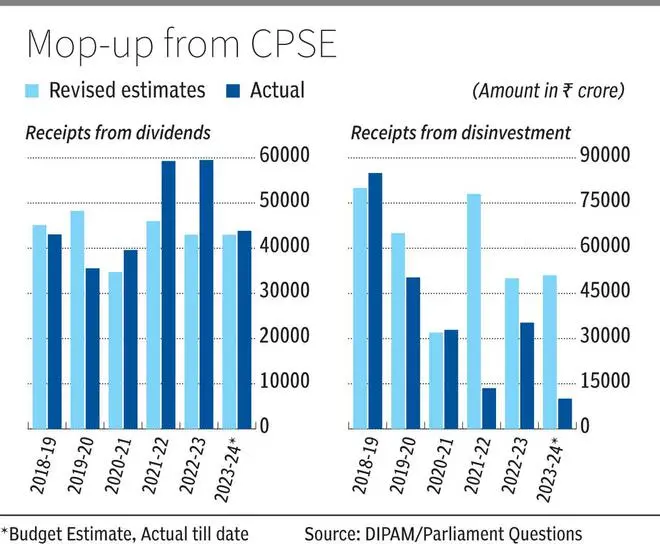

Dividend from Central public sector enterprises (CPSEs) is likely to cross ₹50,000 crore during the current fiscal for the third year in a row. It has already exceeded Budget Estimate (BE) during current fiscal year. However, disinvestment proceeds from CPSEs are likely to remain below the Budget Estimate.

Collections from dividend and disinvestment are part of non-tax revenue and maintained by the Department of Investment and Public Asset Management (DIPAM). While combined collection is lower than the target, but it is unlikely to affect the fiscal deficit target of 5.9 per cent as mobilisation through direct tax, GST and RBI surplus are likely to be much higher.

Better collection of dividend can be attributed to improved profitability of CPSEs and consistent dividend policy. According to Finance Ministry guidelines, announced in 2016, a CPSE would pay an annual dividend of 30 per cent PAT (profit after tax) or 30 per cent of the government’s equity, whichever is higher. However, due account should be taken of cash and free reserves with the CPSE, and accordingly, special dividend would need to be paid to the government as a return for its equity investments. Further, CPSEs with large cash/free reserves and sustainable profit may issue bonus shares.

“Any case of exception should be explained specifically by the concerned Administrative Ministry/ Department concerned to the Secretary DEA,” the guidelines say. Later in 2020, an advisory regarding consistent dividend policy said that the CPSEs, especially companies that pay relatively higher dividend (100 per cent dividend or ₹10 per share), may consider paying quarterly dividend. For others, frequency could be half yearly. Further, all CPSEs should consider paying at least 90 per cent of projected annual dividend in one or more instalments as interim dividend.

Selling stakes in CPSEs has not been easy for the government during this fiscal. Though it managed to sell minor stakes in HAL, Coal India Ltd, RVNL, SJVN Ltd, and HUDCO, strategic sell off of IDBI Bank, Shipping Corporation, BEML PDIL, HLL Life Care Ltd and NMDC Steel Ltd are yet to be completed. In fact, the bigger strategic disinvestment of IDBI Bank is likely to conclude only next year.

DIPAM attributes the snail pace of divestment to the emphasis it places on value creation in CPSEs. It underlines that since the introduction of the New PSE policy in January 2021, the NSE CPSE and BSE CPSE Indices have surpassed benchmarks, showcasing returns of over 160 per cent and 128 per cent, respectively, until November 2023.

Published on January 4, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.