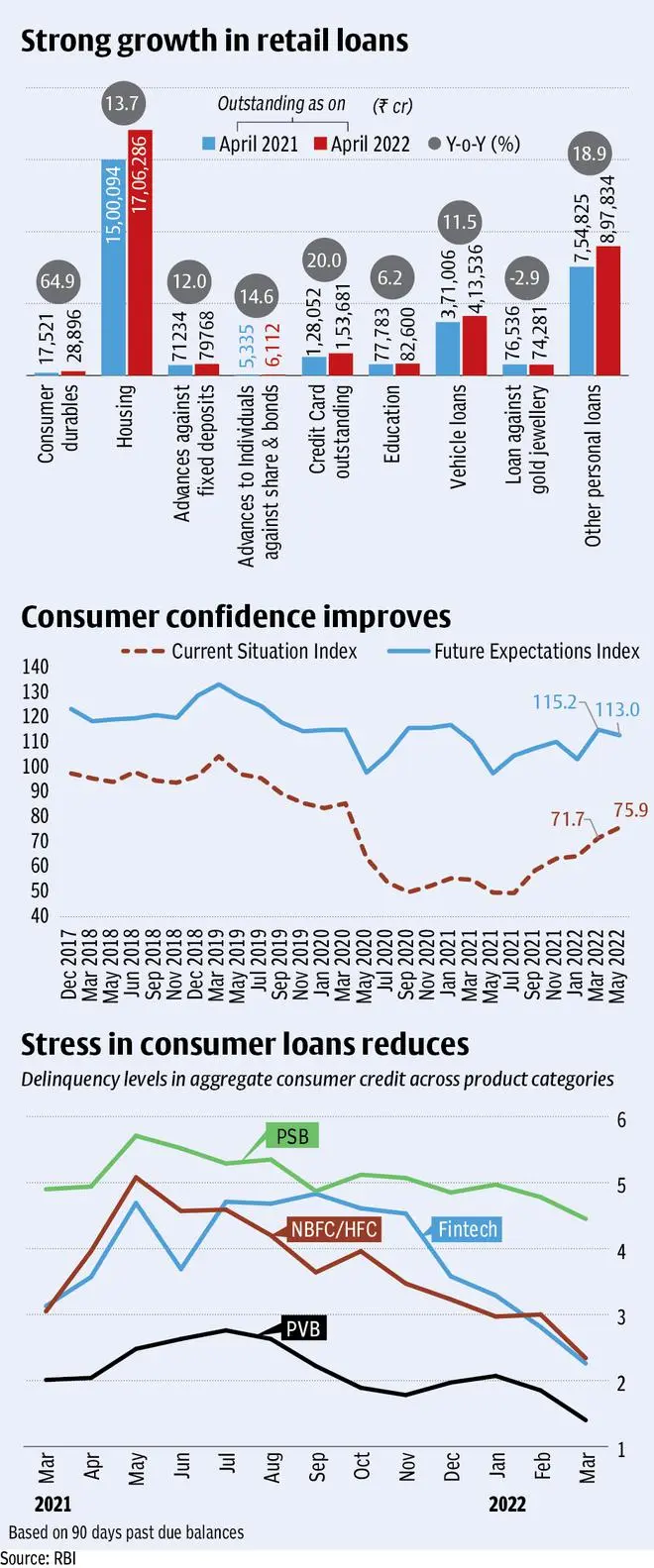

While the initial year of the pandemic impacted loan growth in all categories, there has been a strong rebound in personal loans thereafter. From Rs 3.35 lakh crore in 2020-21, these loans increased to Rs 4.66 lakh crore in 2021-22, registering a growth rate of 39 per cent. The momentum in personal loans continued in April 2022, with consumers showing a propensity to borrow across segments.

Housing loans which account for more than a third of retail loans, registered 13.7 per cent growth in April 2022, compared with the corresponding month in the previous year. “During the current phase of the economic recovery, the housing market has also regained momentum, driven by a combination of easy financial conditions and supportive policy environment. As a result, housing sales have increased, and new launches have expanded, though there was some hiatus around the emergence of Omicron in Q4:2021-22,” says RBI’s Financial Stability Report.

The borrow and spend culture is also back. This is reflected in the 20 per cent growth in credit card loans and 18.9 per cent growth in other personal loans. The sharp 65 per cent jump in consumer durables loans shows that consumers are now beginning to buy non-essential items too, which is a good signal for the economy.

A 2.9 per cent reduction in gold loans shows lower stress among middle and lower middle-class borrowers. This category of loans had shown a sharp spike during the pandemic induced lockdowns.

Consumer sentiment can be gauged from the RBI’s consumer confidence survey. The latest round of the survey conducted in May 2022, covering 6,027 responses, shows that consumer opinion about the economy and inflation is negative, but they intend to increase their spends in the current as well as the future period.

The sentiment is most negative regarding inflation, with the index deteriorating from -92.1 in March 2022 to -94.9 in May 2022. While inflation in expected to moderate slightly after one year, it is expected to remain a source of concern.

But consumers are quite confident about spending, with 60.9 per cent of respondents expected to increase spending in the May survey. The extent of spending is expected to improve further in future, with 66.7 per cent of respondents expecting to increase their spending in a year’s time.

Another indication of improvement in consumption is the reduction in delinquencies in consumer credit. RBI’s FSR shows that delinquency levels based on loans, which were due more than 90 days past their due date, was high between May and July 2021. But it has gradually improved thereafter.

Around 5.71 per cent of consumer credit in public sector banks was delinquent in May 2021. This had reduced to 4.45 per cent by March 2022. The improvement was sharper among private sector banks, with delinquent loans declining from 2.48 per cent to 1.4 per cent; while in NBFC/HFCs, it reduced to 2.34 per cent from 5.08 per cent.

Lower delinquencies show that consumers are in a much better position financially to take on more loans.

Published on July 8, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.