Steel Authority of India Ltd (SAIL), the country’s largest steelmaker, has reported a 10 per cent rise in net profit for the December quarter compared with the year-ago period on robust sales and higher realisations.

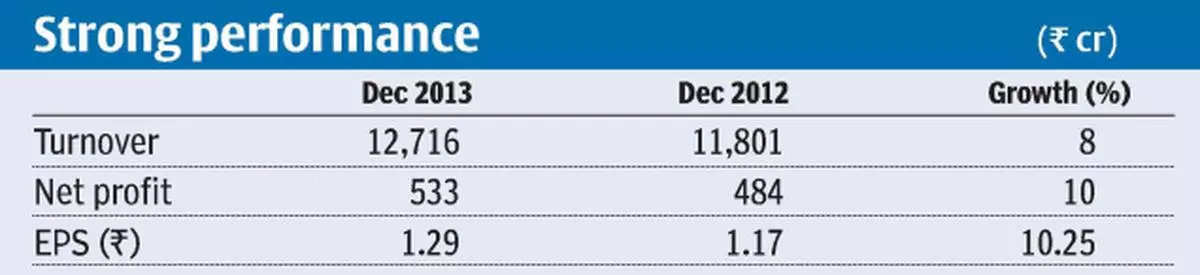

Net profit rose to ₹533 crore in the third quarter against ₹484 crore in the corresponding period quarter last year.

Sales turnover was up 8 per cent at ₹12,716 crore compared with ₹11,801 crore a year earlier.

The SAIL board announced an interim dividend of ₹2.02 per share, or 20.2 per cent on face value of ₹10 each.

Tracking the results, the SAIL scrip gained 1.74 per cent to ₹61.45 on the BSE on Friday.

The state-run company reported 7 per cent growth in sales on tonnage basis at 2.94 million tonnes (mt), while its production of saleable steel during the quarter was up 4 per cent.

“The increase in sales turnover, despite a flat steel market, is an indication that the company is well-placed to meet any market situation,” Chairman CS Verma said.

Construction, automobile and white goods drove demand for the company.

SAIL increased prices by up to ₹1,500 a tonne for different categories during the December quarter. The average net realisation was up at ₹35,336 a tonne against ₹35,168 in the corresponding last quarter. Verma said prices had almost stabilised now and will hover around the current levels, going forward. During the quarter, SAIL also reached a wage hike agreement with its non-executive employees, who will get a minimum hike of 17 per cent effective January 1, 2012.

About 85,000 employees will stand to benefit from the wage hike.

“We have already made adequate provision for implementing the wage hike – which will have an annual implication of ₹1,100 crore every year,” Verma said.

The company is ramping up its iron ore mining capacity to around 42 mt by the end of next year from the current 25 mt.

“The profit growth came in above our estimates mainly due to lower-than-expected staff costs,” said Bhavesh Chauhan, senior analyst at Angel Broking.

SAIL’s employee costs grew 9 per cent to ₹2,268 crore. Going ahead, SAIL’s inability to raise sales volumes, amid slower demand growth, higher salary costs and delay in overruns in its expansion projects, would remain a challenge, he added.