April witnessed double digit inflation in oils and fats (edible oil), vegetable, spices, footwear and fuel and light

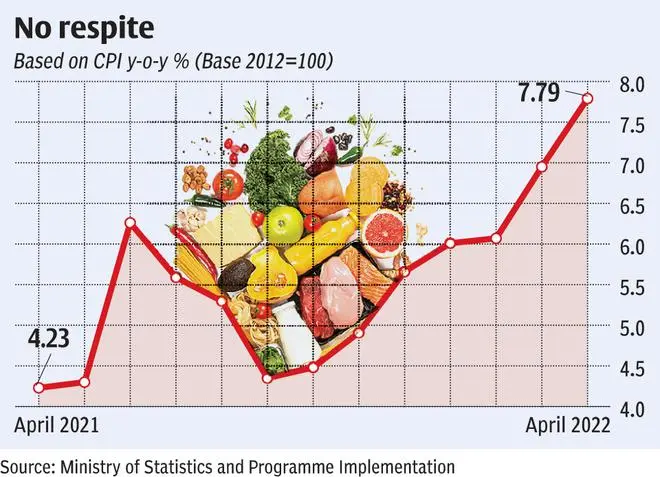

Retail inflation based on Consumer Price Index (CPI) surged to nearly 8-year high in April to 7.79 per cent. Experts say with the current surge, another round of policy interest rate hike by Monetary Policy Committee (MPC) is certain now which, in turn, will further push EMI on loans such as housing.

Previous high was recorded in May 2014, when retail inflation rate touched 8.33 per cent in May 2014.

Continuous fuel price hike has predictably had a spiraling effect on the final price of various products. Also, surging global prices of commodities impact price movement. April witnessed double digit inflation in oils and fats (edible oil), vegetable, spices, footwear and fuel and light. The apprehension now is that prices will continue to remain at high level.

DK Srivastava, Chief Policy Advisory with EY India, says given the trends in inflation rate, the RBI may consider increasing the policy rate further by 50 basis points or more in one or two steps. Though he apprehends higher interest rates and an adverse effect on investment and growth, he feels there may also be a positive spin-off due to higher growth in taxes linked to higher nominal growth.

In April 2022, the gross GST collections were at all time high of ₹1.68-lakh crore. Direct taxes also showed a growth of 49 per cent in FY22. “This additional fiscal capacity may be partly used to reduce union excise duty rates on petroleum products with a view to containing inflation and partly to frontload infrastructure investment in the initial months of FY23 to support growth,” he argued.

Swati Arora, Economist with HDFC Bank, expects inflation to stay above 7 per cent until September/October. In the second half, inflation (average) is expected to ease to 6.3-6.5 per cent. At this point, there are more risks on inflation than one. Prolonged supply disruptions, higher food prices (due to lingering geopolitical tensions, Indonesia’s export ban of vegetable oil, increased transportation costs and heatwave impacting crops), higher commodity prices, and a depreciation in rupee are likely to weigh on the inflation prints.

“On the policy front, we expect the RBI to deliver a rate hike to the tune of 25 bps in its June policy,” she said.

Meanwhile, industrial growth based on Index of Industrial Production (IIP) grew at 1.9 per cent in March though on a high base. At the broad-based level the output of manufacturing the largest component of IIP grew at 0.9 per cent and mining and electricity at 4 per cent and 6.1 per cent, respectively

According to a note prepared by Sunil Kumar Sinha and Paras Jasrai of India Ratings & Research (Ind-Ra), as the geopolitical situation is unlikely to get better in the near term in view of Russia-Ukraine conflict, Ind-Ra believes the ongoing industrial recovery will continue to face headwinds and will require more policy support. “Ind-Ra expects the IIP growth to remain in low single digits in the near term,” the note said.

Aditi Nayar, Chief Economist with ICRA, feels going forward, the surge in global commodity prices following the ongoing Russia-Ukraine conflict and the resultant rise in domestic inflation owing to a pass-through of higher input costs across several categories of goods is expected to impact consumption demand and thereby hurt the growth in the output of consumer goods. Further, “protracted tensions could also impact corporate profits and dampen the investment climate, impacting the output of capital goods and infra/construction goods,” she said.

Published on May 12, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.