The Indian benchmark indices have risen sharply for the second consecutive week. Both the Sensex and Nifty 50 have rallied breaking above their key resistance and have closed on a strong note. Our view of seeing a turn-around from the resistance has gone wrong. This also negates, for now, our broader bearish view of seeing a fall to 14,500-13,500 on the Nifty and 49,000-48,000 on the Sensex that we have been mentioning here over the last several weeks. For now, the outlook is bullish and there is more room for the indices to move up from here.

Among the sectors, barring the BSE Auto index (down 0.81 per cent) other indices closed in green. The BSE Metals outperformed by surging 8.15 per cent. Many indices such as the BSE Oil & Gas, BSE IT, BSE Realty etc were all up over 2 per cent last week.

The Foreign Portfolio Investors (FPIs) remained net buyers of Indian equities for the second consecutive week. They bought $488 million in the equity segment last week. Also, after selling for nine consecutive months, the FPI turned net buyers of Indian equities in July. The month saw an inflow of $579 million into the equities.

Nifty 50 (17,158.25)

Contrary to our expectation to see a reversal from either 16,830 or 16,892, Nifty surged breaking above these resistances last week. Indeed, the index has risen above the psychological 17,000-mark and has closed on a strong note. It has closed the week at 17,158.25, up 2.62 per cent.

Graph Source: MetaStock

The week ahead: The gap-up open on Friday has taken the index well above the 200-Day Moving Average (DMA). This is currently at 17,025. Another trendline support is also near 17,000. Below 17,000, the next important support is at 16,850. The chances are high for the Nifty to sustain above 17,000 itself or 16,850. Dips to these levels will bring in fresh buyers into the market.

As long as the index sustains above these supports, a rise to 17,350-17,400 is possible this week. A further break above 17,400 will then pave way to test 17,600 on the upside.

If Nifty breaks below 16,850, though less likely, it can fall to 16,700 and 16,600 – the next two key supports.

Trading strategy: Traders with a short-term perspective can go long at the current levels. Accumulate longs on dips at 17,030. Keep the stop-loss at 16,970. Trail the stop-loss up to 17,220 as soon as the index moves up to 17,280. Move the stop-loss further up to 17,290 when the index touches 17,320. Book profits at 17,350.

Medium-term outlook: Our earlier bearish view of seeing a fall to 14,500-13,500 has been negated now; 16,500-16,350 will now be a strong support. Nifty has to fall below 16,350 to bring back the negative sentiment.

For now, the outlook is bullish. Nifty can rise to 17,800-17,900 in August. However, the 17,800-17,900 region is a strong trend resistance. Inability to breach 17,900 can drag the Nifty lower again. A strong rise past 17,900 is necessarily needed to see new highs. The price action in the 17,800-17,900 region will need a close watch.

Sensex (57,570.25)

Sensex has surged breaking above the resistance at 57,150. We had expected this resistance to cap the upside and trigger a reversal. That has not happened. It has closed the week 2.67 per cent up at 57,570.25.

Graph Source: MetaStock

The week ahead: The outlook is bullish. The 200-Day Moving Average (DMA) at 57,047. Below that 56,800 is the next important and strong support. A fall below 56,800 looks likely. As long as the Sensex remains above 56,800, there is room to rise towards 59,000-59,150 this week.

In case the Sensex declines below 56,800, it can fall to 56,000. But that looks less probable.

Medium-term outlook: The fall to 49,000-48,000 that we have been mentioning over the last several weeks has been negated for now. The broad 55,000-54,000 will be an important support zone to watch. Sensex will come under pressure only on a decisive fall below 54,000.

The current upmove has the potential to target 60,000-60,200 in the next few weeks. A decisive rise past 60,200 will be needed to turn extremely bullish and see new highs. A reversal from 60,000-60,200 can bring the index under pressure again. The price action in the 60,000-60,200 region will need a close watch.

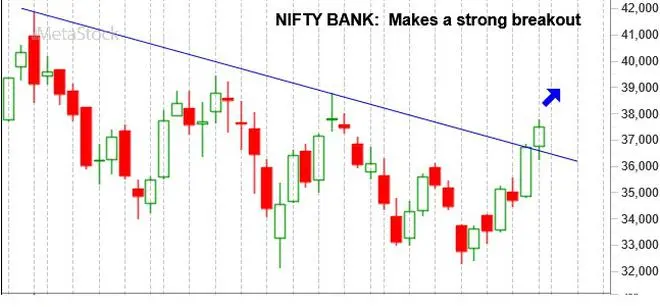

Nifty Bank (37,491.4)

The resistance at 36,850 and 37,400 has been broken. Nifty Bank index has closed just above this resistance at 37,491.4, up 2 per cent for the week.

Graph Source: MetaStock

The outlook is bullish. Immediate resistance is at 38,485. Even if it holds on its first test, the downside can be limited. Clusters of support is poised in the broad 37,000-36,000 region. Within this broad region, 36,600 and 36,400 are key levels. So, dips to 37,000 or lower are likely to see fresh buyers coming into the market.

The chances are high for the Nifty Bank index to breach 38,485 eventually and rise to 40,100-40,200 in the next few weeks.

Trading strategy: Traders with a medium-term perspective can go long at the current levels. Accumulate longs at 36,900 and 36,700. So, the average entry level will be at 37,030. Keep the stop-loss at 35,800. Trail the stop-loss up to 37,800 as soon as the index moves up to 38,500. Move the stop-loss further up to 38,200 when the index touches 39,100 on the upside. Book profits at 39,800.

Global cues

The rally to 32,800 mentioned last week has happened. The Dow Jones Industrial Average (32,845.13) sustained well above 31,500 and surged breaking above the resistance at 32,400. It has closed at 32,845.13, up 2.97 per cent for the week.

Important resistances are at 33,100 and 33,300. Support is at 32,250. Inability to break 33,300 can take the index down to 32,250 or even lower. However, the momentum is strong. So the chances are high for the Dow to break above 33,300 this week. Such a break can take the index up to 34,000 and 34,200 in the coming days.

The 34,000-34,200 is a strong resistance region which is likely to hold. A reversal from this resistance region can bring the Dow under pressure for a fresh fall again. The price action in the 34,000-34,200 region will need a close watch.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.