Following RBI’s repo rate hike by 40 basis points (bps) to 4.4 per cent, banks have been able to pass on the increase to the borrowers almost immediately.

Bank of Baroda, Bank of India, SBI and ICICI Bank were among the first to hike rates and the cheapest home loan is now available at 6.9 per cent against the earlier 6.5 per cent. Non-banks such as LIC Housing Finance and HDFC Limited, too, have increased their home loan rate, but by a lower 20 – 30 bps.

Now it’s almost certain that 75 bps hike is round the corner. But the question is how much leeway banks have in terms of passing on the hikes.

Related Stories

What should you do with bank stocks now

Lack of enough re-rating drivers is a concernLess room to absorb hikes

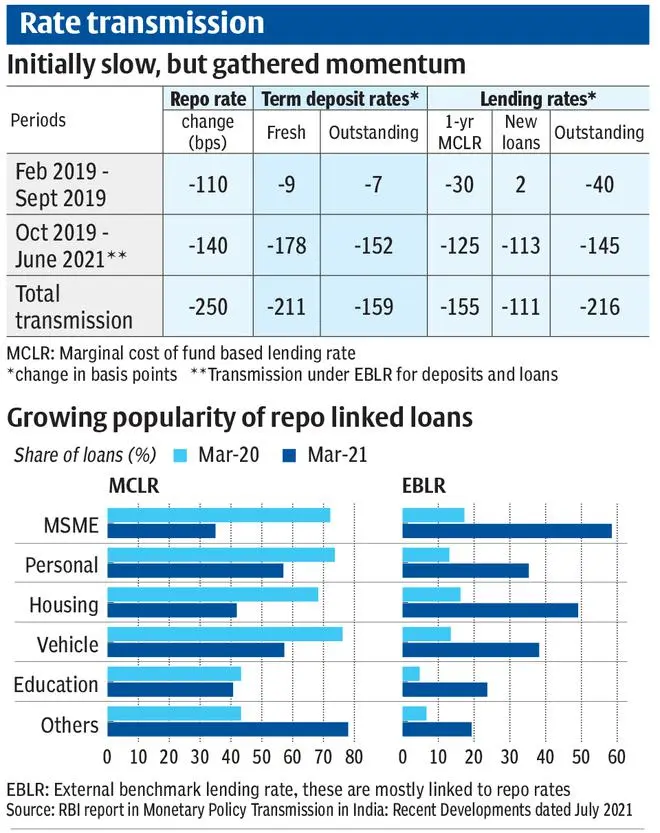

Banks have been quick to adopt external benchmark lending rate (EBLR), which has been at play since September 30, 2019, particularly for home and MSME loans (see table).

The table on rate transmission indicates how under the EBLR, a 140-bps reduction in repo rate between October 2019 and June 2021 resulted in 145 bps reduction of existing loans rates during this period. Comparatively, transmission was slow when the repo rate reduced by 110 bps between February - September 2019, under marginal cost of funds-based lending rate (MCLR). Therefore, as the cycle reverses, banks can pass on the hikes in an equally rapid way to the borrowers. However, there is a catch. The bulk of loan growth since FY19 has been via retail and MSME segments and these tend to be sensitive to high inflation. Rate hikes, hence, can affect demand for these loans. Even in the latest round, the effective hike is 25 bps so far, as banks may have lowered credit spreads, note analysts at Jefferies.

At a time when yields are already under pressure, banks may have limited room to absorb more cost pressures. In other words, hiking rates in tandem with RBI action would be the only way out. But that may come at the cost of loan growth.

Borrowers wary

While the pace of loan enquiries hasn’t abated, conversion of enquiries to transactions (or the customer availing the loan) has been tepid. “In cases like home loans, unless extremely important, customers are holding back. Unlike the earlier hikes in 2013 – 2014, where people advanced their purchases in anticipation of higher credit costs, that sentiment is not play out now”, says a senior executive of a lending platform. Personal loans and credit cards, which are more rate sensitive, are witnessing higher resistance from borrowers. “We may be at the tail end of the cycle where borrowers avail cheap credit to conserve cash,” he indicated.

Even for corporate loans, Krishnan Sitaraman, Senior Director and Deputy Chief Ratings Officer, CRISIL Ratings says a rising interest rate cycle may prompt companies to weigh between equity and debt to fund their capex costs, though high interest rates lead to increased demand for working capital loans.

Asset quality hurt

Normally, low interest rates are supportive for asset quality and vice versa. Given that FY23 would be the first year of steep rate hikes since August 2018, there are concerns around customers repayment behaviour. “While the borrowers’ disciple has improved in 5 – 6 years, their affordability remains muted post the pandemic,” said a retail head of PSU bank. Therefore, banks are bracing for an increase in delinquencies. “MSMEs and retail borrowers in the lower income strata may be vulnerable to delinquencies,” Sitaraman spells out.

Retail and MSME loans account for a chunk of restructured loans and this may compound the asset quality concerns. Sitaraman believes its early days to call out the impact of rate hikes just yet. “However, factoring in rate hikes, we had projected loan growth of 11 – 12 per cent for FY23 and we retain these estimates as of now.”

Banks are also confident of meeting their FY23 loan growth estimates. But the situation may get fluid in a few months. April inflation at 7.7 per cent is a big concern and this may force the regulator to frontload the rate hikes. A combination of high interest rates and high inflation may affect the purchasing power of consumers. Ultimately, this could hurt loan growth.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.