ePV market is set to close the fiscal year on a positive note | Photo Credit: Bijoy Ghosh

India’s electric passenger vehicle (ePV) segment, which includes battery-powered cars and SUVs, has crossed a major milestone, surpassing 1 lakh units in annual sales with a week remaining in the current fiscal year.

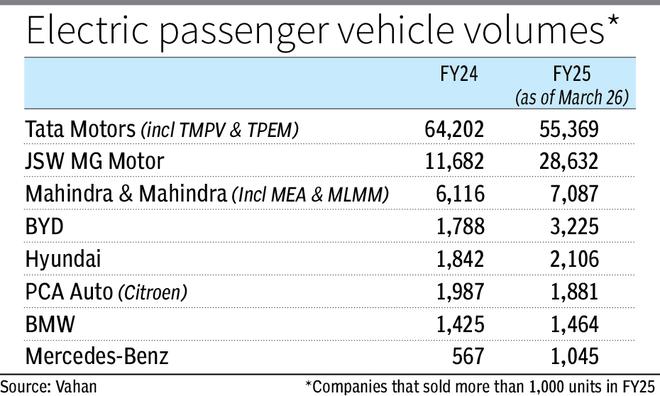

Despite challenges in the first half of FY25, primarily due to the discontinuation of the FAME II subsidy, the ePV market is set to close the fiscal year on a positive note. As of 6 pm on Wednesday (per Vahan data), total ePV sales stood at 101,880 units, compared to 90,974 units in FY24.

The ePV market witnessed contrasting trends over the fiscal year. The first half saw sluggish sales, largely due to the discontinuation of FAME-II incentives on March 31, 2024. A slowdown in fleet purchases, uncertainty between hybrid and EV technologies, and expectations of falling battery prices led many potential buyers to delay their purchases.

“The resurgence of hybrid vehicles, aggressively promoted by Maruti Suzuki and Toyota, along with State government incentives for hybrids, temporarily diverted some potential EV buyers,” said Puneet Gupta, Director at S&P Global Mobility.

However, the second half of FY25 saw a strong recovery, driven by improved market sentiment, clarity on EVs versus hybrids, and new model launches, making electric vehicles more appealing to consumers.

Tata Motors retained its leadership in the ePV segment in FY25, holding a 54 per cent market share, though down from 71 per centg in FY24, amid rising competition.

JSW MG Motor India followed with a 28 per cent share, fuelled by the success of its Windsor EV, which introduced a battery-as-a-service model, allowing buyers to pay ₹3.5 per km for battery usage. Industry analysts hailed this as an affordable and innovative approach, boosting MG’s market share.

Mahindra & Mahindra secured the third spot with the launch of its new electric SUVs, BE 6E and XE 9E. Chinese automaker BYD, despite focusing on the premium segment, claimed fourth place, while Hyundai, with its electric version of the Creta SUV, rounded out the top five.

Chinese brands, particularly BYD and MG Motors (operating through a local partnership with JSW Group), are steadily increasing their footprint in India’s EV market, mirroring their global growth trajectory.

Shailesh Chandra, Managing Director of Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM), had pointed out that more players will benefit the entire industry as this means greater consumer awareness, faster ecosystem development, and stronger confidence in EVs as the future.

Amid intensifying competition, Tata Motors is leveraging its diverse EV portfolio, priced between ₹8 lakh and ₹22 lakh, to maintain its leadership. While most competitors focus on the premium segment (above ₹18 lakh), Tata holds a strong position in the sub-₹12 lakh category, where competition remains limited. This gives Tata an edge in capturing demand from tier 2 and tier 3 cities, as well as rural areas, where interest in EVs is steadily growing.

“India’s electric vehicle (EV) market is set for substantial growth, despite its slow start. While global EV penetration has surpassed 12-13 per cent, India is projected to reach just around 2.5 per cent by the end of FY25. However, a major shift is anticipated in FY26, fuelled by the entry of leading automakers into the EV segment,” said Gupta.

Published on March 26, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.