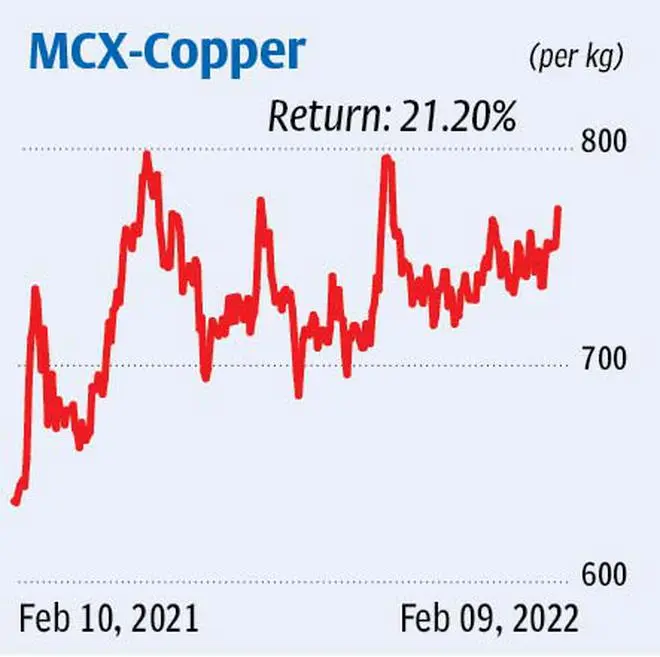

The continuous contract of copper on the Multi Commodity Exchange (MCX) was charting a sideways trend since the year beginning i.e., it was oscillating between ₹735 and ₹760. But in early February, the contract rebounded from the support at ₹735. A rising trendline support coincided at this level, making it a strong base. Since then, the contract gathered enough momentum breaking out of ₹760-level on Wednesday this week, turning the outlook positive.

Supporting the bullish bias, the relative strength index (RSI) and the moving average convergence divergence (MACD) indicators on the daily chart are currently showing fresh uptick. Also, the cumulative open interest (OI) of copper futures on the MCX has been increasing along with rally i.e., it has gone up to 5,212 contracts as on Wednesday as against 4,713 contracts by the end of the January. A build-up in OI combined with price rise is a bullish signal.

On the upside, the contract is set to test the resistance at ₹810. A breakout of this level can induce further bullish momentum resulting in the price appreciating to ₹850 over the medium-term. But there is a possibility of the contract seeing a decline from ₹810. . One can go long at current levels and accumulate if price dips to ₹768 with stop-loss at ₹755. Exit the longs at ₹810 and decide on further trades based on how the contract reacts to ₹810.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.