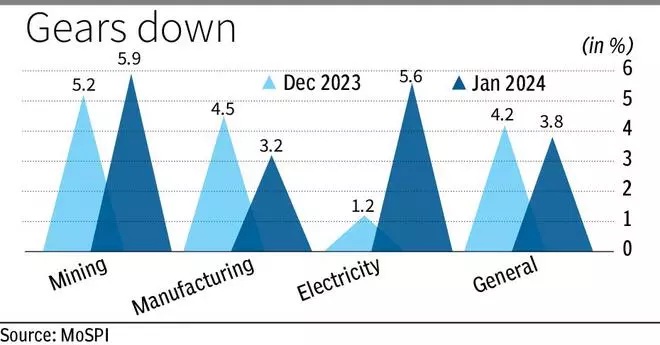

Manufacturing slowed down industrial growth in January as headline number based on Index of Industrial Production (IIP) slipped to 3.8 per cent in January as against 4.2 per cent in December. However, experts still predicted February growth to be closer to the January number.

As per data released by National Statistical Office (NSO), the manufacturing sector’s output growth decelerated to 3.2 per cent in January against 4.5 per cent in December. Manufacturing with a share of around 15 per cent in Gross Value Added (GVA) is considered the biggest job multiplier and plays a significant role in overall indirect tax collection.

Though the overall numbers are down, economists were still optimistic. Sunil Kumar Sinha (Senior Director & Principal Economist) & Paras Jasrai, Senior Analyst at India Ratings and Research in a note highlighted that the output level of all use-based segments are above the pre-Covid level (February 2020) after a gap of 33 months. Overall, the factory output was 14 per cent higher than the pre-Covid level in January 2024. At the 2-digit level, 13 industries had a production level higher than the pre-Covid period.

For coming months, economists had different estimates. “Based on the available high frequency data for February 2024 as well as an unfavourable base (6 per cent) in February 2023), ICRA anticipates the y-o-y IIP growth to remain at 3-4 per cent in that month,” said Aditi Nayar, Chief Economist with ICRA.

However, with rise in capital expenditure by the government during last two years of current fiscal, some economists felt that headline number for February and March would be better. The high frequency indicators such as petroleum consumption, coal, steel production, etc. grew in the range of 5.7-13.8 per cent y-o-y in February 2024. Also, as the states and the union government would be looking to meet their annual capex targets in the remaining two months of this fiscal, the infrastructure industries are expected to get the required support.

“Factoring in all of this along with a favourable base effect in some of the use-based segments, Ind-Ra believes the yoy growth of the IIP could come in the range of 5-6 per cent in the remaining two months of FY24,” Sinha and Jasrai said.

Dharmakirti Joshi, Chief Economist with CRISIL Ltd did not share their optimism. According to him, infrastructure and construction goods, the primary driver of IIP growth this year, moderated in January reflecting government capital expenditure. Consumption-oriented sectors displayed an uneven trend with non-durables much weaker than durables. Export-oriented sectors were mixed with the production of textiles and machinery picking up but petroleum and chemical products slipping.

While investments have driven the surge in GDP growth this fiscal, they could lose some steam as the government pursues fiscal consolidation next year. “A pick-up in private capital expenditure is critical to sustain investment momentum. The full transmission of the MPC’s rate hikes and regulatory measures on credit growth are expected to moderate domestic demand. Uneven global growth could also restrict export recovery,” he said while adding that GDP growth estimated to slow to 6.8 per cent next fiscal from 7.6 per cent in this fiscal.

Published on March 12, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.