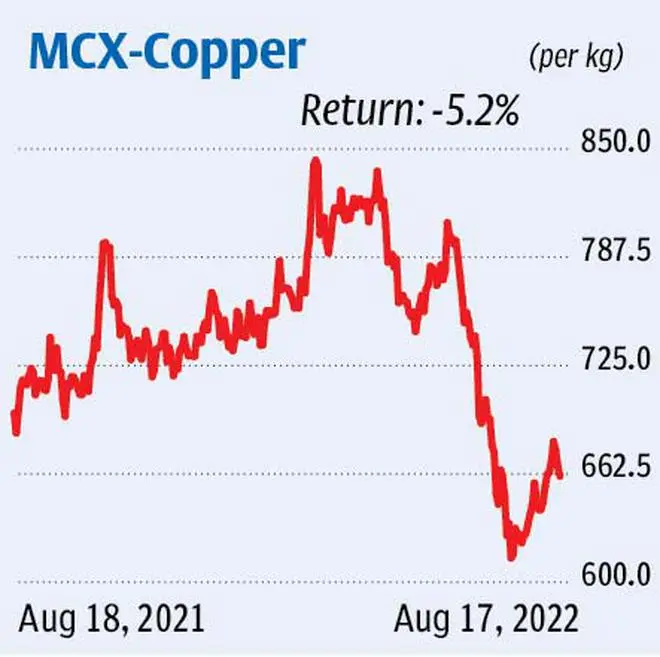

The continuous futures of copper on the MCX (Multi Commodity Exchange) has been on a rally since the past month. After taking support at ₹600, the contract has appreciated to the current level of ₹660 after touch a high of ₹684.3 last week.

The chart indicates resistance between ₹670-700. The 50-day moving average (DMA) lies within these levels, making it a considerable resistance band. Therefore, the likelihood of a decline from here is high given the overall bearish trend. In case the copper futures rally from here, it can be capped at ₹700.

If the contract resumes its downtrend from the current levels, it will most probably fall below ₹600 and touch ₹585, a support level. Subsequent support is at ₹550.

Considering these factors, initiate fresh short positions in two legs. That is, go short at the current level of ₹660, and add more shorts when the contract rallies to ₹700. Place initial stop-loss at ₹745. Once the contract slips below ₹600, tighten the stop-loss to ₹670. Revise it further down to ₹615 when the price falls below ₹585. Exit all the shorts at ₹550.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.