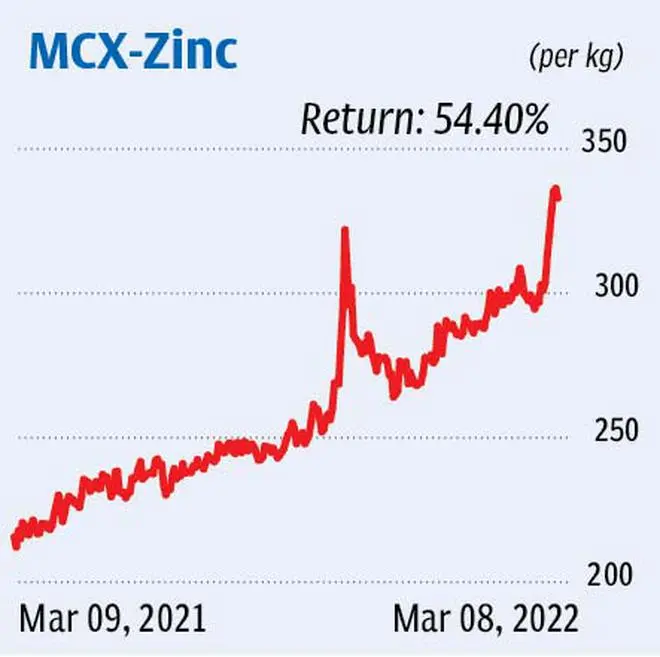

On March 1, 2022, the continuous futures contract of zinc on the Multi Commodity Exchange (MCX) broke out of a resistance at ₹310. The price spiked and hit a fresh high of ₹376.65 on Tuesday. However, the price softened and closed at ₹333 yesterday. Notably, ₹325 is a good support.

Although the major trend is bullish, the volatility in the past couple of days triggered long unwinding. This can be observed in the cumulative open interest of zinc futures on the MCX – it was at 1,909 contracts by the end of third week in February; while it went up to 2,059 contracts by the end of last week, it dropped considerably to 1,128 contracts on Tuesday. Thus, the rally is being capitalised for profit booking. So, going ahead, bulls need to regain traction and build fresh longs. Until then, the contract could stay sideways or might even witness a price correction.

Noteworthy support is at ₹310, where the 21-day moving average coincides. And there is a rising trendline which can provide a dynamic support. On the upside, a daily close above ₹350 can bring back buying interest.

Given the above factors, traders can stay out of zinc futures now. Consider fresh longs at ₹310 and ₹300 with stop-loss at ₹285. When the contract touches ₹350 after our buys are triggered, book one-third of the longs and alter the stop-loss to ₹305. Liquidate the remaining if price rallies to ₹375.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.