The Indian benchmark indices remained volatile but well within the expected sideways range. Nifty 50 remained well within the 15,700-16,400 range barring the short-lived rise to 16,414 seen on Monday. Sensex, on the other hand, has closed just above the 52,630-54,860 and needs to be seen if this break will sustain in the coming week. Both the indices fell in the first half of the week and were threatening to break the range on the downside. However, Sensex and Nifty saw a strong bounce in the final two trading days. Though this has given some relief, it will have to be seen if the indices can get a strong follow-through rise and move up further.

Among the sectors, only the BSE Bankex and BSE Auto index managed to close in the green. Both the indices were up over 3 per cent each. The BSE Metal index was beaten down the most last week by 8.28 per cent.

The Foreign Portfolio Investors (FPIs) continue to sell Indian equities. They sold net assets to the tune of $515 million in the equity segment last week. With this, they have pulled out $5 billion from the Indian equities in the month of May.

Nifty (16,352.45)

Nifty broke above 16,400 but failed to sustain. It fell back from the high of 16,414.7 and made a low of 15,903.7. However, surprisingly, the index made a sharp recovery from the low to close just below the upper end of the 15,700-16,400 range. Nifty has closed the week at 16,352.45, up 0.53 per cent.

The week ahead: Immediate resistance to watch is 16,400 – the upper end of the range. Inability to breach this hurdle can drag the Nifty down to 16,100-16,000 initially. A break below 16,000 can then take the index down to 15,700 – the lower end of the range. In that case, the sideways range will continue to remain intact.

In case Nifty manages to break above 16,400, the upside is likely to be capped. Key resistances are at 16,495 and 16,600 also that can cap the upside. The chances of seeing a reversal from either 16,495 or 16,600 cannot be ruled out. Such a reversal can also drag the Nifty back into its 15,700-16,400 range and keep it pressured to see a steeper fall, going forward.

A strong rise past 16,600 will be needed to turn the outlook bullish and see a rise to 16,800 and 17,000 levels. Overall, it is a wait-and-watch situation for now.

Trading strategy: Traders can stay out of the market until a clarity is obtained.

Medium-term outlook: The medium-term bearish outlook is still valid as long as the Nifty stays below 16,600. A reversal from 16,495 or 16,600 mentioned above will keep alive the chances of the Nifty breaking below 15,700 and falling to 15,500 and 15,100. That will also keep intact the view of testing 14,500-13,500 region over the medium term.

A strong break above 16,600 and a rise to 16,800-17,000 will ease the danger of seeing 15,000 on the downside for the moment. It will not alter the broader down trend though.

In that case, a rally to 17,800-18,000 can happen. However, only a strong break above 18,000 will completely negate the chances of seeing 15,000 and lower levels.

Trading strategy: Positional traders can continue to hold the short positions taken at 17,171. Retain the stop-loss at 16,900. Move the stop-loss down to 16,100 as soon as the index touches 15,600 on the downside. Book profits at 15,100.

Sensex (54,884.66)

Sensex fell sharply from the high of 54,931.30 in the first half of the week. However, the index managed to rise back sharply from the low of 53,425.25 and recovered in the last two trading days. Sensex has closed the week at 54,884.66, up 1.03 per cent.

Chart Source: MetaStock

The week ahead: Immediate resistance is in the 54,950-55,000 region. Above 55,000, the next resistance is at 55,250. It will have to be seen if Sensex can break above 55,250 from here or not. Inability to breach the 55,000-55,250 zone can drag the Sensex down to 54,000 initially. A break below 54,000 can drag it further down to 52,500-52,000 in the near term.

On the other hand, if Sensex manages to break above 55,250, it will be bullish. Such a break can take the Sensex up to 56,500-57,000, going forward.

Medium-term outlook: The region between 55,000 and 55,250 is important to watch. As long as the Sensex trades below 55,250, the broader outlook will remain bearish. It will keep alive the chances of the index falling to 50,000 and 49,000-48,000 on the downside.

This bearish outlook will get negated if Sensex manages to rise past 55,250 decisively. In that case, Sensex will turn bullish to test 56,000 initially and then 58,000 and 60,000 eventually in the coming weeks.

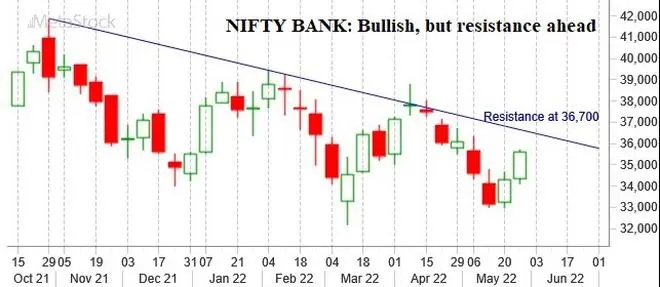

Nifty Bank (35,613.30)

The Nifty Bank index has risen sharply for the second consecutive week. The index rose breaking above the key level of 35,000. We had expected the level of 35,000 to cap the upside and drag the index down to 33,000. That has gone wrong. The index has closed the week at 35,613.30, up 3.9 per cent for the week.

Chart Source: MetaStock

The short-term outlook is bullish. Supports will be at 35,000 and 34,880. As long as the index trades above these supports, the outlook is bullish to see a rise to 36,600-36,700 this week.

The price action in the 36,600-36,700 region will then need a close watch. A break above 36,700 will see an extended rise to 37,300-37,500. On the other hand, a reversal from the 36,600-36,700 region can drag the Nifty Bank index down to 35,000 and even lower thereafter.

Trading strategy: The stop-loss at 35,350 on the short positions recommended last week has been hit. We prefer to stay out of the market some time.

Global cues

The Dow Jones Industrial Average (33,212,96) snapped its eight-week fall. The index surged 6.2 per cent last week and has also closed well above the crucial level of 33,000. The strong rally last week has eased the danger of seeing 30,000-29,000 on the downside.

Supports will now be at 32,880 and 32,500. As long as the Dow sustains above these supports, the outlook will be bullish. A rise to 34,000 and even 34,700-34,800 looks likely in the coming weeks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.