Maharashtra and Gujarat recorded a positive growth in foreign direct investment (FDI) in the current fiscal even as the overall FDI inflows into the country decelerated due to rising global interest rates, waning investor sentiment and gloomy growth outlook.

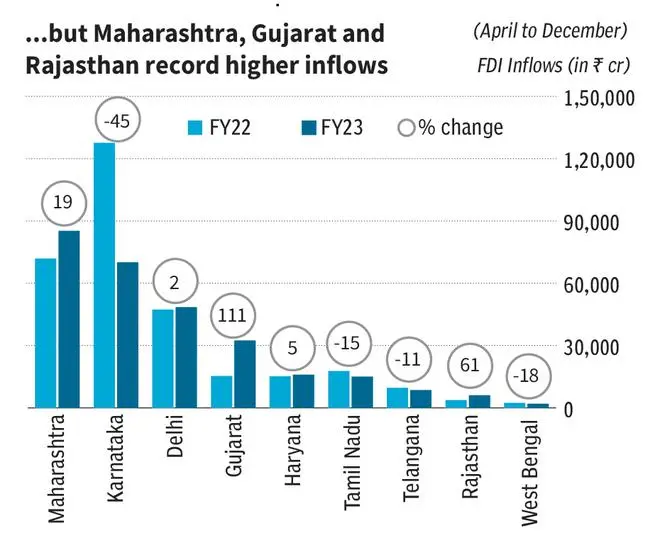

According to Department for Promotion of Industry and Internal Trade data, FDI inflows into Maharashtra went up by 19 per cent year-on-year to ₹85,186 crore during the April-December of the current fiscal. The State received ₹71,858 crore of FDI inflows during the same period of FY22.

FDI inflows into Gujarat during the first three quarters of the current fiscal more than doubled to ₹32,349 crore compared to ₹15,321 crore in the corresponding quarters of the previous fiscal. It is to be noted that Maharashtra, Karnataka and Gujarat historically command the lion’s share of FDI inflows into the country. These three States alone accounted for 68 per cent of the FDI equity inflows (in dollar terms) into the country between October 2019 and December 2022.

However, in the first three quarters of the current fiscal, FDI inflows into Karnataka declined by 45 per cent to ₹70,015 crore from ₹1.28-lakh crore during the same period of FY22. FDI inflows into other major industrial State of Tamil Nadu fell by 15 per cent y-o-y in the current fiscal to ₹14,956 crore. Among smaller States, Rajasthan recorded 61 per cent growth in FDI inflows to ₹6,021 crore.

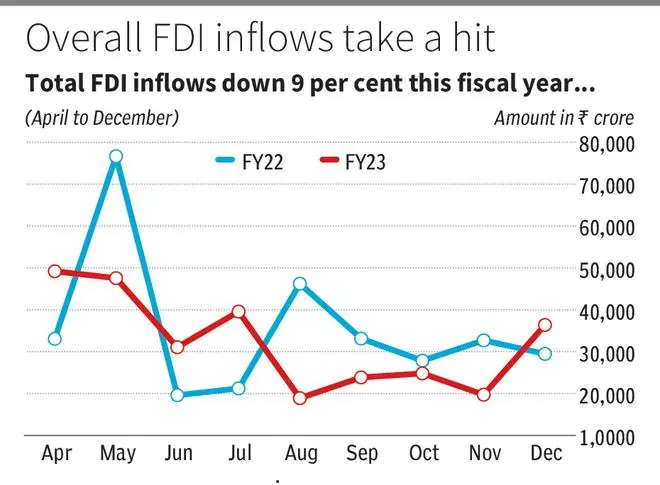

The overall FDI inflows into India fell by 9 per cent to ₹2.91-lakh crore during April-December 2022 as interest rate hike by major central banks and recessionary fears in many parts of the world dampened the investor sentiment. The total FDI inflows includes equity inflows, reinvested earnings and other capital.

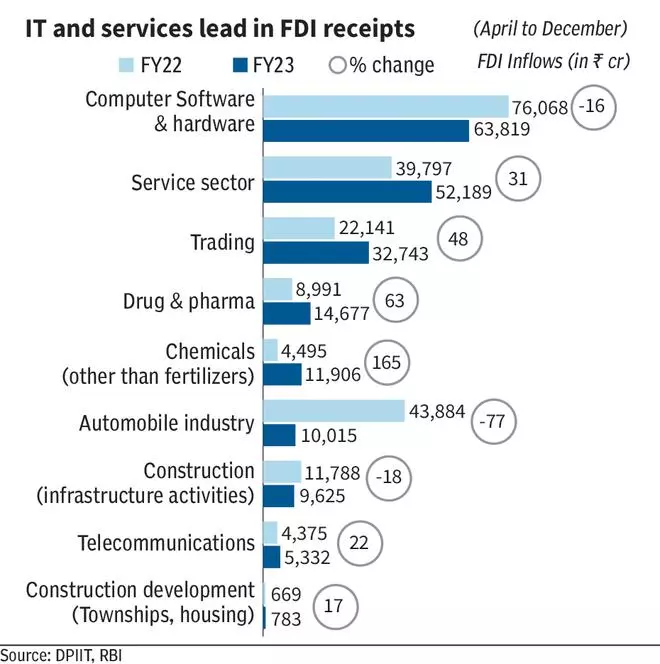

The computer software and hardware sector attracted the highest inflows of ₹63,819 crore in the first nine months of the current fiscal, although in value terms it was down by 16 per cent as compared to the same period of previous fiscal. Inflows into the service sector grew by 31 per cent to ₹52,189 crore (₹39,797 crore) during April-December 2022.

FDI flows to the automobile sector saw the steepest decline of 77 per cent year-on-year to ₹10,015 crore during the current fiscal. The Economic Survey 2022-23 said, FDI equity inflow in manufacturing in the first half of FY23 fell below its corresponding level in the first half of FY22 due to rise in global uncertainty in the wake of the Russia-Ukraine conflict. It also added that the monetary tightening at the global level has further restricted the FDI equity inflows.

“A rebound in FDI inflows is, however, expected as the Indian economy sustains its high growth while monetary tightening the world over eventually eases with the weakening of inflationary pressures,” the survey added.

Published on March 8, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.