As many as 1,100 stocks hit the lower circuit on Wednesday as the benchmark indices slid more than a per cent, after an uptick in US inflation raised uncertainty on the Federal Reserve’s plans for rate cuts.

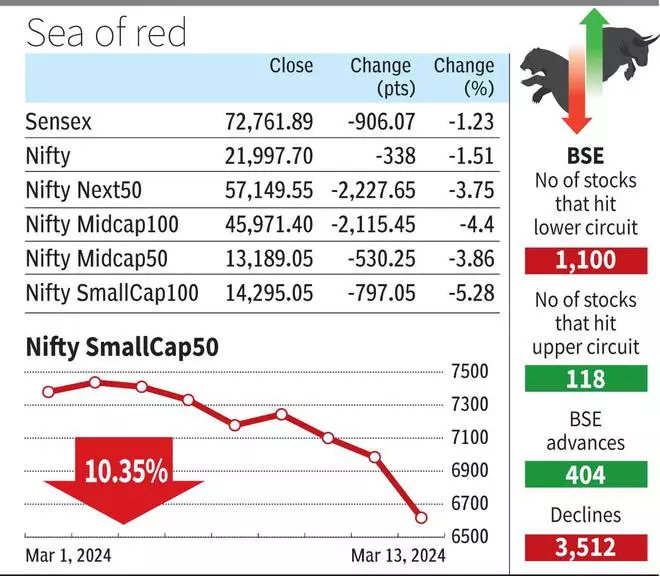

The Sensex closed below the psychological 73,000 mark to end at 72,762, down 1.2 per cent, with 1,100 stocks hitting the lower circuit. Of the 3,976 stocks that traded, 3,512, or 88 per cent declined and 404 advanced. 253 stocks hit a 52-week low. The Nifty ended below the 22,000 mark to end at 21,998, down 1.5 per cent.

Adani Ports, Coal India, and Power Grid Corporation were the top Nifty losers, each losing over 7 per cent.

The broader markets saw a sharper fall, with the Nifty Midcap 100 and Nifty SmallCap 100 slipping 4.4 per cent and 5.3 per cent, respectively. The indices have slid 5.9 per cent and 8.2 per cent in the past week.

FPIs sold shares worth ₹4,595 crore, while domestic institutions bought shares worth ₹9,093 crore on Wednesday.

According to Vinod Nair, Head of Research at Geojit Financial Services, the unfavourable risk-reward balance of mid- and small-cap stocks, fuelled by prolonged premium valuations, has aggravated the downfall.

“Globally, the persistent US inflation rate has cast doubt on the Fed’s ability to implement imminent rate cuts. While domestic inflation appears to be showing signs of easing. However, the easing trend in global commodity prices may prompt central banks to consider rate cuts in the latter half of 2024, which could be positive for equity,” he said.

India’s Consumer Price Index (CPI) increased by 5.09 per cent year-on-year in February. The Index of Industrial Production grew by 3.8 per cent year-on-year in January, at a slower pace than the 4.2 per cent seen in December 2023.

“The ongoing scrutiny from SEBI, the pending outcome of the MF stress test, and the expensive valuation post-smart rally seen in the last few months led to profit booking. We expect the sluggishness in the market to continue in the near term with Nifty’s major support at 21500 zone,” said Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services.

Global shares were mixed in muted trading Wednesday as optimism set off by a record rally on Wall Street gradually ran out of momentum and investors awaited a slew of economic data this week, including producer prices and retail sales numbers, for clues on the Federal Reserve’s rate-cut path. Among Asian peers, Straits Times rose the most, gaining 0.6 per cent.

Published on March 13, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.