Nifty 50 and Sensex have risen well and also closed on a strong note last week. This keeps the overall sentiment positive. The broader uptrend is intact. Both the Sensex and Nifty 50 have potential to move further up in the coming weeks. On the charts, chances of the Indian benchmark indices scaling new highs in the coming months are increasing.

All the sectoral indices ended the week in green. The BSE IT index outperformed by surging 3.69 per cent. This was followed by the BSE Health Care, BSE FMCG and BSE Realty indices. They were up 3.28 per cent, 3.11 per cent and 3.03 per cent respectively.

FPIs Buy

The Indian equity market continues to attract foreign money. The foreign portfolio investors (FPIs) have been buying the Indian equities over the last five consecutive weeks. The equity segment saw an inflow of $769.93 million last week. For the month of May, the FPIs have pumped in about $4.65 billion in the equities. This is a positive for the Indian benchmark indices. Continuing flows can aid the Sensex and Nifty scaling new peaks in the coming months.

Nifty 50 (18,499.35)

Nifty has risen and closed well above the key resistance level of 18,300. The intra-week dip from Tuesday’s high of 18,419.75 found support around 18,200. The index made a low of 18,202.40 on Thursday and surged to close the week on a strong note. Nifty has closed the week at 18,499.35, up 1.63 per cent.

The week ahead: The near-term outlook is bullish. The rise to 18,600-18,700 mentioned last week is happening now. Immediate support is at 18,390. Below that, the 21-Day Moving Average (DMA) at 18,237 is the next important support. It is to be noted that the strong bounce last week has happened after testing the 21-DMA.

Nifty can rise to 18,700-18,800 this week or early next week. Cluster of supports are poised above 18,200. The near-term outlook will turn weak only on a break below 18,200. Such a break, though less likely, can drag the Nifty to 18,000.

Graph Source: MetaStock

Medium-term outlook: The medium-term outlook is bullish. Strong support is in the 17,900-17,700 region. Nifty can rally to 19,000-19,150 over the next two-three weeks. Thereafter, a corrective fall to 18,600-18,500 is a possibility. Such a correction will be a good opportunity to accumulate from a long-term perspective.

So, the overall picture will continue to remain bullish. Nifty has potential to target 19,800-20,000 over the medium term. The index can even touch 20,500 over the long term before any sharp reversal happens.

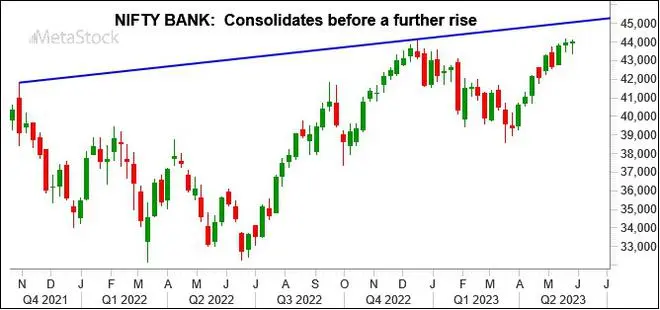

Nifty Bank (44,018)

Nifty Bank index has been stuck in a sideways range over the last couple of weeks. 43,390-44,152 has been the range of trade. The index tested the lower end of this range last week and has risen back well recovering all the intra-week loss. It has closed the week at 44,018, up marginally by 0.11 per cent.

Graph Source: MetaStock

The short-term outlook is bullish. The bounce last week from the low of 43,390 has happened from around a key trendline as well as the 21-Day Moving Average (DMA) support level. So, this leaves the bias positive to break the range above 44,152. Such a break can see the Nifty Bank index rallying to 45,000 and 45,500 in the coming weeks.

From a medium-term perspective, the Nifty Bank index has potential to target 47,000-48,000 and even higher levels. A decisive break above 45,500 will open the doors for this rally.

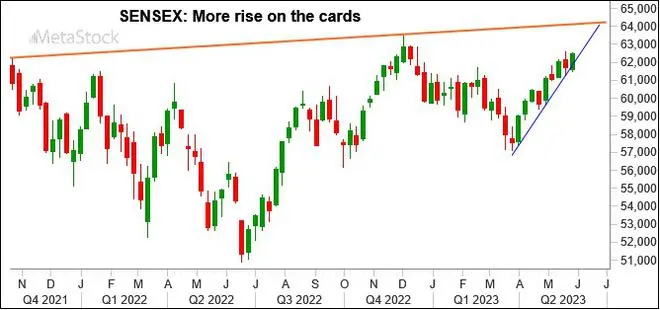

Sensex (62,501.69)

Sensex continues to get support from the 21-Day Moving Average (DMA), currently at 61,695. The index made a low of 61,484.66 and then has bounced back sharply. Sensex has risen and closed well above the key level of 62,000. The index has closed the week at 62,501.69, up 1.25 per cent.

The week ahead: The close above 62,200 on Friday is a positive. This leaves the near-term outlook bullish. Cluster of supports are poised in the broad 62,200-61,700 region. We expect the Sensex to sustain above 62,000 this week.

We expect the Sensex to see a further rally towards 63,000 initially in the near term. Thereafter, Sensex can target 64,000-64,200 eventually over the next few weeks.

The short-term outlook will turn negative only if the index declines below 61,700. In that case, a fall to 61,000 and lower is possible. However, such a fall is unlikely as the charts are looking strong. So, dips will get bought.

Graph Source: MetaStock

Medium-term outlook: The medium-term outlook is bullish; 60,500-60,000 will be the strong support zone. Key resistance to watch is the 64,000-64,200 region. A short-lived corrective fall from this resistance zone cannot be ruled out. However, the overall trend will continue to remain up; 63,000-62,000 can be a broad support zone that can limit the downside during the correction.

As such, we can expect the index to breach 64,200 eventually. Such a break can take the Sensex up to 66,000-66,500 initially over the medium term. From a long-term perspective, that will keep the doors open for the Sensex to target 68,000-68,500 over the long term.

Dow Jones (33,093.34)

As expected, the Dow Jones Industrial Average fell breaking below 33,000 last week. A test of 32,500 almost happened in line with our expectation. The index made a low of 32,586.56 on Thursday and reversed sharply higher from there recovering some of the loss. The index has closed the week at 33,093.34, down 1 per cent.

Graph Source: MetaStock

The bounce-back from above 32,500 is very important. It has happened from a strong support zone. It is now very important for the Dow Jones to get a strong follow-through rise from here this week.

Key resistances are at 33,625 and 33,800. The Dow Jones has to breach 33,800 to turn the outlook positive. Only in that case, the bullish view of a rise to 34,500 and 34,650 will come into the picture. So, the price action this week is going to be very important for the Dow Jones. That could set the trend for the coming weeks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.