Indian wheat exporters have signed deals to export at least 5.5 lakh tonnes (lt) over the next couple of months as nations in South Asia, South-East Asia and West Asia are looking to New Delhi to meet their requirements for food and feed in view of the Ukraine-Russia crisis.

“We have demand for Indian wheat from March-April. Our exporters have committed to ship 5.5 lakh tonnes. Both old and the new crop will be shipped out by exporters under these deals,” said Rajnikant Rai, Divisional Chief Executive, ITC Agri-Business.

Indian wheat is currently being quoted at $330 a tonne, up from $300 before Russia ordered its troops into Ukraine on February 24.

“Russia and Ukraine make up 35-40 per cent of global wheat exports,” the ITC official said.

According to FAOSTAT, Russia exported 37.26 million tonnes (mt) and Ukraine 18.06 mt of wheat of the total exports of 202.48 mt in 2020 by various countries, including India.

“The wheat market is volatile with buyers and sellers in a wait and watch mode. But prices have increased by $15-20 a tonne after the Ukraine crisis deepened. India’s advantage is that no other origin has its new crop coming during this time of the year,” said Nitin Gupta, Vice-President, Olam Agro India Ltd.

Wheat prices in the global market are ruling at a nine-year high with the rates swinging below and above $9 a bushel. On Tuesday, benchmark wheat futures on the Chicago Board of Trade was quoted at $9.75 a bushel or $358.24 (₹27,150) a tonne.

“We have been witnessing good demand for Indian wheat over the last couple of months. We are also finding parity in shipping the grain,” said Mukesh Singh, Director, MuBala Agro.

ITC’s Rai said countries in South Asia, West Asia and even the Philippines in the South-East Asian region are buying Indian wheat. “Even South Korea is buying Indian wheat for feed purposes,” he said.

Olam’s Gupta said India could easily ship out 3-4 mt by June this year, particularly when 5-6 lt are being exported every month. “In December, we exported close to one million tonnes,” he said.

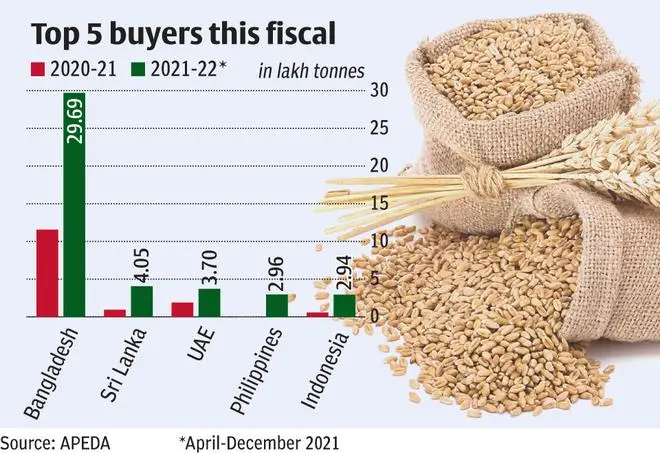

According to Agricultural and Processed Food Products Export Development Authority (APEDA) data, India exported 50.41 lt of wheat valued at $1.43 billion during the April-December period of the current fiscal compared with 10.69 lt valued at $278 billion lt in the year-ago period.

Until November, exports were at 41.14 lt. While the per tonne realisation was $280 until November, it increased to $285 in December. Bangladesh bought 29.68 lt of Indian wheat in the first nine months of this fiscal, followed by Sri Lanka (4.04 lt), UAE (3.69 lt) and the Philippines (2.96 mt).

Higher wheat exports this year have helped growers with prices topping the minimum support price (MSP) of ₹1,975 a quintal announced for the 2021 rabi marketing season. This year, the MSP has been hiked to ₹2,015.

“If the Ukraine-Russia standoff prolongs, Indian exports will gain. Both Ukraine and Russia too have a bumper wheat crop. But if the current situation continues, exports will be good until June-July,” Rai said.

According to the second advance estimates of foodgrains for 2021-22 (July-June), wheat production is projected at a record 111.32 million tonnes against 109.59 million tonnes in 2020-21.

“India’s wheat exports will be more in 2022 than last year in view of the current Ukraine-Russia problem,” said Gupta.

“If the market is disturbed for, say, two months, India could turn out to be a huge supplier in West Asia and even ship to as far as Egypt,” said MuBala’s Mukesh.

Pramod Kumar, Vice-President, Roller Flour Mills Association of India, said domestic wheat prices have gained in view of higher exports. “In the global market too, wheat prices are above our MSP,” he said.

Currently, the modal price or the rate at which most trades took place in Uttar Pradesh and Madhya Pradesh is between ₹1,900 and ₹2,000 a quintal. In markets such as Agra, prices are firmly above ₹2,000. But the problem for Indian exports will be that freight rates are also rising in view of the geopolitical crisis.

“If the Government can support transportation of wheat, we can certainly do well on the export front,” ITC’s Rai said.

However, in view of the rise in wheat price the user industry has written to the Centre to suspend wheat shipments until the Ukraine-Russia crisis ends.

Though the crop is expected to be a record this year, arrivals have been delayed in view of the cold weather. “Wheat harvest has been delayed by 15-20 days,” Rai said.

Kumar said the quality of the wheat crop this year is good and any drop in the grain’s acreage will be made good by a better yield.

“We will have to watch out for the weather over the next 30 days. If there is no rain, then we will have a good crop,” said Rai.

Indian wheat exports are also aided by higher inventories with the Food Corporation of India (FCI). As of February 1, FCI had 28.27 mt of wheat with it against 31.83 mt during the same period a year ago. Currently, it is estimated at around 26 mt.

Published on March 1, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.