Financial literacy initiatives in the country need to continue with more vigour, with a study indicating that roughly one in every four investors today is a woman. Six locations in the country account for 41 per cent of women investor populace, indicating the scope of deeper penetration. Retirement, buying home and child education are the top financial goals of women. Also, women investing in tax-saving funds has shown a consistent and significant rise over the years. Here are charts that give you the complete picture.

Growing presence

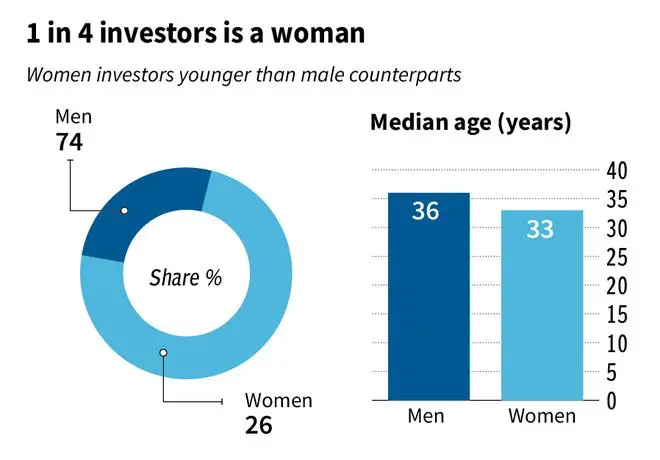

If you have ever wondered, how many investors around you are women, here is some help. Just over 1 in 4 investors are women, finds analysis by investing platform Kuvera. While the number is still low compared to men, the latest number is an improvement over 19 per cent.. While this goes to show that various financial literacy activities undertaken by industry participants are showing results, this is no time to rest on laurels. There is clearly a long way to go to achieve investing equality.

The urban-rural divide?

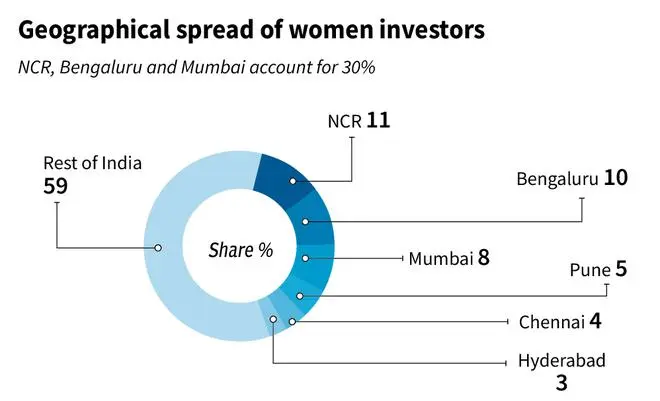

Women investors from the National Capital Region (NCR), Bengaluru and Mumbai account for 30 per cent of all women investors in the country, indicating better financial literacy among women in metro cities. Yet, the urban-rural divide has never been starker. Just 6 locations accounted for 4 of 10 women investors, which shows the scope for deeper penetration outside these locations.

Top financial goals

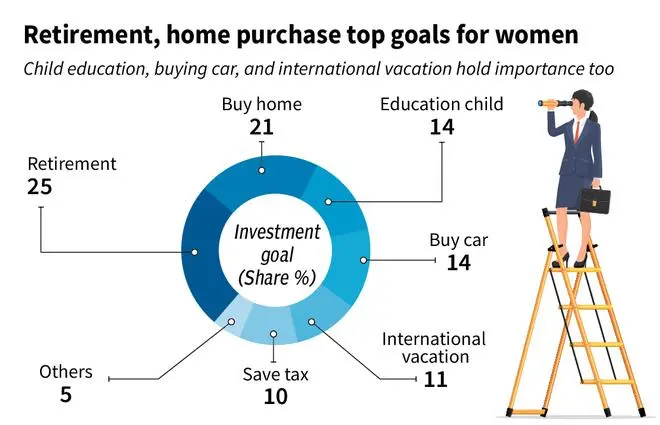

A financial goal is a target to aim for when managing your money. So, what drives women to invest? The study shows that retirement, home purchase, child’s education are top goals for women investors. Buying car, international vacation and saving tax are also in the list.

Axe the tax

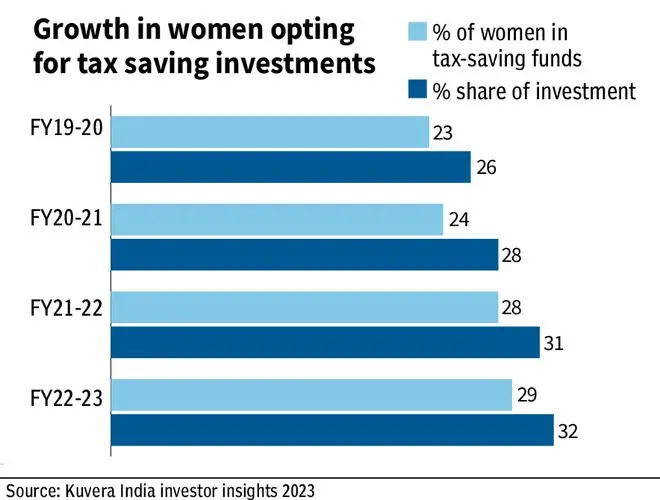

Tax-saving funds continue to be a favourite among women as the share of women investing in these funds has shown a consistent and significant rise over the years - from 23 per cent in FY20 to 29 per cent in FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.