Stocks markets have partially recovered from the fallout of Russia-Ukraine war the began on February 24, 2022. European equity markets were among the worst-hit by the war, given the continent’s proximity, but were also the quickest to recover.

Here are 3 charts that show how stock markets in different countries were affected by the Russia-Ukraine war.

A year after the war

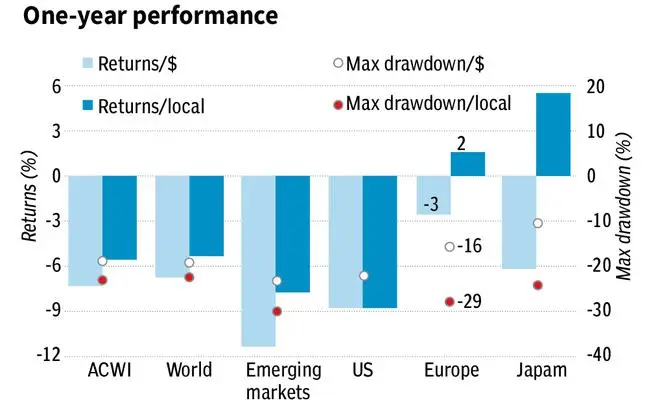

According to a MSCI blog post, global equity markets have been on a shaky ground since the beginning of Russia’s invasion of Ukraine a year ago.

While some big MNCs have left Russia, high energy prices, rising interest rates became a norm due.

Uncertainties in the global markets caused meltdown in stock markets till September 2022. Over the past 12 months, stock markets in emerging economies and the US suffered the most.

The hardest hit

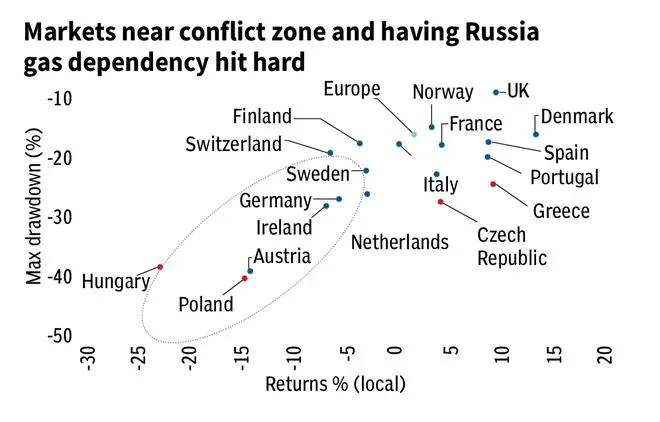

In Europe, countries that are in geographical proximity to the conflict zone and are dependendent on Russia’s gas, such as Hungary, Poland and Germany, reported high negative returns. The UK had a strong finish to the year despite being hit hard by energy-led inflation.

Investment styles

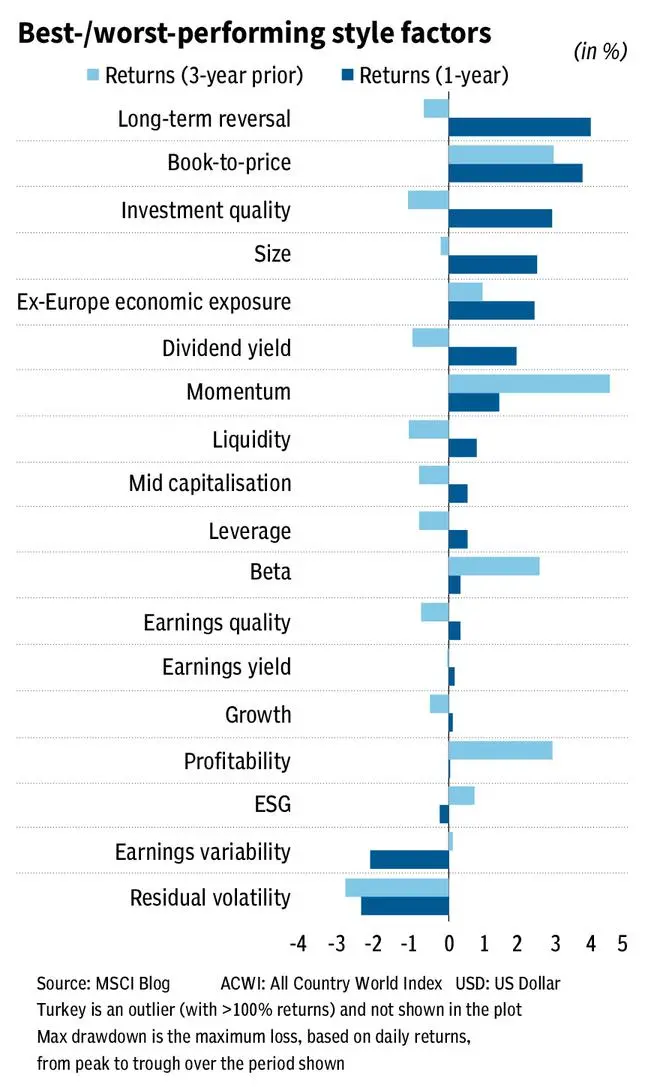

On the investment style front, the performance of value (as measured by book-to-price ratio and long-term reversal) became more pronounced.

High inflation and the corresponding rate hikes across the globe had a negative impact on growth-oriented strategies.

According to MSCI, European equities benefitted from exposure to the value factors, reinforcing the traditional view of the US equities as a “growth” play vs. European equities as a “value” play. Equity markets continued to punish high-risk stocks.

The bond market’s initial response to Russia’s invasion was swift. Government yield curves shifted upward, and corporate-bond spreads widened. Spreads widened less in the US and more in Europe.

Hard-currency Russian sovereign bonds were priced to default, while emerging-market bonds traded-off sharply as the US dollar strengthened.

Cumulative negative returns from both bonds and equities resulted in a strange situation. When faced with deteriorating economies and higher inflation, central banks chose to focus on inflation.

As inflation has started to decline on the back of falling energy prices, will the markets get their mojo back if the armed conflict subsides?

All that can be said now is: wait and watch.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.