The government has decided to sell ‘enemy’ shares of 84 companies that are being held by the Custodian of Enemy Property of India (CEPI).

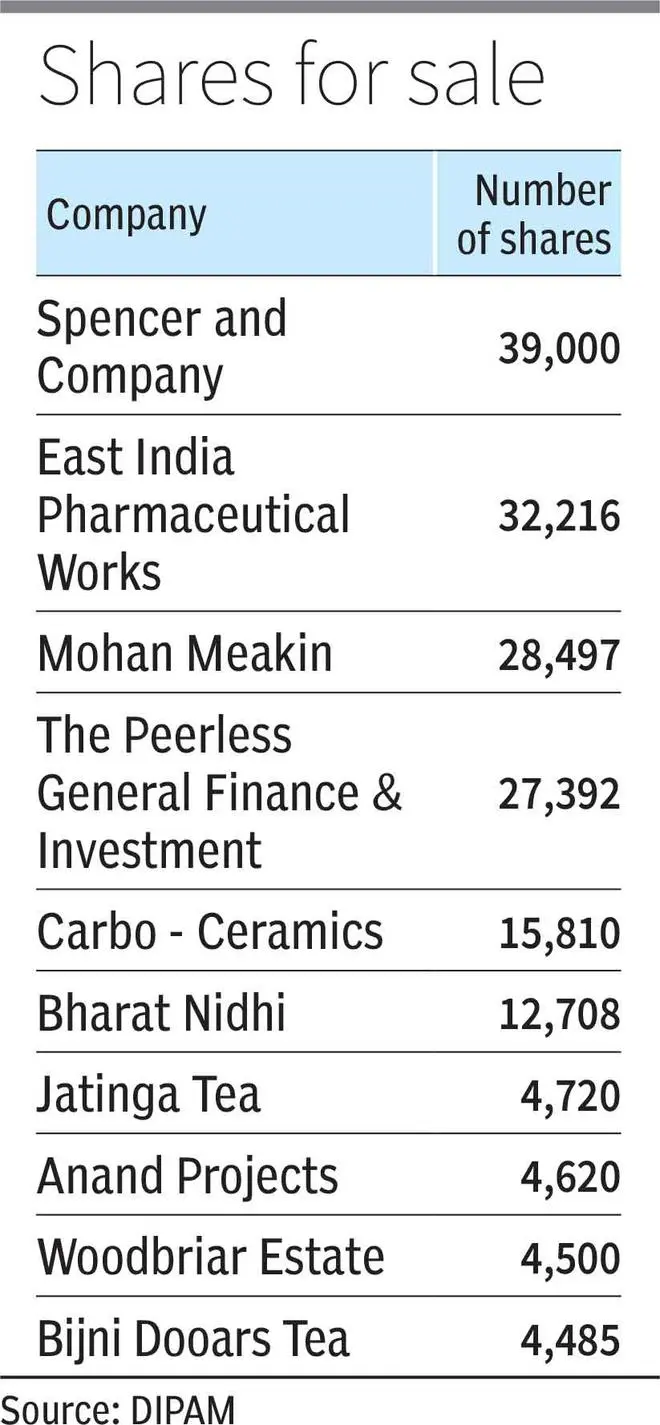

According to a notice by the Finance Ministry, the list of companies includes Anand Projects Ltd, Bharat Nidhi Ltd, Delhi Flour Mills, Mohan Meakin, Spencer & Co, the Peerless General Finance & Investment, the Bengal Dooars National Tea Limited, and Woodbriar Estate, among others. SBI Caps is the merchant banker and selling broker for the transaction.

Resident Indian individuals, NRIs, HUFs (in the name of the karta), companies, corporate bodies, scientific institutions, societies, trusts, family offices, and qualified institutional buyers can submit bids for shares till February. Interested buyers (IBs) are requested to submit their bids, indicating the number of shares of companies they intend to bid for and the bid price.

The government will fix a reserve price for shares of each of these companies, which shall not be disclosed to the IBs. Price bids submitted at a value lower than the reserve price shall be rejected. Shares will be allotted to the eligible bidders who have submitted a valid price bid on a price priority basis, subject to the approval of the Centre.

The selling process is taking place based on a Cabinet decision taken in 2018. The decision took the definition of enemy from an Act of 1968, which says “enemy” or “enemy subject” or “enemy firm” means a person or country who or which was an enemy, an enemy subject, or an enemy firm, as the case may be, under the Defence of India Act and Rules, but does not include a citizen of India. In the amendment of 2017, this was substituted by “including his legal heir or successor, whether or not a citizen of India or the citizen of a country that is not an enemy or the enemy... who has changed his nationality.”

A statement issued after the cabinet decision said that over 6.50 crore shares in 996 companies with 20,323 shareholders are under the custody of CEPI. Of these 996 companies, 588 are functional or active; 139 of these are listed, with the remaining being unlisted.

The process for selling these shares is to be approved by the Alternative Mechanism (AM) under the chairmanship of the Finance Minister, the Minister of Road Transport and Highways, and the Home Minister. The AM will be supported by a High-Level Committee (HLC) of officers co-chaired by the Secretary, DIPAM and Secretary, MHA (with representatives from DEA, DLA, Corporate Affairs and CEPI) that will give its recommendations with regard to quantum, price/price-band, principles/mechanisms for sale of shares, etc.

Before the initiation of the sale of any enemy shares, the CEPI shall certify that the sale of the enemy shares is not in contravention of any judgment, decree, or order of any court, tribunal, or other authority or any law for the time being in force and can be disposed of by the government. The government said that the decision to sell enemy shares will lead to the monetisation of enemy shares that had been lying dormant for decades since coming into force and the Enemy Property Act in 1968.

Published on January 11, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.