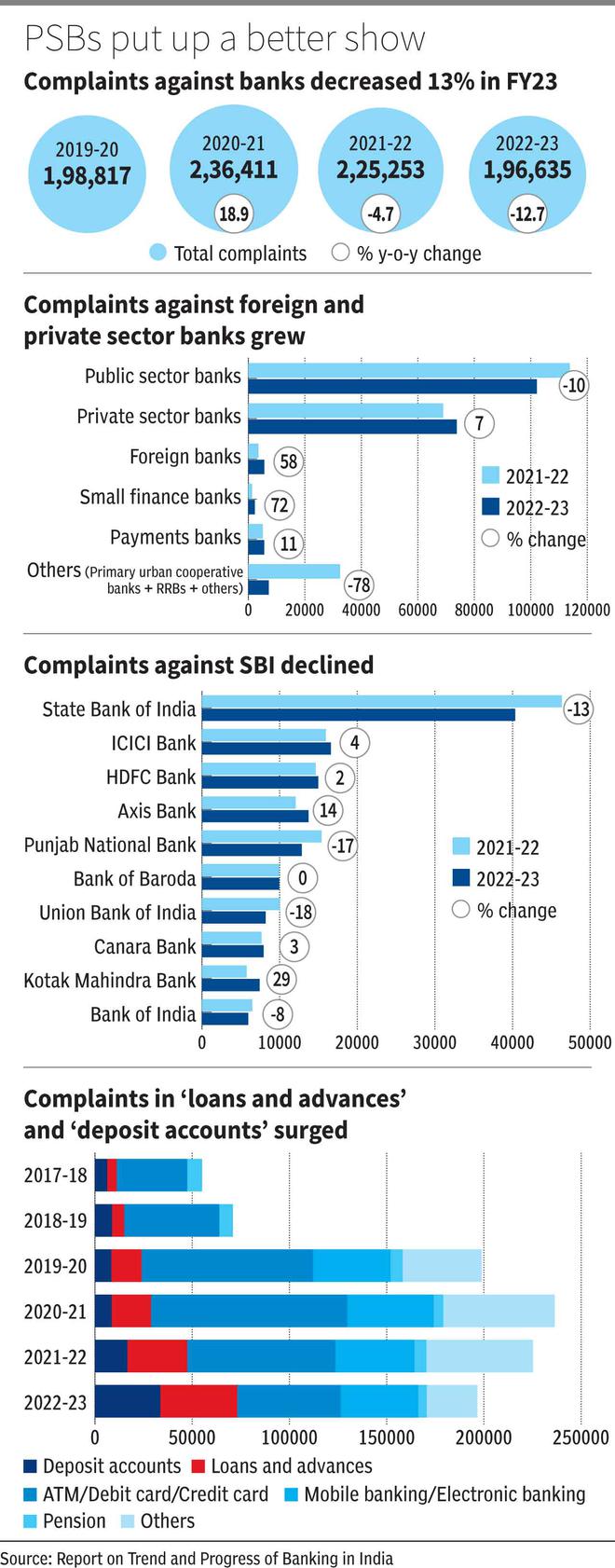

Annual complaints to the RBI ombudsman have been gradually decreasing after hitting a peak of 2.36 lakh complaints in FY21, when the country was in the throes of the pandemic. Total complaints were down 12.7 per cent in FY23 at 1.96 lakh. While public sector banks registered a decline in complaints, private sector banks recorded an increase.

The RBI’s Report on Trend and Progress of Banking in India’ shows that complaints against public sector banks have decreased from 1.13 lakh in 2021-22 to 1.02 lakh in 2022-23, marking a reduction of 10 per cent this year. Private sector banks have observed a 7 per cent growth, from 68,981 in 2021-22 to 73,764 in 2022-23.

Under the RBI’s Integrated Ombudsman Scheme, 2021, customers of regulated entities such as banks, non banking financial companies, payment system participants, and credit information companies can register grievances or complaints through a centralised reference point, which is later addressed by the RBI ombudsman.

Chief Economist of Bank of Baroda, Madan Sabnavis said, “One of the primary reasons for the decrease in complaints against banks is the effective functioning of the customer service department (CSD) in many banks. The CSD adeptly handles internal grievances, minimising the need for customers to escalate complaints to the ombudsmen, thereby ensuring swift resolution of issues.”

Despite foreign banks and small finance banks constituting a smaller number of complaints compared with other banks, both have experienced significant growth in FY23. Foreign banks have witnessed a growth of 58 per cent in complaints, while small finance banks have seen a 72 per cent growth.

Among the 77 banks in India, State Bank of India (SBI), ICICI Bank Limited, and HDFC Bank Limited top the list with the most number of complaints, recording 40,345, 16,602, and 14,979 complaints, respectively. Notably, complaints against SBI have reduced by 13 per cent compared with the previous year. In contrast, annual complaints against ICICI and HDFC have grown by 4 per cent and 2 per cent, respectively.

Sabnavis explained, “There is a possibility that private sector banks in India may outsource their staff from third parties, potentially leading to a lower quality of service compared with public sector banks. This could contribute to a higher number of complaints against private sector banks.”

The report highlights a category-wise breakup of complaints, revealing that within the span of six years, complaints related to ATM/debit card/credit card increased from 36,250 in 2017-18 to 1 lakh in 2020-21, gradually decreasing to 53,184 complaints in 2022-23.

In the loans and advances section, complaints increased from 4,926 in 2017-18 to 39,579 in 2022-23. Similarly, complaints in the deposit account section rose from 6,287 in 2017-18 to 33,612 in 2022-23. The number of complaints in mobile banking/electronic banking is steadily growing each year.

Published on January 11, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.