Wheat prices increased by eight per cent in agri-terminal markets over the past month, while flour mills are paying 10 per cent more for the grain since October 1.

The cereal’s prices have soared to record highs despite arrivals during November 1-23 rising to a 13-year high of 7.48 lakh tonnes (lt). The last time when wheat arrivals were so high was in 2009 when 8.27 lt arrived during the same period, data from Agmarknet, a unit of the Ministry of Agriculture show.

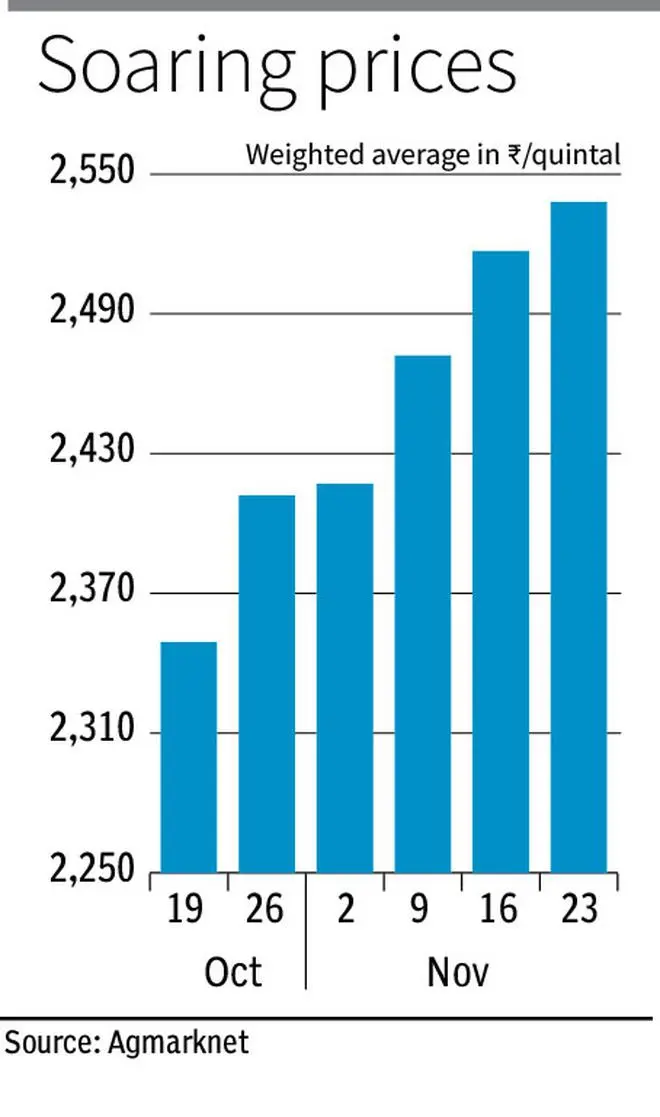

According to Agmarknet data, the weighted average price of wheat across various agricultural produce marketing committee (APMC) yards is currently ₹2,538 a quintal against ₹2,349 on October 19. Daily arrivals of wheat this month are above 30,000 tonnes.

“We paid ₹2,750 a quintal for wheat in early October for mill delivery in South India. The price has increased to ₹3,050 now,” said a southern India-based miller not wishing to identify.

According to the Consumer Affairs Ministry, wholesale and retail prices are currently ₹2,831.92 a quintal and ₹31.61 a kg, respectively. These are 5.13 per cent and 3.54 per cent, respectively, higher than a month ago.

“Arrivals are proof that there are people who are holding stocks. The Centre has to take steps to crack down on the hoarders,” a trade analyst said on condition of anonymity.

Food Secretary Sanjeev Chopra told reporters in New Delhi, on Wednesday, that the Centre, as of now, has no plans to impose stock limits or intervene in the market through the open market sale scheme (OMSS).

“If the Centre does not take any immediate action, things can go out of hand in December,” the miller said.

The analyst said the Centre could come up with some measures once elections for Gujarat Assembly get over. “Now, the Centre may say there is no ground for its intervention. But its stand can change overnight,” the analyst said.

The Centre could have considered imports from Russia, which has ample stocks. “But, it is too late now to import from there as any deal struck to ship in the cereal will be after January only. By then, the new crop will be ready for harvest and could affect the prices that growers get,” said a trading source.

The source said India could have tapped the goodwill it enjoys with Russia to import wheat, the way it has been buying crude oil and fertilisers.

Global prices are currently at a three-week low of $7.93 a bushel ($291.34 a tonne) on the Chicago Board of Trade for delivery in December. This is lower than the domestic price. According to the International Grains Council, European wheat (France grade) is currently the most competitive at $346 a tonne in the spot trade.

Wheat prices in the country have been ruling higher than the minimum support price (MSP) of ₹2,015 a quintal from the start of the season in April following export demand in view of the Ukraine War. In fact, demand for exports picked up in March since wheat supplies to the global market were high in view of the war.

This is because Russia and Ukraine make up 30 per cent of the supplies in the global market. As a result of the export demand, the Government’s procurement of wheat for the Central pool declined by over 50 per cent to 18.79 million tonnes (mt) this year. Stocks in the Central pool are used for distribution through ration shops and for various welfare schemes.

In view of this, the Centre banned wheat exports from May 13. However, by that time, 4.59 mt of wheat had been shipped out of the country. According to Agricultural and Processed Food Export Development Authority data, wheat shipments until the ban are higher than exports made in H1 FY22.

The ban on wheat exports is expected to continue until April since the Centre would prefer to mop up wheat stocks and assess the demand-supply situation. For the coming crop, the Centre has fixed the MSP at ₹2,125.

During the current rabi season, the area under wheat is 15 per cent higher as of November 18 at 101.49 lakh hectares.

Published on November 24, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.