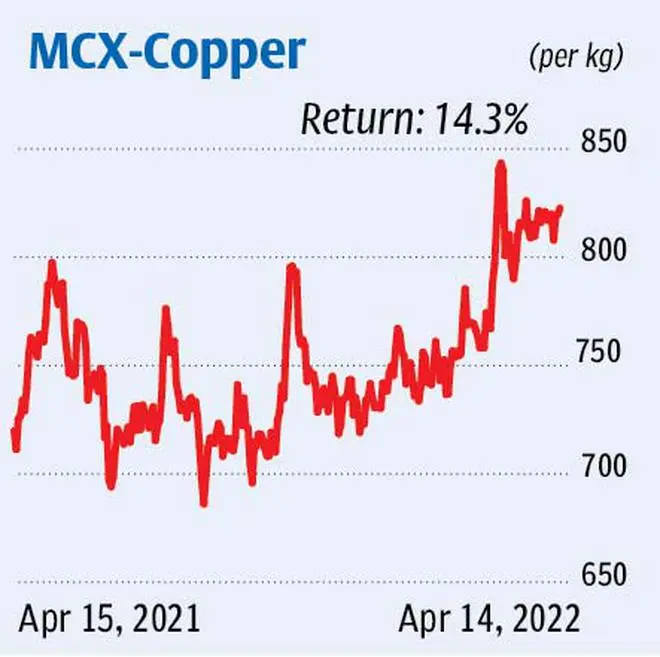

In March, we had recommended a couple of long positions on the copper futures on Multi Commodity Exchange. One was at around ₹830 and the other at around ₹815, both with stop-loss at ₹780.

Although the overall trend of the contract remain bullish as it stays above key supports, in our analysis on March 31, we had predicted the contract to stay sideways i.e., between ₹810 and ₹835 for some time before breaking out of this range. In line with this, the copper futures has been trading in that manner.

But last week, the contract bounced off a rising trendline support, increasing the probability of a breakout. A breach of ₹835 can lift the contract to ₹860 initially and then to ₹885 from where there might be a price correction.

That said, fresh trades can wait until the breakout of ₹835 occurs. Nevertheless, traders who are holding longs can continue to hold with earlier recommended stop-loss at ₹780. When the contract breaks out of ₹835, tighten the stop-loss to ₹800. Move it further upward to ₹830 when copper futures decisively breach ₹860. Liquidate all your longs at ₹885.

On the other hand, a break down from the range of ₹810-835 can drag the contract to ₹785, a support level. Subsequent support is at ₹740.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.