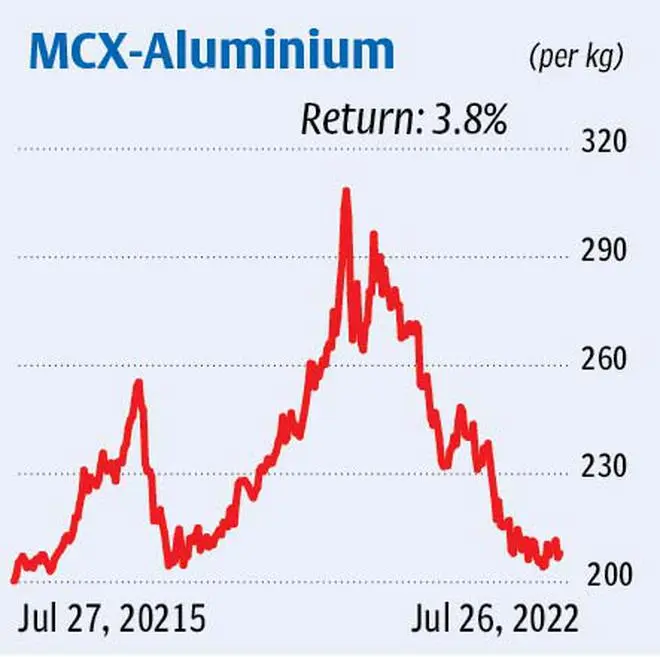

The aluminium futures (continuous contract) on the MCX, after hitting a high of ₹325.4 in March has been moving southwards. It made a low of ₹202.25 recently, thereby, losing about 39 per cent from the top i.e., ₹325.4.

However, the price action over the past few weeks suggests that the downtrend has halted, at least temporarily, and the contract is now largely oscillating in the range of ₹200-215. While this may not be an indication of a bullish trend reversal, the consolidation improves the chances for a corrective rally from here even as the overall trend is bearish.

That said, technically, the aluminium futures should move out of the ₹200-215 range for the next leg of the trend.

If the contract falls below ₹200, it can decline to ₹187 and possibly to ₹160, the nearest supports below ₹200. On the other hand, if it breaks out of ₹215, it can appreciate to ₹235, the immediate barrier. A breach of this can lift the contract to the ₹250-254 range — a resistance band. But a rally beyond this price band is unlikely.

Traders can stay on the fence, and consider fresh shorts if the support at ₹200 is breached. Or short if aluminium futures rallies to ₹235 and ₹250 i.e., split the entries into two legs and initiate one leg of short at ₹235 and another at ₹250 so that the average short price would be around ₹243.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.