Total PAN allotment surged to 80 crore at the end of FY24-25 as against over 45 crore at the end of FY18-19 | Photo Credit: iStockphoto

With rising participation in newer areas of the financial market, besides to avail government schemes, the allotment of PAN (Permanent Account Number) among individuals aged up to 30 years has increased around 69 per cent over the past seven years. Notably, the male-female ratio in PAN allotments has come down.

According to the Income Tax Department, the total PANs issued surged to around 80 crore at the end of FY24-25, as against over 45 crore at the end of FY18-19, reflecting an 80 per cent growth. Specifically, the numbers jumped from 43.5 crore to over 78.4 crore, showing an increase of 80 per cent.

Among individuals, people below 30 recorded a significant rise. Sneha Padhiar, Partner at Bhuta Shah & Co LLP, listed multiple reasons for this rise, chief among them is the increased financial awareness. Initiatives like Pradhan Mantri Jan Dhan Yojana (PMJDY) have emphasised the importance of financial inclusion, encouraging young people to get PAN cards for banking and financial activities, she said.

“Parents are increasingly becoming more proactive in securing PAN cards for their children to prepare them for future financial responsibilities. This trend has contributed to growth in PAN allotments among the minor population,” she said.

Shaily Gupta, Partner at Khaitan & Co, agrees, “The rise in PAN allotments among youth reflects increasing financial awareness and rapid digital adoption”.

The trend is fuelled by growing engagement of young people with online platforms where PAN is required for KYC compliance, particularly for the use of digital payment platforms. “Growing financial literacy and parental planning for children’s future financial needs are also key drivers — from converting minor bank accounts to major accounts, withdrawing maturity proceeds from child-focused investment plans, to naming minors as nominees in investments, all of these necessitate a PAN,” she explained.

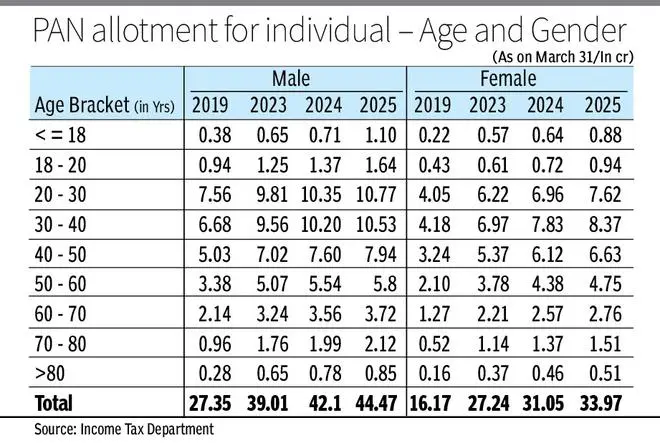

As on March 31, 2025, 44.47 crore men had been allotted PAN cards as compared to 33.97 crore women. The male-to-female ratio of PAN allotment has dropped from 1.96 in FY14 to 1.31 in FY25.

However, experts feel some social issues persist, resulting in the gap. These include women continuing to work in informal sector or remain unpaid caregivers. “There has been a disparity in financial literacy, with fewer women aware of necessity and / or benefits of having a PAN for financial transactions,” Sneha Padhiar noted.

Adding to this, Gupta said while the gender gap in PAN issuance remains a concern, the “declining trend offers a glimmer of hope — signalling a slow but steady progression towards greater financial independence and inclusion for women.”

Meanwhile, data showed that as on March 31, 2025, of total of 80 crore PANs, over 66 crore have been linked with Aadhaar. Lack of linking could make PAN inoperative.

Published on April 20, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.