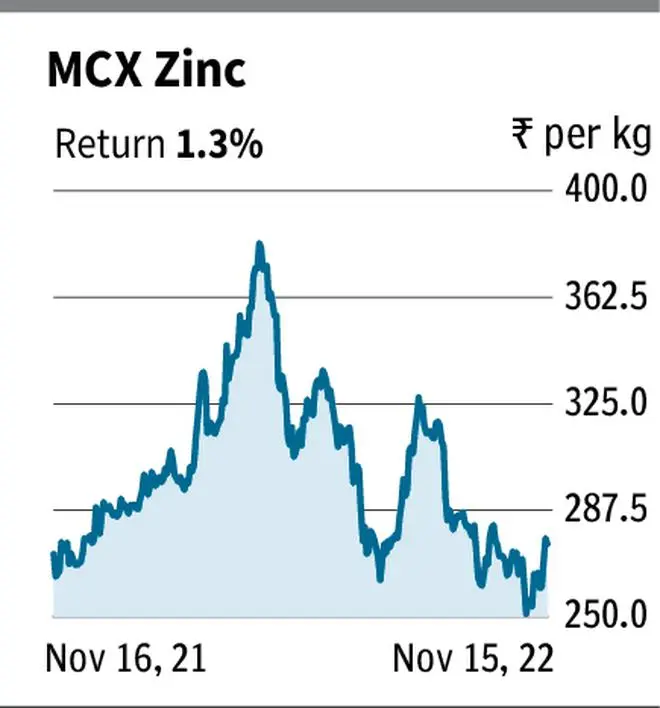

By taking support at ₹250, the continuous futures contract of zinc on the Multi Commodity Exchange (MCX) rebounded in early November. It currently trades around ₹276, above both the 20- and 50-day moving averages. This gives the contract a positive bias.

Supporting the case for the bulls, zinc futures on the MCX has witnessed a long build-up of late. That is, between November 4 and 15, the November expiry futures rallied from ₹265.2 to ₹275.7 and parallelly, the cumulative open interest went up from 2,743 to 3,621 contracts. A price rally accompanied by an increase in the open interest denotes long build-up. Therefore, there is good likelihood of the contract producing a further rally from.

However, traders should be wary of impending resistance in the ₹290-292 price band. Also, from the current level of ₹276, there is support at ₹272. Therefore, given the prevailing chart set-up, it is better to look for short-term long trades from here. Also, the risk-reward ratio is better for longs.

Trade strategy

Buy MCX-Zinc futures at the current level of ₹276 and place stop-loss at ₹270. Book profits when the contract touches ₹290.

The above suggested trade is a short-term trade. Positional trades can be considered based on how zinc futures react to the resistance band of ₹290-292.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.