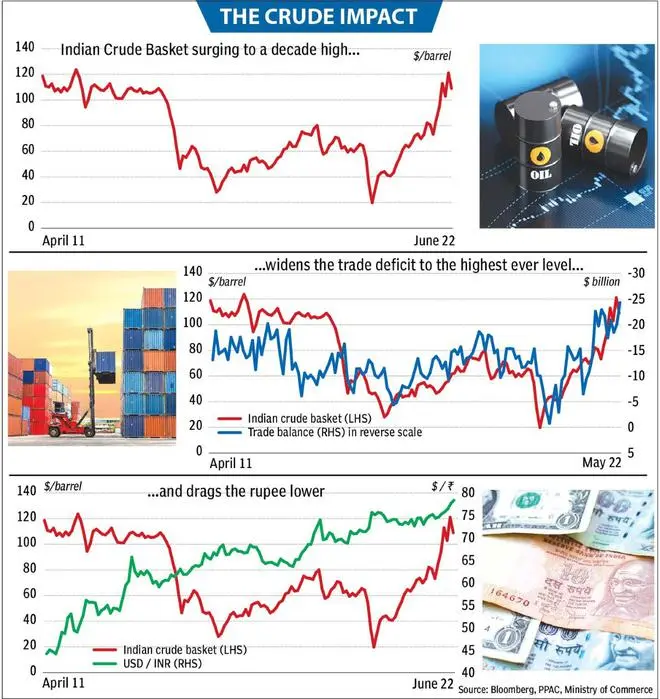

After nudging close to its decadal high of $121.28 a barrel, the price of India’s crude basket has moderated in the last couple of weeks to $109. This reflects the cooling of global crude prices on recession fears.

But Indian economy watchers believe that this will only be a breather and may not provide relief to the trade deficit, the Rupee or consumers feeling the pinch of inflation.

Theoretical construct

The Indian crude basket is a theoretical blended price that averages global prices for sour and sweet grades in a set proportion. It is used to estimate India’s import bill and for fuel pricing decisions.

Supply disruptions after the outbreak of the Russia-Ukraine war in February were the major trigger for the Indian oil basket to top $100 a barrel for the first time since August 2014. The price of the basket had plummeted to $16.2 in April 2020. However, experts believe that the price of the Indian basket is not likely to fall below $100 any time soon and can in fact flare up again.

Some economists feel that amid supply constraints, there’s a strong possibility of a demand rebound from China. Rajani Sinha , Chief Economist, CareEdge Ratings (CARE Ratings), says, “Chinese demand can pick up now as the economy is opening up after the recent lock downs. This can put upward pressure on the oil price.” Others feel that sanctions against Russia, which have kept the global markets short-supplied, will continue even if the Russia-Ukraine conflict winds down. “Even if the Russia-Ukraine war ends, the sanctions may continue for longer and so the oil price may not sustainably fall below $100 per barrel soon,” says Aditi Nayar , Chief Economist, ICRA .

Anindya Banerjee , Vice President – Currency and Interest Rate Research Desk, Kotak Securities, says: “$100 to $125 range in Brent crude will keep the oil basket stable at current levels and will have negative impact on the rupee.”

Three-fold impact

Elevated oil prices can have a three-fold impact on India.

The first is on consumer price inflation. A research report by the Reserve Bank of India (RBI), published in January 2019, estimated that every $10 per barrel increase in the oil price takes headline inflation up by 49 basis points (bps).

The RBI , in its Aprilmonetary policy meeting had assumed a pricing of $100 for the Indian crude basket, while projecting inflation to average 5.7 per cent in FY23. If the crude price is revised higher in the coming months, the inflation forecast will need to move up.

“Inflation for FY23 is projected at 6.5 per cent with an upward bias,” says ICRA’s Nayar . Last month, to curb the fuel price rise, the government had cut excise duty on petrol by ₹8 per litre and on diesel by ₹6 . Further relief for consumers will be difficult if oil prices move up again, feel economists. The government will not have the buffer to bring down the excise duty on fuels further if there’s a crude shock.

Negative for bonds

Kotak’s Banerjee talks of the second-order impact on the bond market. “High oil will take inflation higher which in turn will be negative for bonds. That can cause foreign money outflows and keep the rupee weak against the dollar,” he adds. According to him, oil prices are not likely to come down below $100 unless recession fears escalate significantly.

Big import component

Crude oil is one of the largest import components for of India. Combined with other oil products it makes up 28-30 per cent of total imports. The country’s crude oil import cost has surged to $16.2 billion in April, this year according to the data from the data from the Petroleum Planning & Analysis Cell (PPAC), up a 41 per cent increase from $11.485 billion in January, before the Russia-Ukraine war began. “A $10 rise in the crude oil price increases the current account deficit by 0.5 per cent of GDP. We expect the CAD to be around 3 per cent of GDP in FY 23”, says CARE’s Rajani Sinha .

India’s total import bill has increased 22 per cent from $51.93 billion in January 2022 to $63.22 billion in May, while exports have risen 13 per cent from $34.5 billion to $38.94 billion over the same period. This has widened the merchandise trade deficit to $24.3 billion, the highest ever since 1994.

Impact on rupee

A widening trade deficit expands the demand for dollars and weakens the rupee. During April 2020 to August 2021, when the price of the Indian crude oil basket rose from $19.9 to $69.8, there was no major impact on the rupee. The Indian unit had actually strengthened from 75 to 73 against the US dollar. But the sustained rise in oil above $70 per barrel has been pressuring the domestic currency along with other factors such as the strengthening of the US dollar.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.