AU Small Finance Bank (₹1,371.7)

At range top

Since April 2021, the stock of AU Small Finance Bank has been charting a broad sideways trend between ₹930 and ₹1,400. Last week, the stock made a high of ₹1,465 but then declined below ₹1,400. It has thus formed an inverted hammer candlestick pattern, hinting at a decline. As it is trading near the range top, the likelihood of a fall from here looks high. Within the broad range, the stock can find support at ₹1,240 and ₹1,100.

We expect the stock to gradually depreciate to these levels in a month or two. So, traders can initiate fresh short positions at current levels with initial stop-loss at ₹1,480. When price drops to ₹1,240, exit 25 per cent of your positions. At ₹1,180, exit 50 per cent of the shorts and tighten stop-loss to ₹1,335. Exit the remaining at ₹1,125.

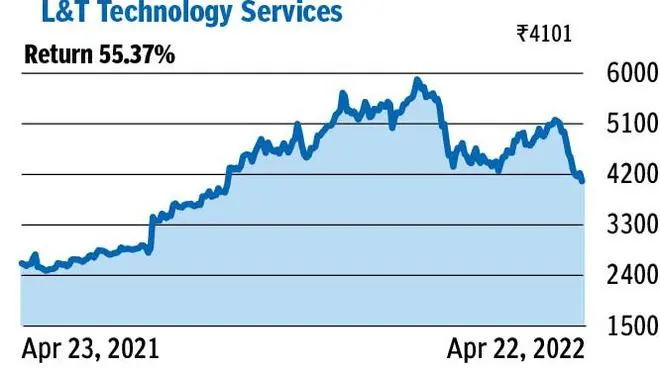

L&T Technology Services (₹4,101.4)

Makes lower low

The stock of L&T Technology Services has fallen over the last three consecutive weeks. It closed at ₹4,101.4 last week. With that, it has formed a lower low on the daily chart and has slid below the 50-day moving average support. Thus, the outlook is clearly bearish.

The scrip is likely to fall towards the nearest support at ₹3,480, which is the 50 per cent Fibonacci retracement level of the prior rally. This is likely to occur in a couple of months. But before that, the stock could see a corrective rally to ₹4,440. Therefore, traders can short now and on a rise to ₹4,440. So the average entry price will be around ₹4,270. Place the stop-loss at ₹4,600. When the stock falls below ₹3,750 alter stop-loss to ₹4,100. Liquidate all your shorts when price declines to ₹3,480.

Tech Mahindra (₹1,306.5)

Breaches a key support

The stock of Tech Mahindra is on a steady downtrend since the beginning of this year. Extending the fall, it breached a key support at ₹1,375 and a rising trendline support last week. Also, the price action on the daily chart has some resemblance to a confirmed head and shoulder pattern, showing a bearish reversal. So, the stock will most likely decline more in the coming weeks.

The nearest support is the price band of ₹1,110-1155. But before that, the stock could retest the support-turned-resistance level of ₹1,375. So, traders can initiate shorts worth 80 per cent of the total planned amount now and short for the remaining on a rally to ₹1,375. Place the stop-loss at ₹1,460. When the price falls below ₹1,200, tighten the stop-loss to ₹1,300. Liquidate all the shorts when the stock touches ₹1,155.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.