Cricket on your mind? This IPL season comes free for your viewing pleasure, courtesy streaming platform JioCinemas, which you can download on any device with an internet connection.

And, if you are anywhere in Telangana or Andhra Pradesh, you can catch the matches armed with a 200 ml bottle of Campa Cola (priced ₹10) from a store, or a two-litre family-size pack from JioMart for ₹49, at nearly half its maximum retail price.

Reliance Industries has shaken and stirred the cold carbonated drinks segment with the re-launch of Campa Cola, the ’80s drink that replaced Coca-Cola (after it exited the country in the late 1970s) and, along with Thums Up, remained the cola of choice in India for several years. This follows close on the heels of yet another disruption by the conglomerate — in the sports broadcasting arena — as its media property Viacom18 is offering free streaming of all the cricketing action on JioCinemas, across networks and devices.

When we think of disrupters, the predominant image is that of a brash start-up peopled by youngsters brimming with new-age ideas. Few would have thought of a stodgy old company of 50-odd years, earning most of its revenue from traditional businesses.

Yet, under Mukesh Ambani, that is exactly what the group is attempting as it consolidates its hold in new-age businesses while venturing into areas dominated by entrenched players with deep pockets.

Thanda matlab — Campa

Coca-Cola’s catchphrase of two decades ago, “Thanda matlab Coca-Cola”, is, according to industry insiders, what RIL is eventually aiming for from its association with the Campa range.

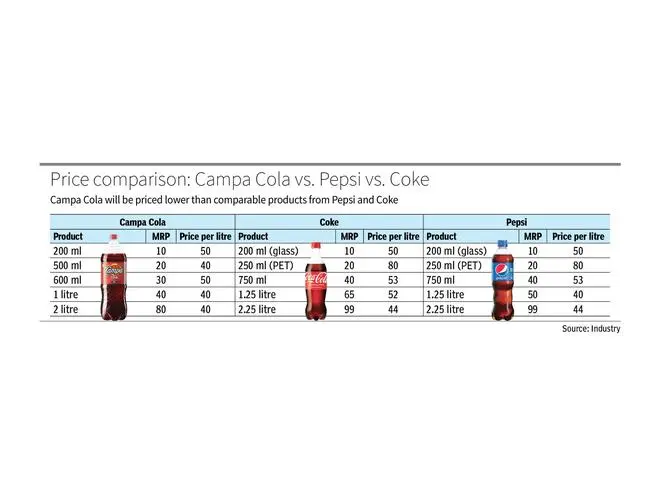

Having acquired the brand last year from Pure Drinks, RIL lost no time in launching Campa in three flavours that are priced attractively at ₹10 for a 200 ml bottle and ₹20 for a 500 ml bottle. Both Coke and Pepsi offer 250 ml PET bottles for ₹20, and 200 ml glass bottles for ₹10 across most markets.

Pepsi and Coke have the advantage of a three-decade presence in India, with strong brand recall. RIL’s Campa aims to break through that with its low prices, while also piggybacking on the country’s cricket mania and the upcoming IPL. While the company declined to share details, market sources hinted that a number of activities were planned around the IPL, for which the group has bagged digital streaming rights.

“It is expected they will do a cola campaign during IPL,” said business strategist and angel investor Lloyd Mathias.

Mathias agreed that both PepsiCo and Coca-Cola have a deeply penetrated distribution network across hotels, cafes, restaurants, and shops. But “Reliance has the largest retail platform and, for the in-house brand, they will ensure there is price competition,” he said.

A former Coke executive who spent close to two decades working with the Atlanta-based company across geographies, he said the biggest challenge likely for RIL is in setting up the distribution, cold storage network and coolers at sales points.

US investment bank Jefferies echoed this in a note, “While RIL is deep-pocketed, beverage is a tough category due to presence of entrenched brands like Coke & Pepsi and dispersed manufacturing footprint due to long lead distance, route-to-market challenge due to requirement of visi-coolers at point of sale.”

Intense competition

Coca-Cola has its own bottling operations in India and sells its products through an impressive network of 2.6 million retail outlets. It reports more than 500 servings per second. It just had a ‘stellar 2022’ in India, adding retailers, consolidating its distribution system, and unleashing an intense campaign during cricket matches. It was rewarded with Thums Up accounting for a quarter of India’s volume growth during the year and garnering a fifth of the cola market share.

Coca-Cola Chairman and CEO James Quincey said during an earnings call that besides the volume growth driven by affordable entry price points, the brand was ‘growing on all dimensions’ in India.

In the case of PepsiCo India, Varun Beverages — the biggest bottler for the cola maker outside the US — accounts for over 90 per cent of its beverage volumes in India. It has 37 manufacturing facilities and 9.25 lakh visi coolers.

RIL started off by launching Campa in Telangana and Andhra Pradesh, which together form the largest market for Thums Up from the Coke stable but have little to show for PepsiCo.

RIL has the advantage of stocking Campa Cola at its retail outlets, but it is uncertain whether this will prove enough to crack the market.

“The introduction of a new player like Campa Cola will provide consumers with an additional choice, but it may not necessarily lead to an increase in consumption,” said Amarnath Halember, Executive Director and CEO, NextG Apex India Pvt Ltd, a retail sales and execution company.

Meanwhile, the distributors are not in favour of a cola war.

Dhairyashil Patil, president of the All India Consumer Products Distributors’ Federation, said that a price war would lead to losses for the sector.

“On a bottle of ₹15 a distributor earns 84 paise; now when the bottle is priced at ₹10 we will earn 70 paise. If we sell 100 crates of cola in one day we have a net loss of ₹1,500.” He added that expenses were climbing while revenues were falling.

Free-to-air IPL

Pricing is a tried-and-tested strategy for Ambani.

Seven years ago, Reliance Jio Infocomm brought about a revolution in the telecom sector by making domestic calls virtually free and slashing data prices.

Now Ambani expects to repeat the feat with the OTT digital streaming sector by live-streaming all IPL matches for free on JioCinemas.

Industry sources said this will have a big impact in non-metros and other places with no access to Star India, which is the television broadcast partner.

In areas with patchy power supply the mobile is the trusted and handy device for work, play and entertainment. People whose work keeps them outside the home, such as security guards, can watch the matches only on their mobile phones.

How the numbers will stack up, however, is not clear yet.

Last year, when RIL won the digital rights, JM Financial Institutional Securities had said that Voot, Reliance’s OTT platform, would likely break even in the fifth year. It said, “We estimate Voot’s MAU (monthly active users) can reach 400 million by 2027 (up from Disney+ Hotstar’s 300 million MAU)... advertisement revenue of ₹2,160 crore and subscription revenue of ₹3,000 crore by 2027 from IPL alone. However, on a cumulative basis, Voot’s revenue over 2023-27 is likely to fall short of the media rights value it has paid, as per our current estimates.”

For the company it is all about attracting users to its platform, while advertisers hope to reach their audience of choice. Based on the results in the first year, the company will likely make up for the losses in subsequent years.

For the streaming industry, it is obviously testing times.

Says Karan Taurani of Elara Capital, “Reliance’s decision to air IPL — one of the most expensive content marquees — for free has likely stalled ARPU (average revenue per user) growth in digital streaming for the foreseeable future.”

He added that digital broadcasters will now have a tough time convincing subscribers to pay more for their content.

It is likely to lead to consolidation in the OTT market, making India a less prominent market for global broadcasters such as Netflix, Disney and Amazon, which are struggling to grow revenues in the country.

(With inputs from Ayushi Kar and Aroosa Ahmed)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.