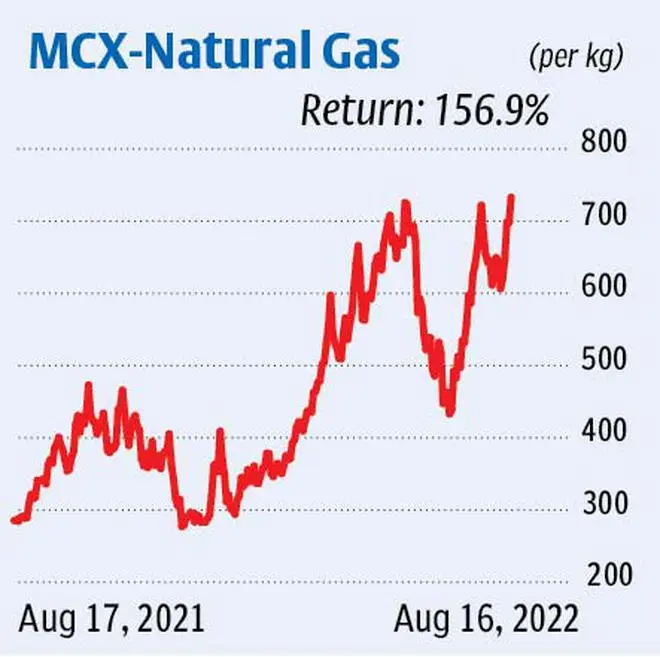

The natural gas futures on the MCX , which has been on a rally over the past week, has now reached an important point. Currently trading at around ₹745, the contract faces a strong resistance band between ₹730 and ₹760. It has already declined a couple of times after rallying to this price region.

So, although the recent trend has been bullish, we expect a price drop from here, at least a minor one. From the current level, nearest support can be spotted at ₹600. The 50-day moving average lies at ₹585 thereby making the price band of ₹585-600 a considerable base. Subsequently, there is a support at ₹540.

But note that a decisive breakout of ₹760 can result in a quick rally to ₹800, a potential resistance.

Since MCX natural gas futures is trading around a critical resistance level and the risk-reward ratio is favourable for selling at the current juncture, we suggest shorting the contract at the current level of ₹745. Place stop-loss at ₹770.

When price drops below ₹645, tighten the stop-loss to ₹680. Liquidate the short positions when the contract touches ₹610.

This is counter-trend trade, and we recommend you stick to the above said stop-loss and target levels strictly.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.