The mega IPO of state-owned insurance behemoth LIC is expected to hit the market this week and raise a record ₹21,000 crore. For the sake of millions of investors waiting to lay their hands on this crown jewel, hopefully the big daddy of Indian markets breaks the mega IPO jinx as well.

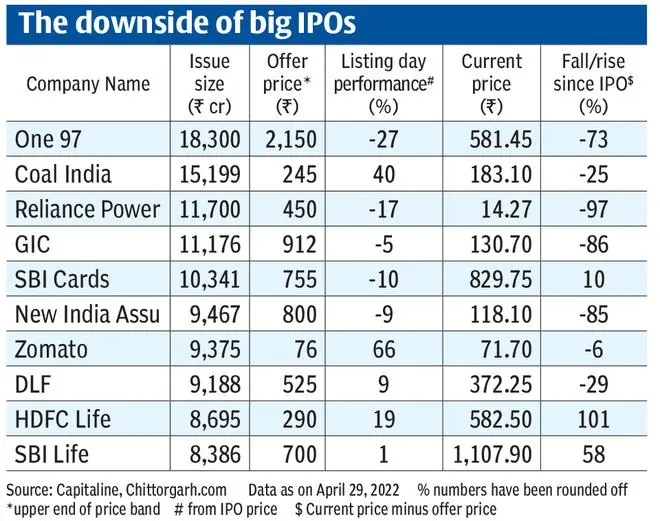

On the face of it, big IPOs have come short on investor expectation. Seven of the ten biggest IPOs are trading below their respective issue price. Aggressively priced issues on the back of frothy markets, change in company fundamentals, and the dissipating initial euphoria are some of the reasons why many big IPOs went kaput when it comes to delivering sustainable returns. Will LIC side step these headwinds?

The biggest IPO of Indian markets so far has been One 97 (Paytm) that raised ₹18,300 crore in November. The stock value has eroded over 70 per cent from its public issue price tag. The IPO price was at an EV/revenue multiple of 40 times compared to profitable foreign listed peers that then traded in 7-12 times range. But Paytm is not alone. The stock of Coal India, which raised about ₹15,200 crore way back in 2010, is also down 25 per cent from its IPO price of ₹245, though the stock had scaled highs of ₹440 a share.

Reliance Power is another example. Launched just ahead of the famous 2008 crash, the stock is down over 90 per cent from its IPO price. IPOs of GIC, New India Assurance, Zomato and DLF are similarly jinxed.

It’s different

Yet, LIC may be a different story on many counts.

One, LIC is the dominant leader in its space but isn’t exorbitantly valued. The insurance giant accounts for over 60 per cent of life insurance new premiums, driven primarily by its industry leading agency force of 13.4 lakh. It is the biggest domestic institutional investor with an AUM of ₹40-lakh crore AUM, bigger than the corpus of the entire MF industry.

LIC IPO’s asking rate is just 1.1 times price-to-embedded value compared to peers HDFC Life, SBI Life and ICICI Pru Life that roughly trade at 2-4 times. Interestingly, HDFC Life (up 101 per cent) and SBI Life (up 58 per cent) are among the few that have delivered returns from their big-ticket IPOs.

Two, the maiden public issue of LIC is happening in the backdrop of a weak markets. This could have led to the promoter, that is, the Government of India, pricing the IPO modestly. All the previous 10 biggest IPOs came at a time when the stock markets were standing tall with gains of up to 25 per cent in the respective preceding six-month period. The LIC IPO comes at a time when markets are down 4 per cent in the same period — courtesy incessant selling by foreigners who have net sold equities worth ₹2.4-lakh crore. The IPO price may thus leave something on the table for investors.

Three, there are strong signals that the LIC IPO will be subscribed for by a much more diversified set of investors, many of whom are not the regular IPO punters. Already, 6.48 crore policy-holders have linked their PAN number with the policy details and are thus eligible to participate in the LIC IPO via the reserved category. Around 1.21 crore demat accounts have been opened by policyholders, per reports.

Many of these potential LIC IPO investors, who are likely to be new-to-market participants, and could be long-term stakeholders. LIC’s policyholders have shown strong connect for policies; LIC has one of the highest 61st month persistency.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.