Indian exporters will likely enter into deals to ship out at least five million tonnes (mt) of sugar once the Centre lifts the 10 mt cap imposed on shipments for the current sugar season to September 30.

The export prospects are despite the International Sugar Organization (ISO) estimating higher production and ending stocks during the 2022-23 season starting October 1.

“We hope the Centre will remove the ceiling on exports after September 30. If that happens and exports are allowed, deals to ship five lakh tonnes will be signed in a month’s time,” said Praful Vithalani, President, All India Sugar Traders Association (AISTA).

“Government should open up exports from October 1. Deals for 5-6 mt of sugar exports are likely to be signed in the first tranche. Though early, sugar production is expected to be 35 mt next season,” said Rahil Shaikh, Managing Director, MEIR Commodities India.

Vithalani said there are good enquiries for raw and refined sugar from the Gulf and other Asian countries “as usual”. Reuters reported that the Centre could allow sugar exports in two tranches with 4-5 mt in the first and the rest in the second.

The wire agency reported that the Government may cap sugar exports next season at 8 mt compared with the 11.2 mt permitted this season. It also reported that traders have signed to ship out at least three lakh tonnes once the Centre permits the resumption of exports.

The Centre initially capped the exports at 10 mt this season before permitting an additional 1.2 mt. The restriction was imposed to ensure the country had ample stocks during the festival season.

Sugar production has been estimated at 36 mt in 2021-22 with another 3.4 mt being diverted for manufacturing ethanol. Consumption has been estimated at 27.5 mt and the country’s ending stocks are projected at 6.7 mt, ample enough to meet three months’ demand in the domestic market.

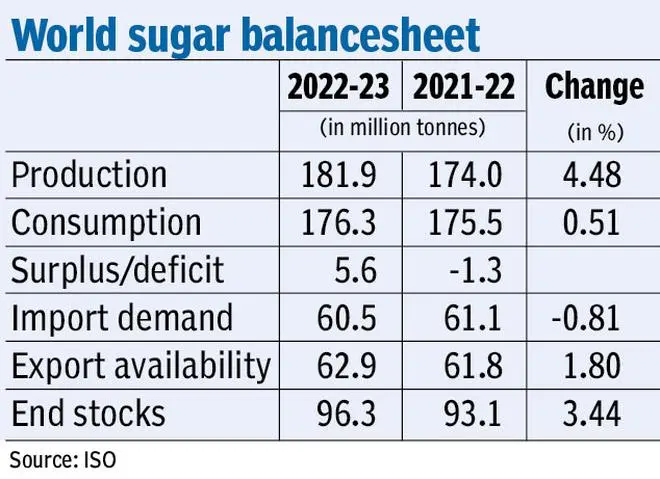

The ISO came out with its sugar balance sheet on Wednesday night, estimating nearly 5 per cent higher production next season at 181.91 mt and ending stocks increasing by over 3 per cent to 96.35 mt.

The projection is seen as bearish with raw sugar prices dropping by about 10 per cent year-on-year to 17.92 cents a pound (₹31,700 a tonne) on the Intercontinental Exchange, New York. In London, white sugar for October delivery was quoted at $554.50 a tonne.

“ISO is projecting a surplus because of Europe and Brazil. We don’t agree with the estimates. India will enjoy an advantage at least until April 2023,” said Vithalani.

“At least 4.5 mt of sugar production will go into the making of ethanol. One of the steps the Centre can take to promote exports is to allow them under the open general licence (OGL). But I don’t think it will happen,” said Shaikh.

The Indian Sugar Mills Association, a body of private millers, has estimated another bounty season in 2022-23 with a higher diversion of sugar production to ethanol. The estimate is based on projections of a higher area under sugarcane.

According to the Ministry of Agriculture and Farmers Welfare, the area under sugarcane as of August 26 was 55.59 lakh hectares compared with 54.70 lakh hectares a year ago. “The area under sugarcane in Uttar Pradesh is higher. It will increase in Maharashtra too,” Shaikh said.

“We are getting good enquiries from Malaysia and Indonesia too. India should be the market maker next season,” Vithalani said.

“Domestic demand is strong. Prices in local markets have increased by ₹2,000 a tonne in the past couple of months,” Shaikh said. Currently, sugar prices are ruling at ₹3,380-3430 a quintal in Maharashtra and above ₹3,450 in Uttar Pradesh.

According to the Ministry of Consumer Affairs, the all-India average price of sugar in the country is ₹42.43 a kg, up 1.78 per cent month-on-month and 4.48 per cent year-on-year.

Besides Brazil and Europe, sugar supplies from Thailand are also expected to increase next season.

Published on September 1, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.