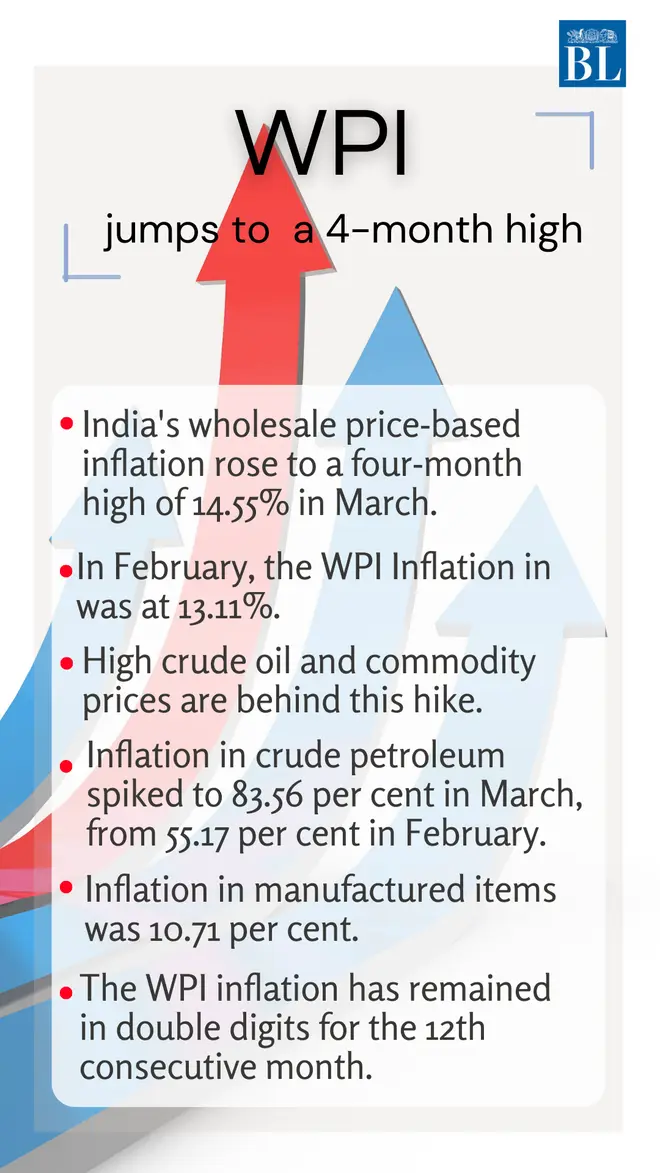

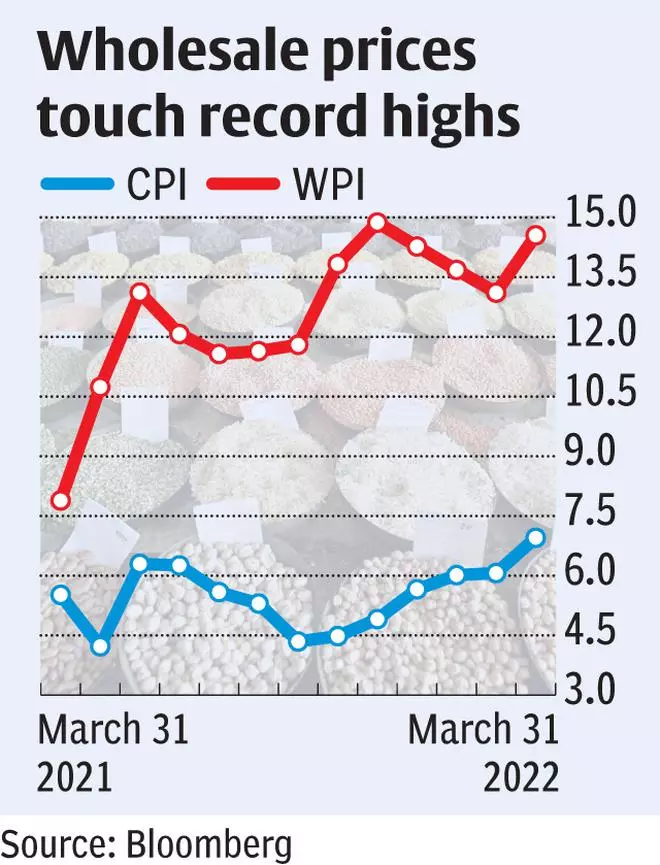

New Delhi, April 18 Factory inflation based on Wholesale Price Index (WPI) surged to 14.55 per cent in March as against 13.11 per cent in February.

WPI-based inflation in March is a four months high. Last week, Statistics Ministry released data for retail inflation based on Consumer Price Index (CPI) which was at a 17-month high of 6.95 per cent. CPI inflation is a more critical data point in policy making as compared with retail inflation. With the rising inflation, analysts believe Monetary Policy Committee may announce an interest rate hike in its next meeting scheduled to take place in June.

The data released by the Commerce and Industry Ministry showed that crude oil prices were the biggest contributor to the rise in WPI inflation in March as compared to February, followed by fuels and core items. Food articles witnessed some softening month-on-month led by vegetables and pulses, even though wheat, paddy, potato, milk, egg, meat and the fish basket saw moderate increases during March.

During March, inflation in food articles eased to 8.06 per cent from 8.19 per cent in February. Vegetable inflation was 19.88 per cent in the month, as against 26.93 per cent in February.

A note prepared by Sunil Kumar Sinha and Paras Jasrai of India Ratings & Research (Ind-Ra) said that the surge in wholesale inflation is fairly broad based as all the three major categories namely primary articles, fuel and power and manufacturing recorded double-digit inflation in March. Further, manufacturing inflation rose to 10.7 per cent in March from 9.8 per cent in February. Edible oils inflation increased further to 16.06 per cent (14.9 per cent), remaining in double digits for 28 months.

Even core inflation remained sticky and rose further to 10.9 per cent in March “This was led primarily by the uptick in inflation of manufactured items such as basic metals, chemicals and textiles. As the margins of the manufacturers have been under pressure due to the rising input costs, transportation and logistics, they are passing it on to their output prices leading to higher inflation in manufactured products,” said Ind-Ra. It expects the wholesale inflation to remain in high single digits in FY23 despite high base of last year kicking in from April.

Aditi Nayar, Chief Economist with ICRA said that the jump in crude oil prices was the biggest contributor to the rise in the WPI inflation in March 2022 relative to the previous month, followed by fuels and core items. “We expect the WPI inflation to remain in the range of 13.5-15 per cent in the current month, partly depending on where crude oil prices settle in the rest of April 2022 and how much petrol and diesel prices are revised further,” she said.

The broad-based nature of the rise in the WPI inflation is likely to be of particular concern to the MPC. “We see a growing probability of the first repo hike being preponed to June,” she said.

Published on April 18, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.